Undiscovered Gems Three Promising Stocks To Explore In November 2024

Reviewed by Simply Wall St

In the wake of a significant rally in U.S. stocks driven by growth and tax expectations following the recent election, small-cap indices like the Russell 2000 have shown impressive gains, although they remain slightly below record highs. This environment presents an intriguing opportunity to explore promising small-cap stocks that may benefit from anticipated economic policies and market sentiment shifts. Identifying potential "undiscovered gems" involves looking for companies with strong fundamentals, innovative approaches, or unique market positions that align well with current economic trends and investor optimism.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Franklin Financial Services | 222.36% | 5.55% | -1.86% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Grupo Profuturo. de (BMV:GPROFUT *)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Grupo Profuturo, S.A.B. de C.V. manages retirement funds for workers affiliated with the IMSS and ISSSTE in Mexico and has a market capitalization of MX$27.08 billion.

Operations: Grupo Profuturo generates revenue primarily from managing retirement funds for workers affiliated with the IMSS and ISSSTE in Mexico. The company has a market capitalization of MX$27.08 billion.

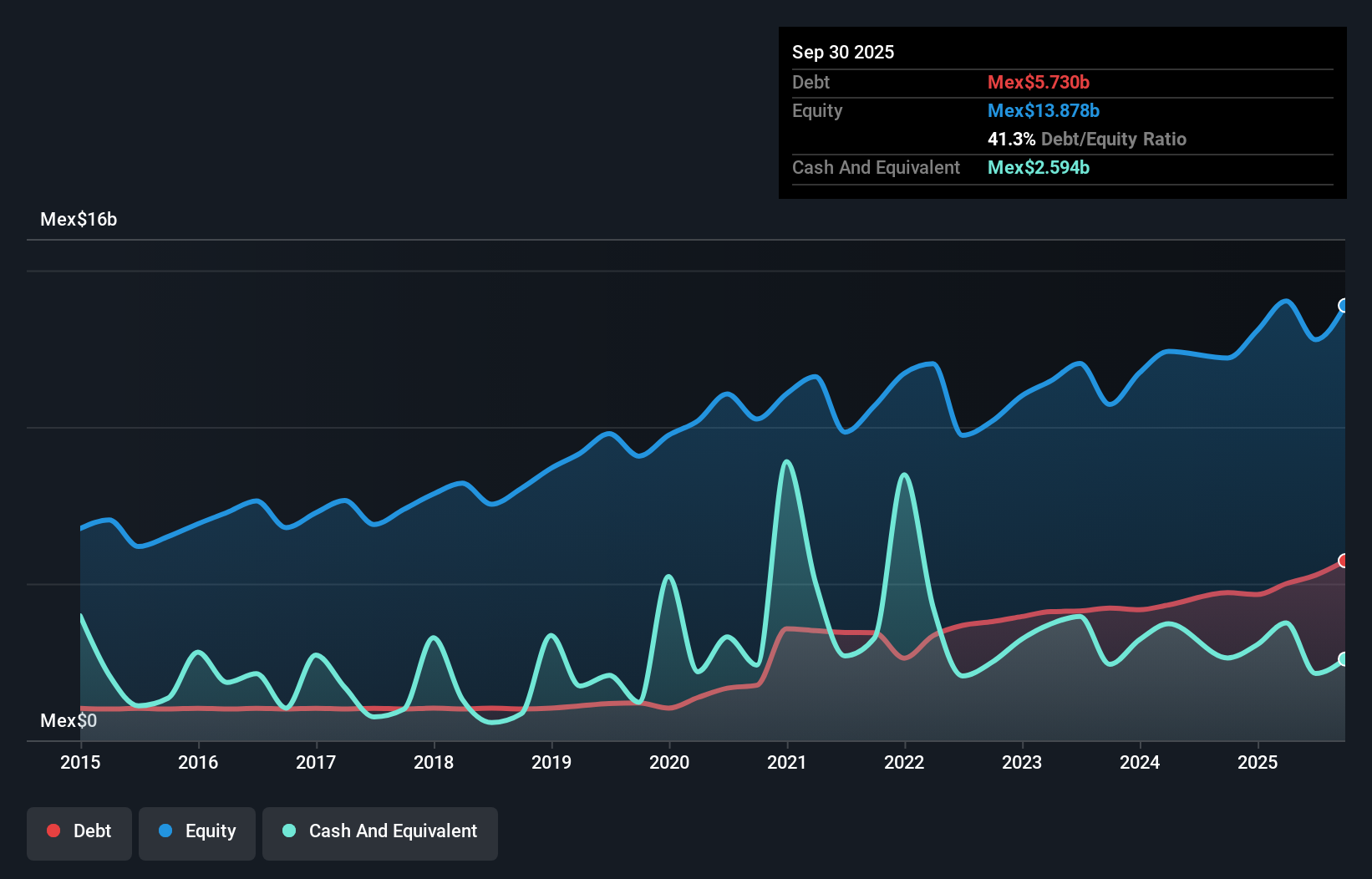

Earnings at Grupo Profuturo have shown impressive growth, soaring by 44.2% over the past year, outpacing the Capital Markets industry's 6.7%. This performance is underpinned by high-quality earnings and a favorable price-to-earnings ratio of 7.7x, which is below the MX market's 11.5x benchmark. Despite its profitability and satisfactory net debt to equity ratio of 17.1%, shares remain highly illiquid, posing a challenge for investors seeking liquidity. The company reported net income of MXN 2,484 million for nine months ending September 2024 compared to MXN 1,625 million last year, with basic earnings per share rising from MXN 6 to MXN 9.

Thai Coconut (SET:COCOCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Thai Coconut Public Company Limited specializes in the production and distribution of coconut products in Thailand, with a market capitalization of THB16.02 billion.

Operations: Thai Coconut generates revenue primarily from the production and distribution of coconut products. The company's financial data highlights a market capitalization of THB16.02 billion, indicating its significant presence in the industry.

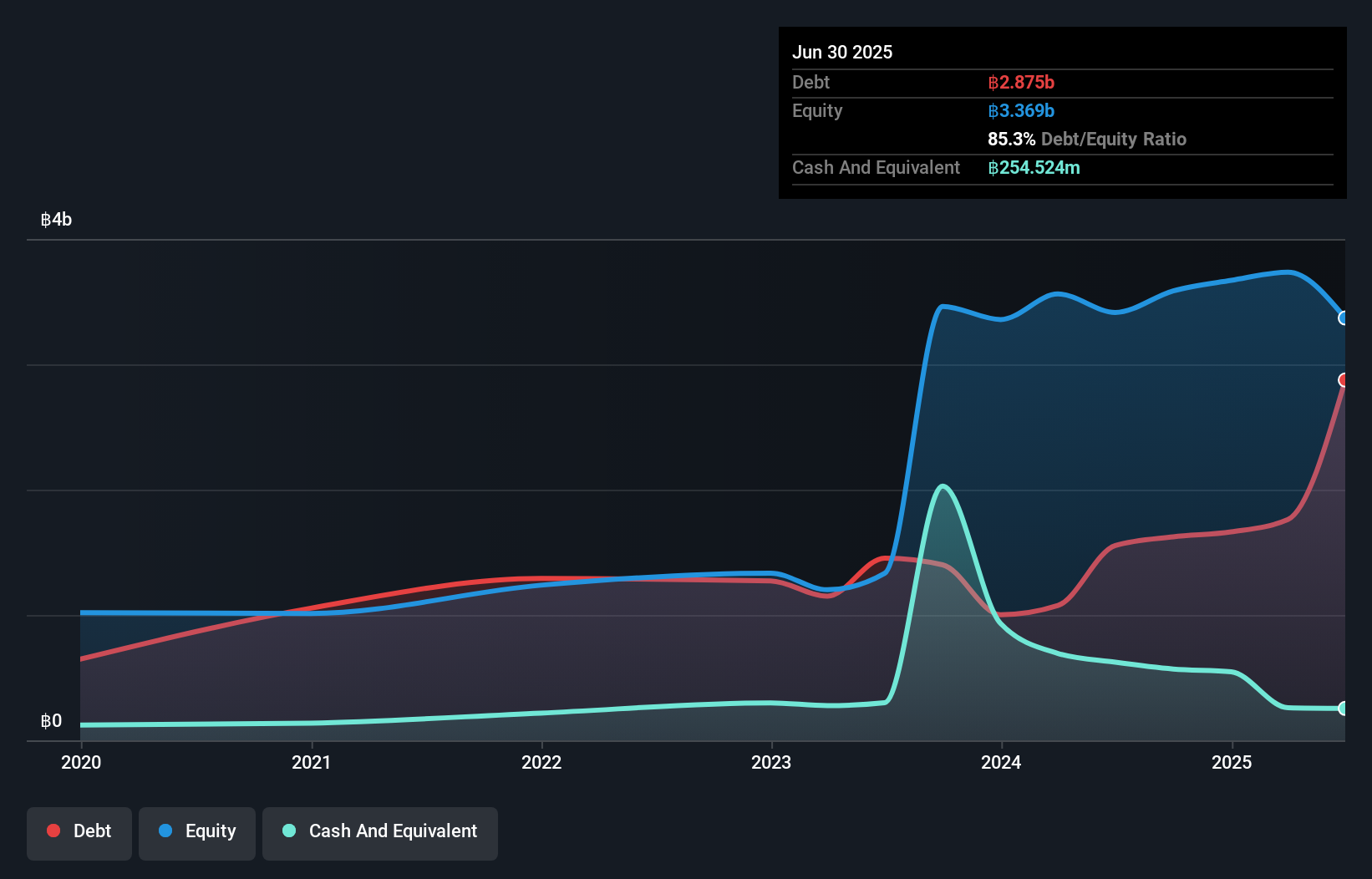

Thai Coconut, a relatively small player in the food industry, is trading at 42.8% below its estimated fair value, presenting an intriguing opportunity. The company boasts a net debt to equity ratio of 29.4%, indicating satisfactory leverage levels, and its interest payments are well covered by EBIT with a coverage ratio of 25.3x. Despite not being free cash flow positive recently, earnings grew impressively by 83.5% over the past year—outpacing the industry average of 36.5%. Recent quarterly results show revenue rising to THB1,928 million from THB1,298 million last year with net income increasing to THB172 million from THB153 million previously.

- Navigate through the intricacies of Thai Coconut with our comprehensive health report here.

Gain insights into Thai Coconut's historical performance by reviewing our past performance report.

Gamania Digital Entertainment (TPEX:6180)

Simply Wall St Value Rating: ★★★★★★

Overview: Gamania Digital Entertainment Co., Ltd. operates as an integrated internet company with a market cap of NT$14.39 billion, serving Taiwan, the rest of Asia, and international markets through its subsidiaries.

Operations: Gamania Digital Entertainment generates revenue through its integrated internet services across Taiwan, Asia, and international markets. The company's financial performance is highlighted by a market capitalization of NT$14.39 billion.

