- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:APAM

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of a new U.S. administration, fluctuating interest rates, and mixed economic signals from major regions like Europe and China, investors are closely watching how these factors might impact their portfolios. Amid this backdrop of uncertainty and sector volatility, dividend stocks can offer a measure of stability by providing consistent income streams, making them an attractive consideration for those looking to balance growth with income in their investment strategies.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.29% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.89% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Aperam (ENXTAM:APAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aperam S.A., along with its subsidiaries, is engaged in the production and sale of stainless and specialty steel products globally, with a market cap of approximately €2.04 billion.

Operations: Aperam's revenue is primarily derived from its Stainless & Electrical Steel segment (€4.03 billion), followed by Services & Solutions (€2.36 billion), Recycling & Renewables (€2.00 billion), and Alloys & Specialties (€943 million).

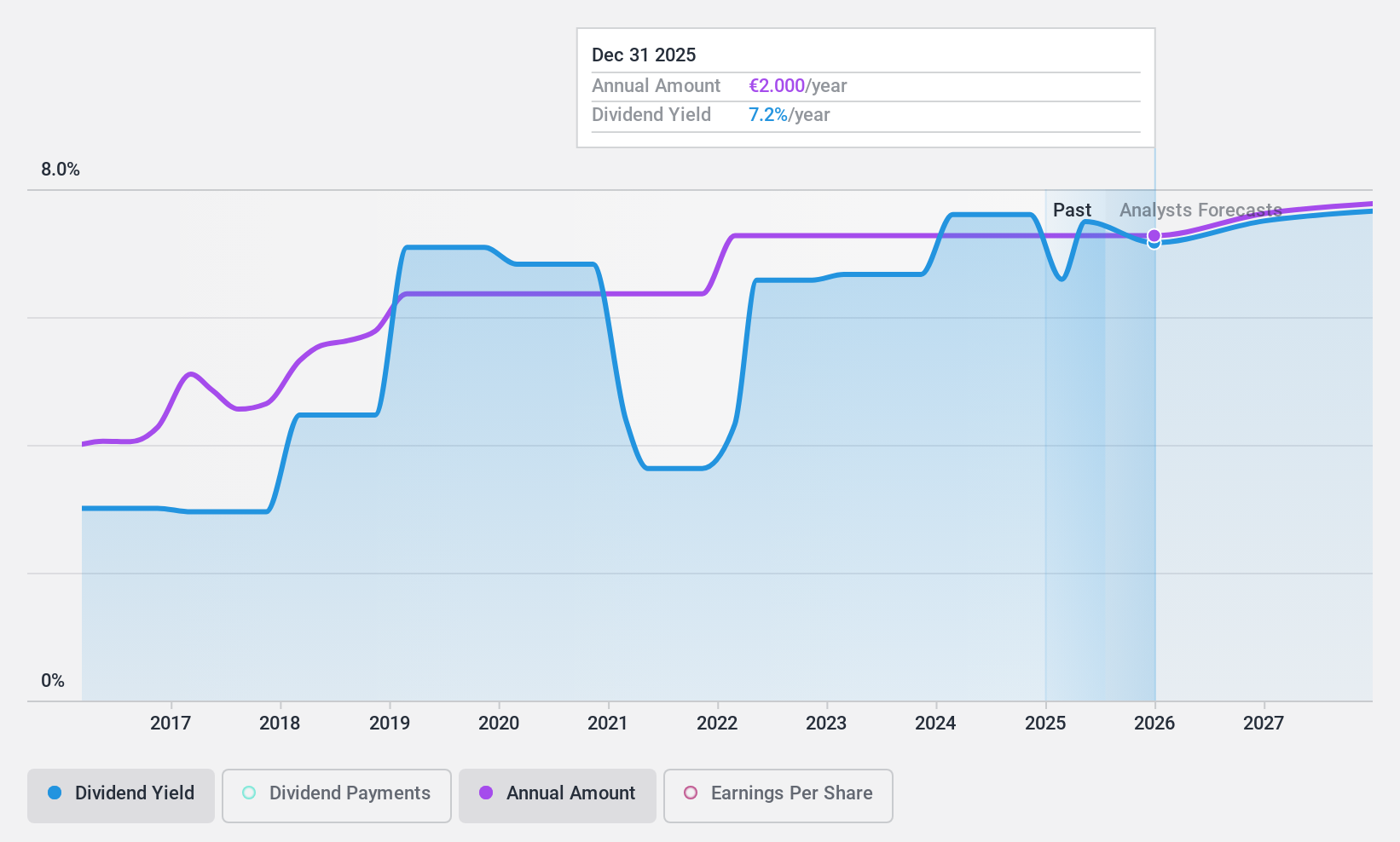

Dividend Yield: 7.1%

Aperam's dividend yield of 7.09% ranks in the top 25% of Dutch market payers, supported by a sustainable payout ratio of 50%. The company's dividends are covered by both earnings and cash flows, with a cash payout ratio at 73%. Despite being relatively new to dividends with less than ten years of payments, Aperam has shown reliability and growth. Recent Q3 results highlight strong performance with EUR 179 million net income compared to a loss last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Aperam.

- Our expertly prepared valuation report Aperam implies its share price may be lower than expected.

TECO Electric & Machinery (TWSE:1504)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TECO Electric & Machinery Co., Ltd. operates in the manufacturing, installation, wholesale, and retail sectors for electronic and telecommunications equipment, office equipment, and home appliances across Taiwan, the United States, China, and internationally with a market cap of approximately NT$109.68 billion.

Operations: TECO Electric & Machinery Co., Ltd. generates revenue through its diverse operations in electronic and telecommunications equipment, office equipment, and home appliances across multiple regions including Taiwan, the United States, China, and other international markets.

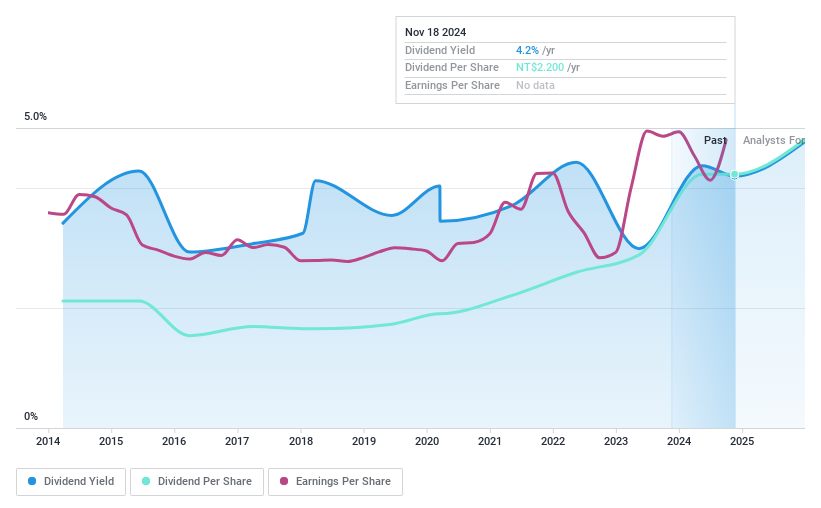

Dividend Yield: 4.2%

TECO Electric & Machinery's dividend yield is 4.23%, slightly below the top 25% of Taiwan market payers. The company's dividends, though covered by earnings (payout ratio: 81.9%) and cash flows (cash payout ratio: 82.7%), have been volatile and unreliable over the past decade with significant annual drops exceeding 20%. Recent Q3 results show improved net income of TWD 1,770 million from TWD 981.15 million a year ago, despite declining sales figures.

- Click here to discover the nuances of TECO Electric & Machinery with our detailed analytical dividend report.

- Our valuation report unveils the possibility TECO Electric & Machinery's shares may be trading at a discount.

Da-Li DevelopmentLtd (TWSE:6177)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Da-Li Development Co., Ltd., along with its subsidiaries, engages in the construction business in Taiwan and the United States, with a market capitalization of NT$18.68 billion.

Operations: Da-Li Development Co., Ltd. generates revenue from its construction operations in Taiwan and the United States.

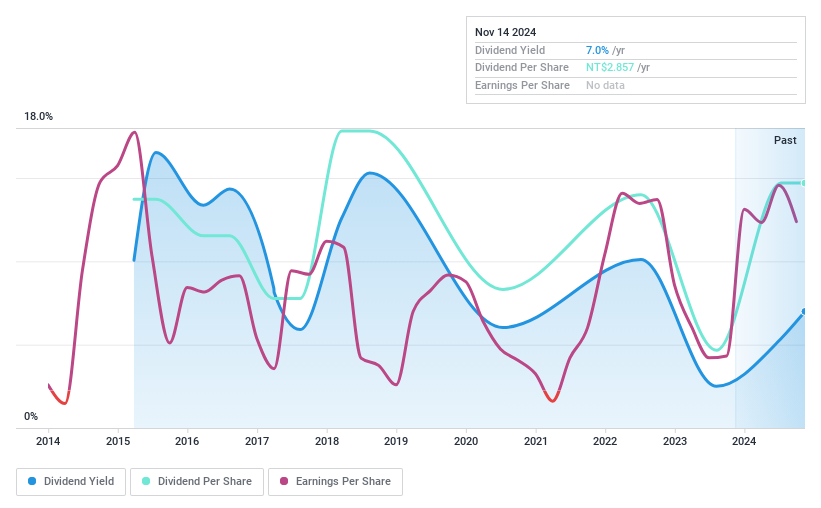

Dividend Yield: 6.6%

Da-Li Development Ltd. offers a strong dividend yield of 6.55%, placing it in the top 25% of Taiwan market payers, though its dividends have been volatile over the past decade. The company's payout ratio is reasonable at 63.4%, with cash flows covering dividends comfortably at a 21.8% cash payout ratio. Despite recent earnings declines, Da-Li's strategic expansion in Taipei City could bolster future financial stability and support dividend sustainability.

- Get an in-depth perspective on Da-Li DevelopmentLtd's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Da-Li DevelopmentLtd shares in the market.

Taking Advantage

- Investigate our full lineup of 1951 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:APAM

Aperam

Produces and sells stainless and specialty steel products worldwide.

Undervalued with proven track record and pays a dividend.