- Taiwan

- /

- Metals and Mining

- /

- TWSE:2069

Optimism around Yuen Chang Stainless Steel (TWSE:2069) delivering new earnings growth may be shrinking as stock declines 14% this past week

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Yuen Chang Stainless Steel Co., Ltd. (TWSE:2069) shareholders have had that experience, with the share price dropping 45% in three years, versus a market return of about 54%. And the share price decline continued over the last week, dropping some 14%.

If the past week is anything to go by, investor sentiment for Yuen Chang Stainless Steel isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Yuen Chang Stainless Steel

While Yuen Chang Stainless Steel made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last three years, Yuen Chang Stainless Steel's revenue dropped 4.8% per year. That's not what investors generally want to see. The stock has disappointed holders over the last three years, falling 13%, annualized. And with no profits, and weak revenue, are you surprised? Of course, sentiment could become too negative, and the company may actually be making progress to profitability.

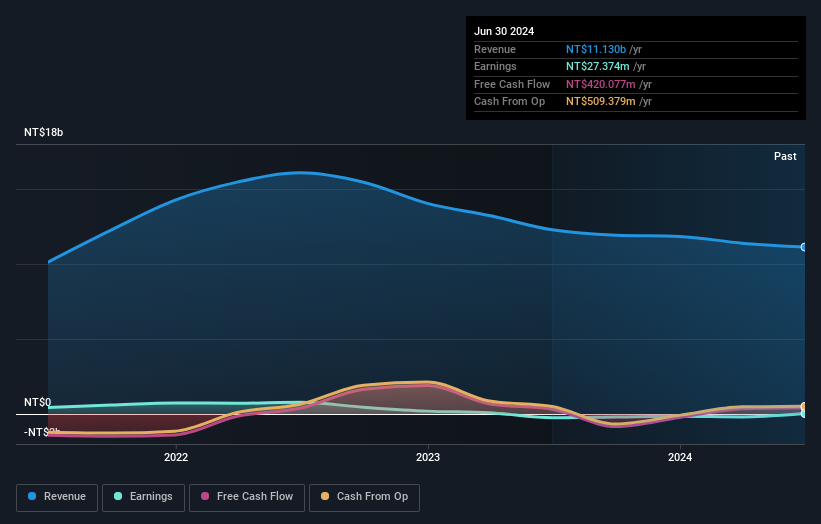

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Yuen Chang Stainless Steel the TSR over the last 3 years was -34%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Yuen Chang Stainless Steel shareholders gained a total return of 11% during the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 1.5% per year over five year. This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Yuen Chang Stainless Steel better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Yuen Chang Stainless Steel (at least 2 which are potentially serious) , and understanding them should be part of your investment process.

Of course Yuen Chang Stainless Steel may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2069

Yuen Chang Stainless Steel

Engages in the processing and manufacturing of stainless steel products in Taiwan and internationally.

Slight with questionable track record.