- Taiwan

- /

- Semiconductors

- /

- TPEX:6699

If You Had Bought Kiwi Technology's (GTSM:6699) Shares A Year Ago You Would Be Down 75%

As every investor would know, you don't hit a homerun every time you swing. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. So spare a thought for the long term shareholders of Kiwi Technology Inc. (GTSM:6699); the share price is down a whopping 75% in the last twelve months. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. Kiwi Technology may have better days ahead, of course; we've only looked at a one year period. Unhappily, the share price slid 3.6% in the last week.

View our latest analysis for Kiwi Technology

Kiwi Technology wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Kiwi Technology saw its revenue grow by 27%. We think that is pretty nice growth. Unfortunately, the market wanted something better, given it sent the share price 75% lower during the year. One fear might be that the company might be losing too much money and will need to raise more. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

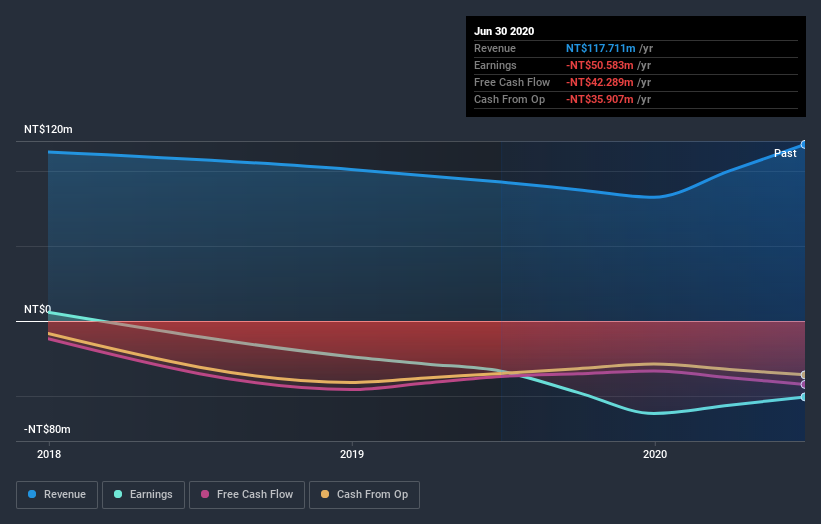

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Kiwi Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Kiwi Technology shareholders are down 75% for the year, the market itself is up 38%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 7.5%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Kiwi Technology (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

But note: Kiwi Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Kiwi Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kiwi Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6699

Kiwi Technology

Provides end-to-end AIoT solutions and platform services in Taiwan, Japan, and ASEAN countries.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives