- Taiwan

- /

- Metals and Mining

- /

- TPEX:5009

Spotlighting November 2024's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets see U.S. indexes approaching record highs and small-cap stocks outperforming their larger counterparts, investors are keenly observing the positive sentiment driven by strong labor market data and stabilizing economic indicators. In this environment, identifying stocks with robust fundamentals and growth potential becomes crucial for those looking to capitalize on emerging opportunities amid broad-based gains.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 15.25% | 15.00% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.32% | -9.98% | 7.95% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 18.55% | 49.61% | 71.72% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Power HF | 2.91% | -6.25% | -22.13% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Lydia Yesil Enerji Kaynaklari (IBSE:LYDYE)

Simply Wall St Value Rating: ★★★★★★

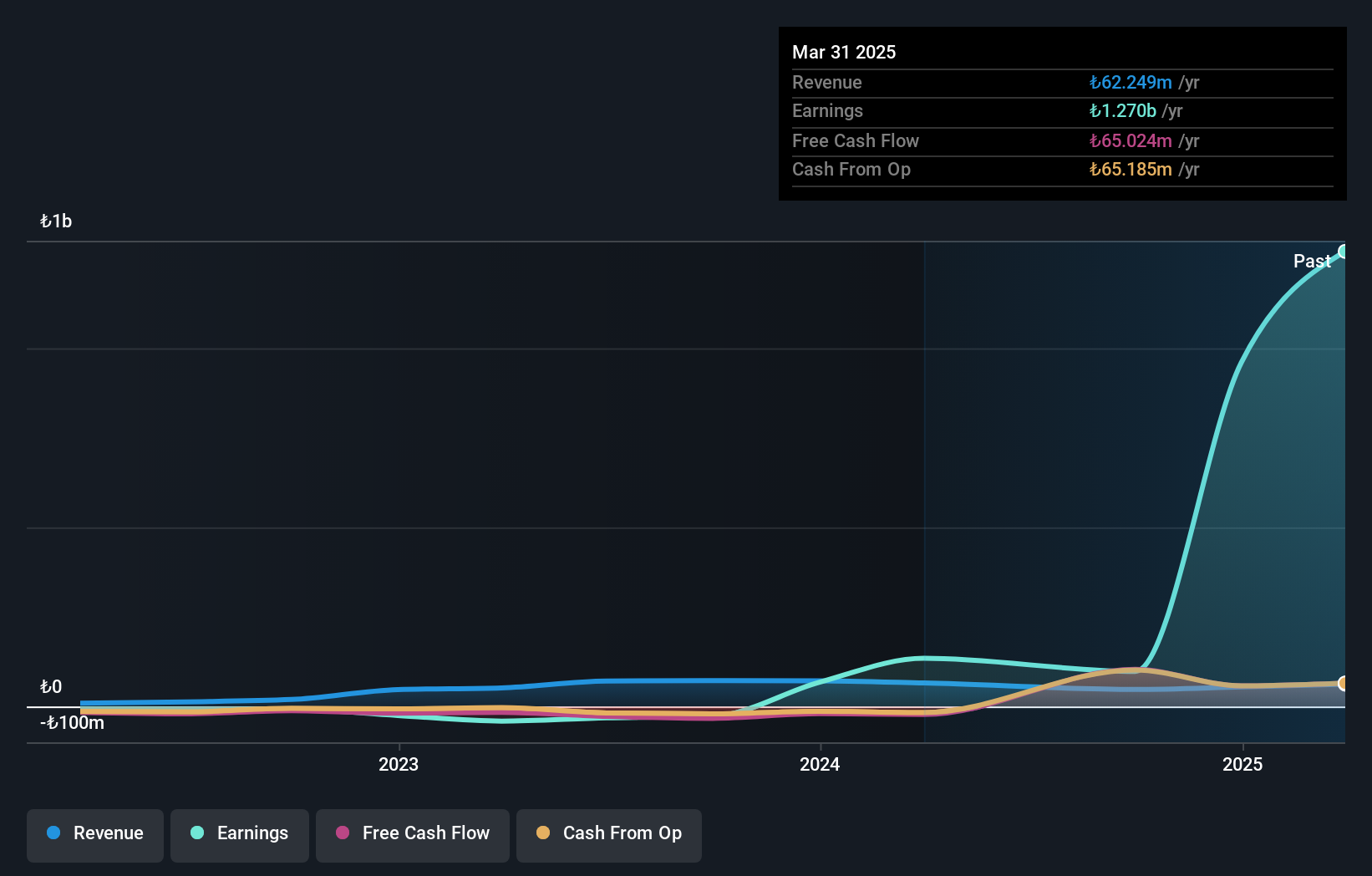

Overview: Lydia Yesil Enerji Kaynaklari A.S. is a company operating in the food industry in Turkey with a market capitalization of TRY17.45 billion.

Operations: Lydia Yesil Enerji Kaynaklari generates revenue primarily from its food processing segment, totaling TRY47.53 million.

Lydia Yesil Enerji Kaynaklari, a smaller entity in the energy sector, has shown notable financial dynamics recently. Despite no debt and high-quality earnings, its share price has been highly volatile over the past three months. The company reported TRY 33.7 million in third-quarter sales compared to TRY 9.17 million last year but faced a net loss of TRY 39.2 million against a previous net income of TRY 1.31 million. Over nine months, it achieved a net income of TRY 43.53 million from a prior loss of TRY 8.06 million, reflecting significant profitability improvement despite revenue challenges at TRY 48M annually.

Gloria Material Technology (TPEX:5009)

Simply Wall St Value Rating: ★★★★★☆

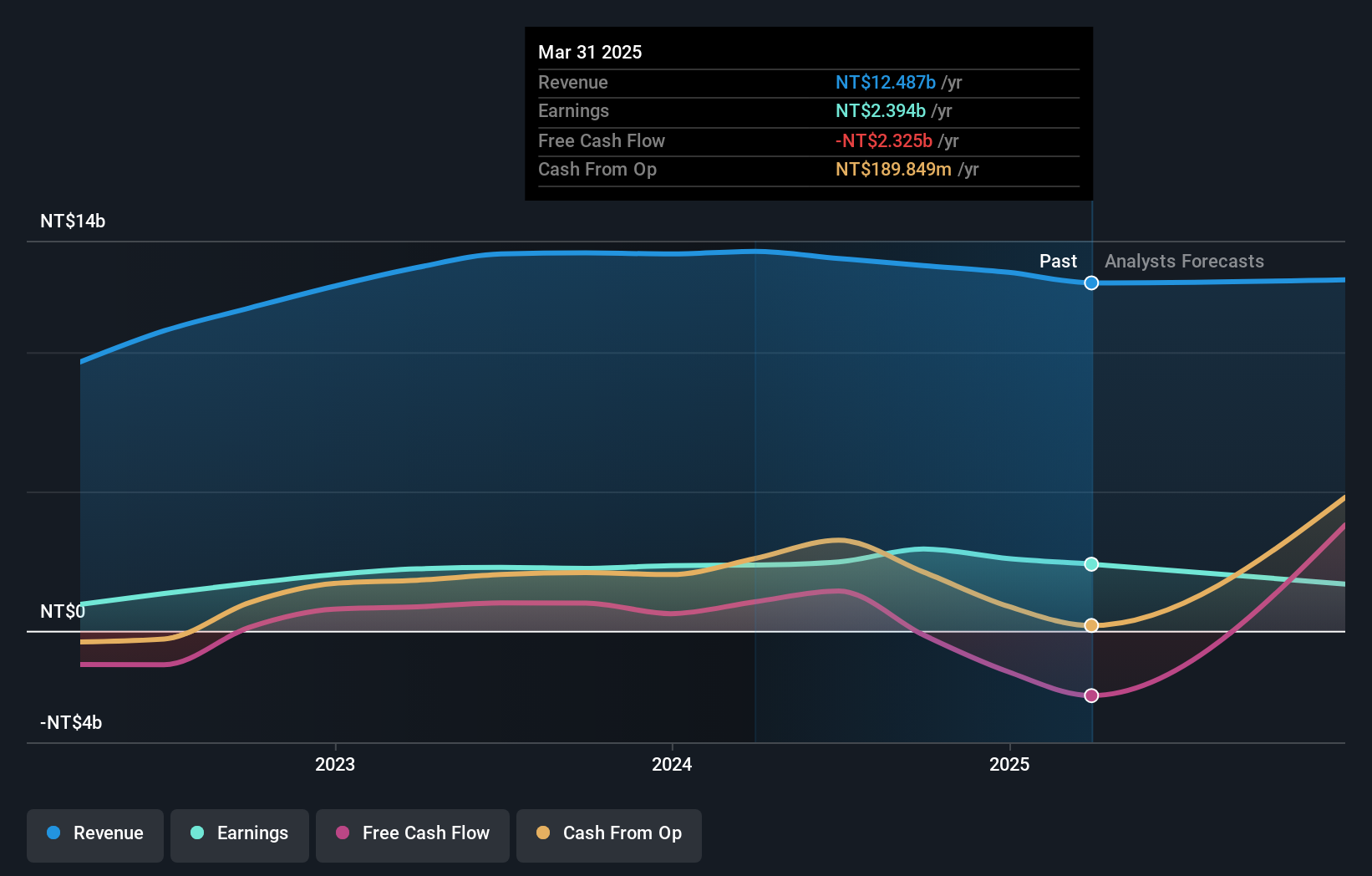

Overview: Gloria Material Technology Corp. is a company that produces and sells alloy steel across Taiwan, the United States, China, and internationally with a market cap of NT$28.69 billion.

Operations: Gloria Material Technology generates revenue primarily from the production and sale of alloy steel. The company operates in multiple regions, including Taiwan, the United States, and China.

Gloria Material Technology, a nimble player in the metals and mining sector, has shown impressive earnings growth of 31.2% over the past year, outpacing industry averages. Despite a dip in third-quarter sales to TWD 3.04 billion from TWD 3.29 billion last year, net income surged to TWD 990.97 million from TWD 523.75 million previously, highlighting its high-quality earnings profile and robust cost management. Trading at a considerable discount of 63% below estimated fair value suggests potential upside for value seekers; however, shareholders experienced dilution recently which might weigh on investor sentiment despite strong EBIT coverage of interest payments at 15.8 times.

- Click here to discover the nuances of Gloria Material Technology with our detailed analytical health report.

Learn about Gloria Material Technology's historical performance.

Sinyi Realty (TWSE:9940)

Simply Wall St Value Rating: ★★★★★★

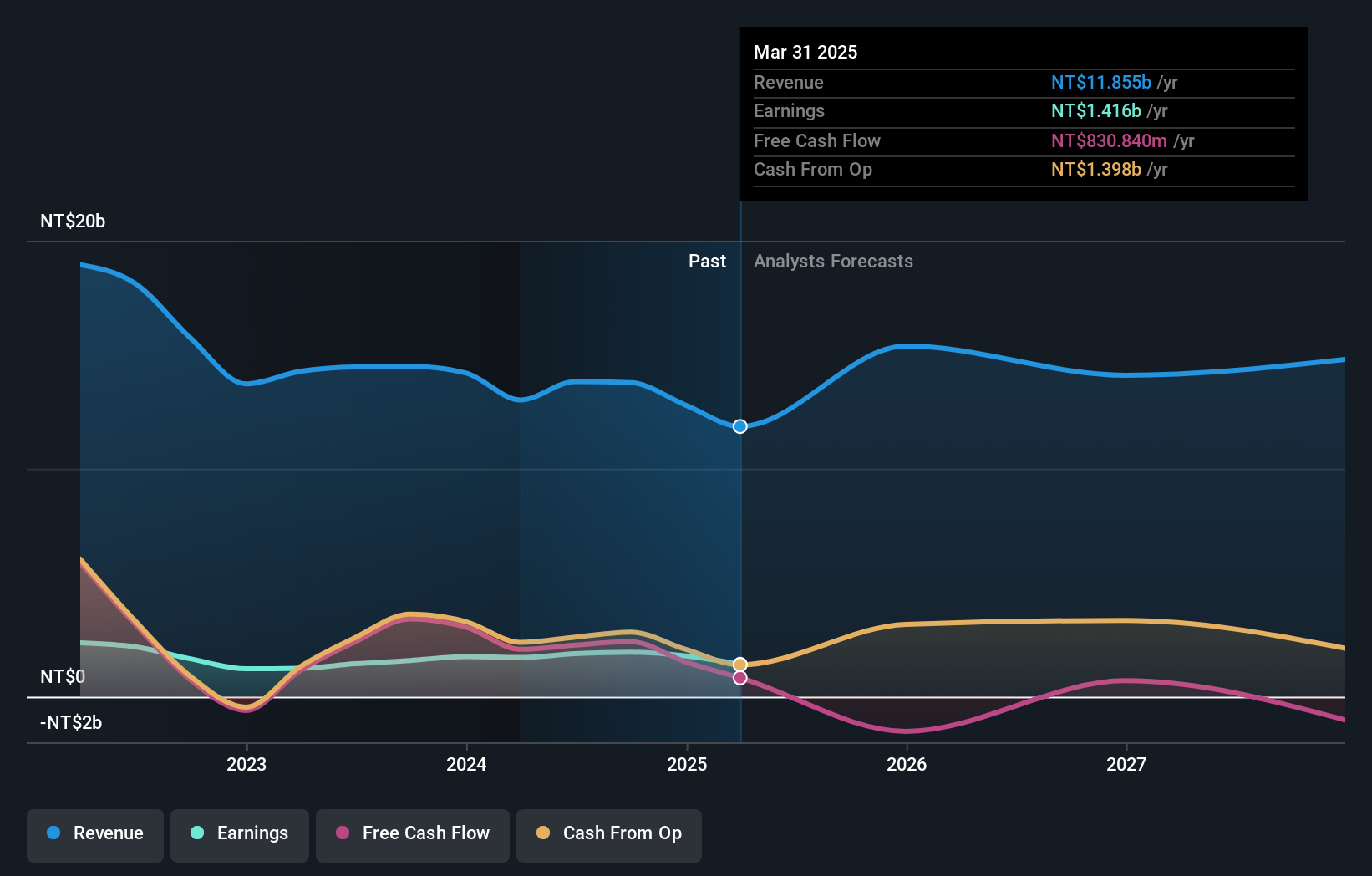

Overview: Sinyi Realty Inc. is engaged in real-estate brokerage and development across Taiwan, Mainland China, and internationally, with a market capitalization of NT$21.77 billion.

Operations: Sinyi Realty generates revenue primarily from its real estate brokerage operations in Taiwan, accounting for NT$12.96 billion, with additional contributions from its real estate development activities in both Taiwan and Mainland China. The company also earns revenue from tourism services in Taiwan and Mainland China, albeit on a smaller scale.

Sinyi Realty shows promise with its earnings growing at 4.6% annually over the past five years, yet it trails the Real Estate industry's 52% growth. The company's debt to equity ratio has improved from 114.7% to 78.5%, indicating better financial health, while a net debt to equity ratio of 36.7% is deemed satisfactory. Despite a dip in third-quarter sales from TWD 55.08 million last year to TWD 37.61 million this year, net income rose from TWD 342.46 million to TWD 405.43 million, reflecting high-quality earnings and effective cost management strategies in place for future stability and growth potential.

- Get an in-depth perspective on Sinyi Realty's performance by reading our health report here.

Examine Sinyi Realty's past performance report to understand how it has performed in the past.

Next Steps

- Navigate through the entire inventory of 4631 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5009

Gloria Material Technology

Engages in smelting, manufacturing, processing and sales of steel in Taiwan, the United States, China, and internationally.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives