Stock Analysis

Recent 4.2% pullback isn't enough to hurt long-term Mercuries Life Insurance (TWSE:2867) shareholders, they're still up 49% over 1 year

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Mercuries Life Insurance Company Ltd. (TWSE:2867) share price is 49% higher than it was a year ago, much better than the market return of around 32% (not including dividends) in the same period. That's a solid performance by our standards! On the other hand, longer term shareholders have had a tougher run, with the stock falling 14% in three years.

In light of the stock dropping 4.2% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

Check out our latest analysis for Mercuries Life Insurance

Mercuries Life Insurance wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Mercuries Life Insurance grew its revenue by 13% last year. That's not great considering the company is losing money. In keeping with the revenue growth, the share price gained 49% in that time. That's not a standout result, but it is solid - much like the level of revenue growth. It could be worth keeping an eye on this one, especially if growth accelerates.

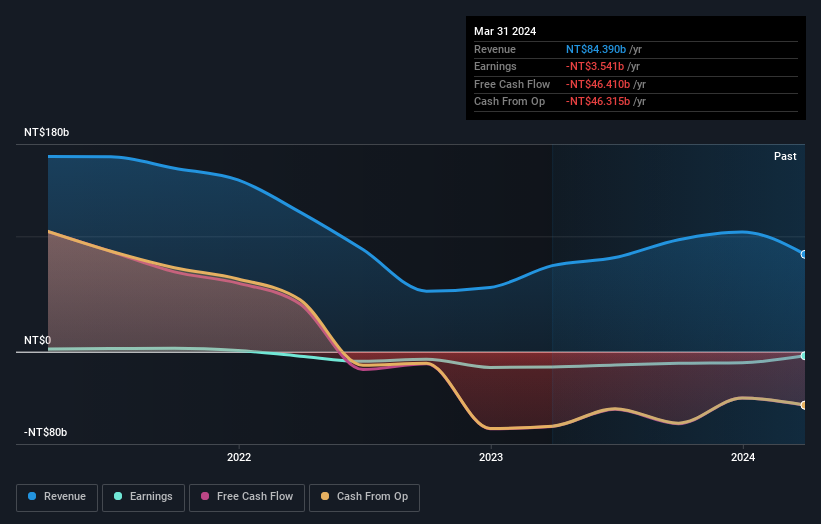

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Mercuries Life Insurance shareholders have received a total shareholder return of 49% over the last year. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Mercuries Life Insurance (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

But note: Mercuries Life Insurance may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2867

Mediocre balance sheet and slightly overvalued.