As global markets react to anticipated interest rate cuts and small-cap stocks outperform their larger counterparts, investors are increasingly looking for opportunities in lesser-known companies. In this environment, identifying a good stock often means finding those with strong fundamentals and growth potential that have yet to be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mobile Telecommunications | NA | 3.85% | -0.40% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 8.04% | -3.72% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Anadolu Hayat Emeklilik Anonim Sirketi offers individual and group insurance, reinsurance services, and personal accident coverage in Turkey with a market cap of TRY44.20 billion.

Operations: Anadolu Hayat Emeklilik Anonim Sirketi generates revenue primarily from its Life segment, which accounts for TRY13.34 billion, and its Retirement segment, contributing TRY2.83 billion. The Non-Life segment adds a minor portion with TRY1.19 million.

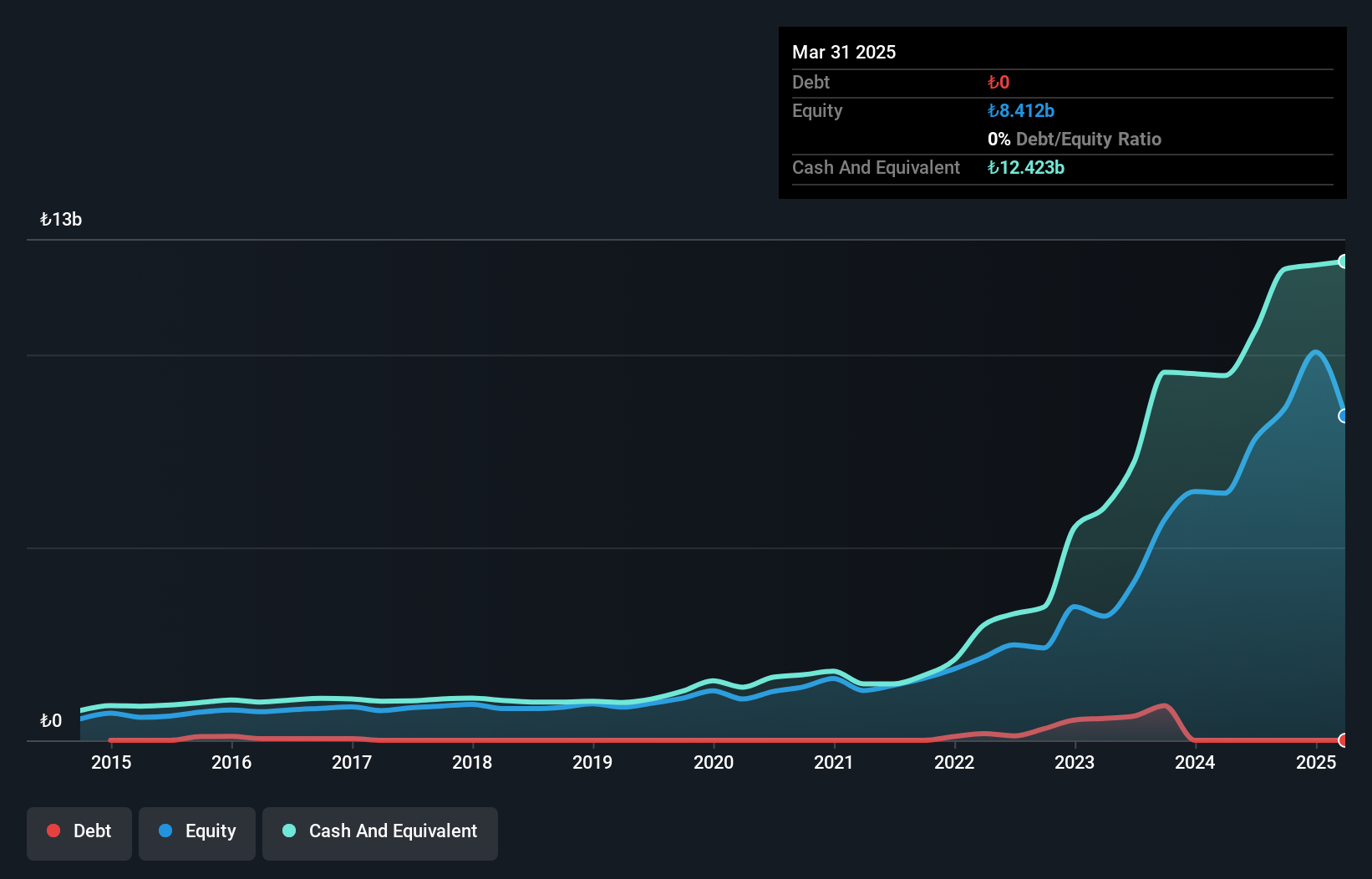

Anadolu Hayat Emeklilik Anonim Sirketi, a notable player in the insurance sector, reported impressive net income of TRY 1.22 billion for Q2 2024, up from TRY 925.83 million a year ago. Over the past five years, earnings have grown at an annual rate of 51.4%, showcasing strong performance despite not outpacing industry growth (91.8%). The company’s P/E ratio stands at a favorable 11.8x compared to the TR market's 16.5x, indicating potential value for investors. Additionally, ANHYT's debt-to-equity ratio has slightly increased to 0.02% over five years but remains low with interest payments well covered by EBIT (198x).

ESSA Industries Indonesia (IDX:ESSA)

Simply Wall St Value Rating: ★★★★★★

Overview: PT ESSA Industries Indonesia Tbk., along with its subsidiaries, operates an ammonia plant in Indonesia and has a market cap of IDR14.90 trillion.

Operations: ESSA Industries Indonesia generates revenue primarily from its ammonia plant operations. The company has a market cap of IDR14.90 trillion and operates within the chemical manufacturing sector in Indonesia.

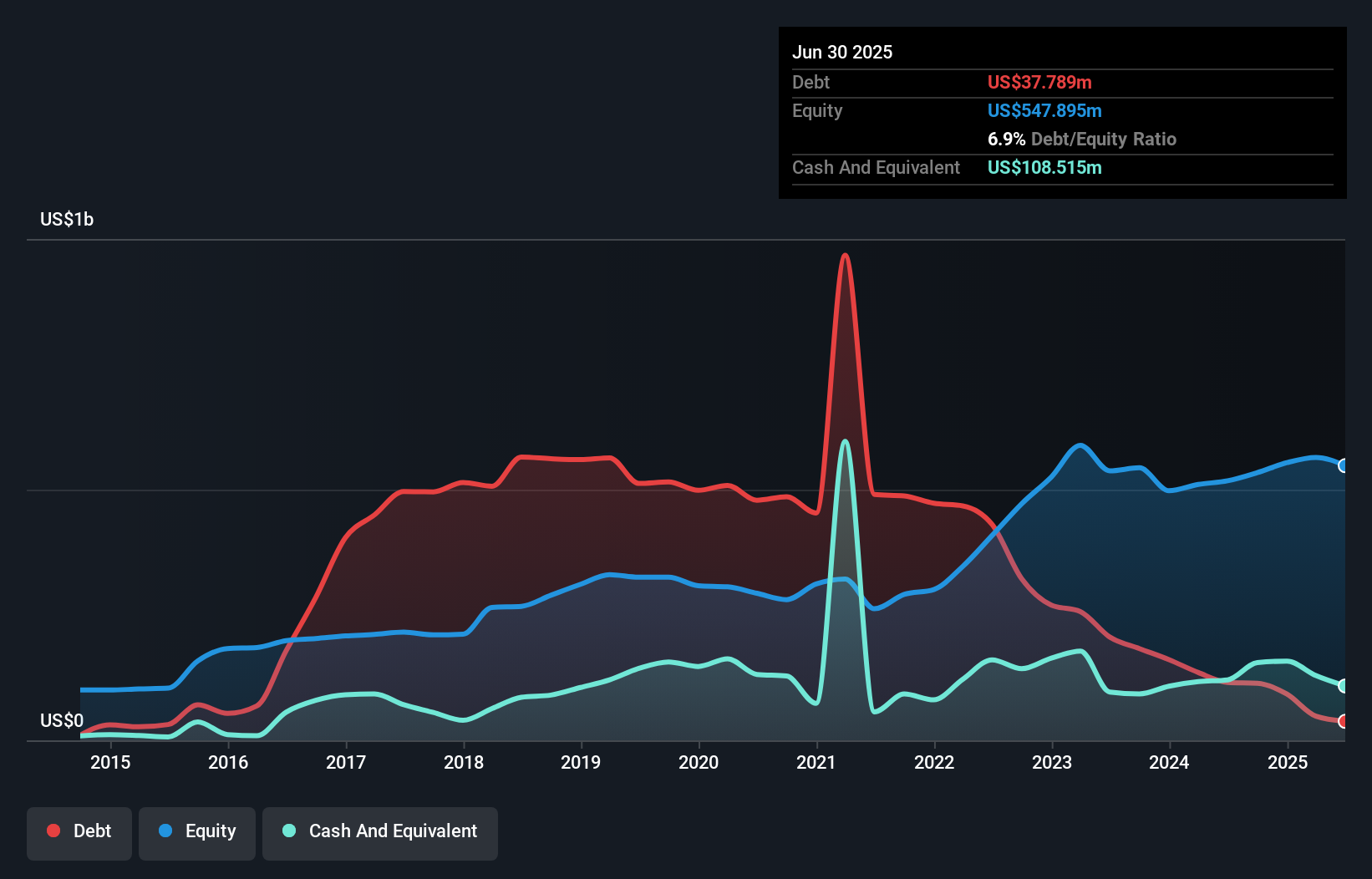

ESSA Industries Indonesia has shown significant improvement by reducing its debt to equity ratio from 157.5% to 22.3% over the past five years, and its interest payments are well covered by EBIT at a 13.2x coverage ratio. Despite negative earnings growth of -32.5% last year, ESSA reported net income of US$20.59 million for H1 2024, up from US$3.98 million a year ago, with basic earnings per share rising to US$0.001195 from US$0.000231 in the same period.

Farglory Life Insurance (TPEX:5859)

Simply Wall St Value Rating: ★★★★★☆

Overview: Farglory Life Insurance Co., Ltd. operates in Taiwan, offering a range of insurance products and services, with a market cap of NT$24.54 billion.

Operations: Farglory Life Insurance generates revenue primarily from its insurance products and services in Taiwan. The company's net profit margin stands at 5.75%.

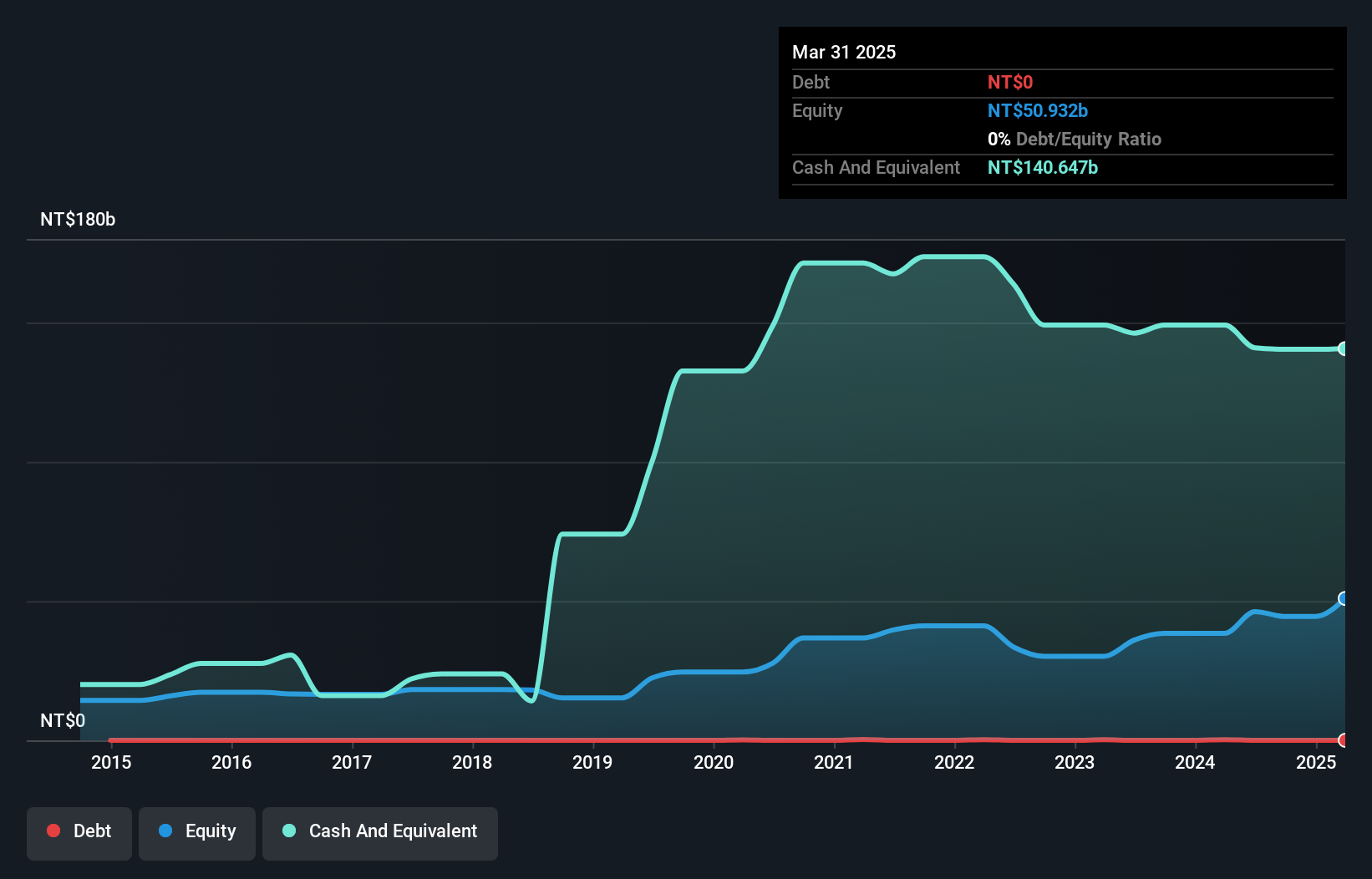

Farglory Life Insurance has shown strong financial performance recently, with Q2 revenue at TWD 20.51 billion and a net income of TWD 2 billion, up from TWD 1.81 billion last year. The company reported a basic EPS of TWD 1.6 for the quarter and achieved an impressive six-month net income of TWD 6.15 billion, compared to just TWD 1.52 billion previously. Trading at about 83% below its estimated fair value, Farglory seems undervalued despite its recent profitability surge and high-quality earnings profile.

Seize The Opportunity

- Click here to access our complete index of 4877 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ESSA Industries Indonesia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IDX:ESSA

Flawless balance sheet with proven track record.