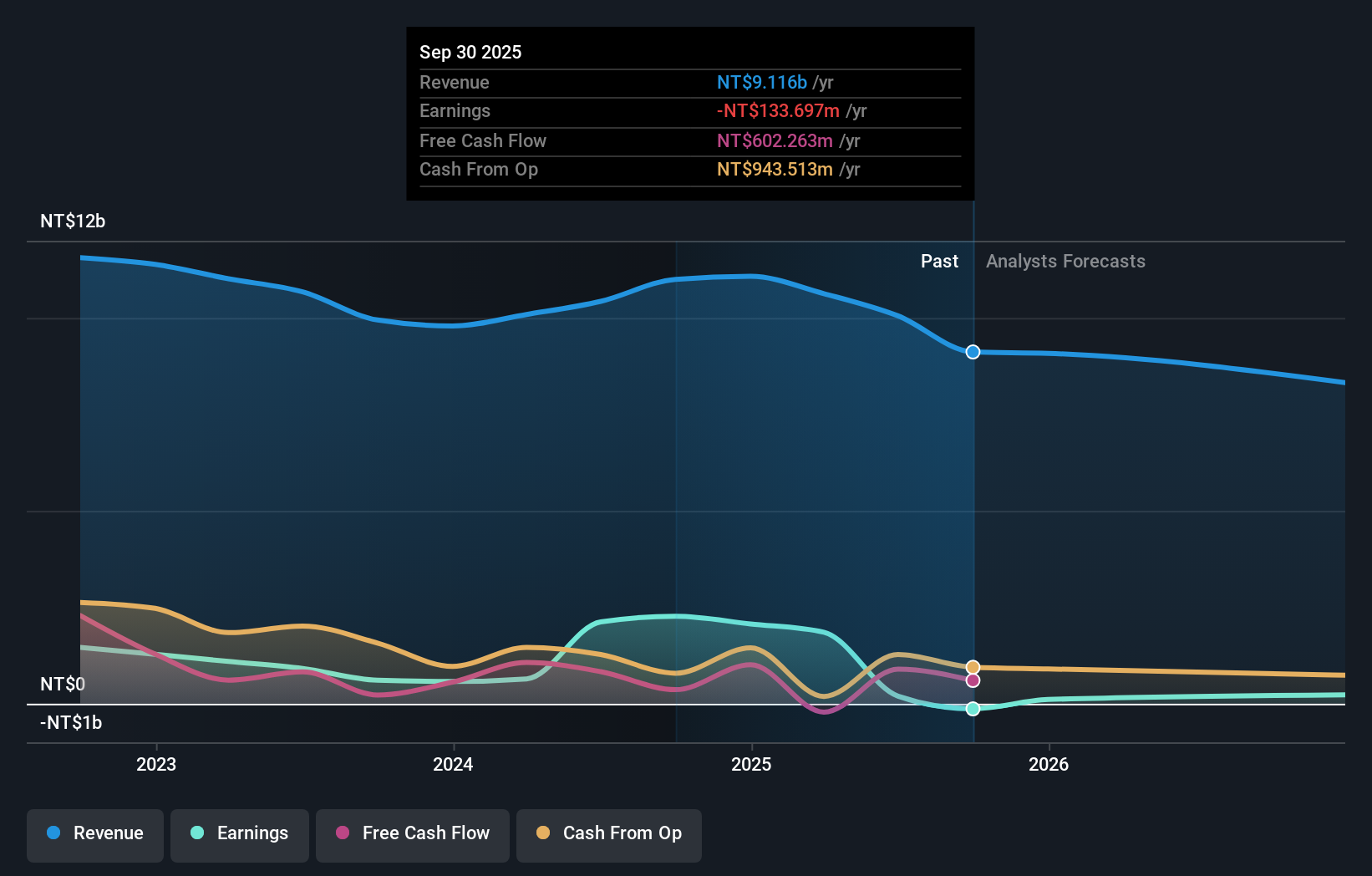

Gamania Digital Entertainment shines in the small cap arena with impressive growth metrics. Over the past year, earnings surged by 273%, far outpacing the entertainment industry's 29.2% increase. The company reported a robust Q3 performance with sales hitting TWD 3.24 billion and net income reaching TWD 331.67 million, compared to last year's figures of TWD 2.67 billion and TWD 186.49 million respectively. Its debt-to-equity ratio has significantly improved from 27% to just 3% over five years, indicating strong financial health, while its price-to-earnings ratio of 6x suggests it trades at a good value relative to peers.

- Click here and access our complete health analysis report to understand the dynamics of Gamania Digital Entertainment.

Understand Gamania Digital Entertainment's track record by examining our Past report.

Turning Ideas Into Actions

- Dive into all 4666 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thai Coconut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:COCOCO

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives