- Taiwan

- /

- Auto Components

- /

- TWSE:2101

Even though Nankang Rubber TireLtd (TWSE:2101) has lost NT$2.1b market cap in last 7 days, shareholders are still up 27% over 1 year

It hasn't been the best quarter for Nankang Rubber Tire Corp.,Ltd. (TWSE:2101) shareholders, since the share price has fallen 14% in that time. But at least the stock is up over the last year. In that time, it is up 27%, which isn't bad, but is below the market return of 38%.

Although Nankang Rubber TireLtd has shed NT$2.1b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Nankang Rubber TireLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Nankang Rubber TireLtd went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

However the year on year revenue growth of 19% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

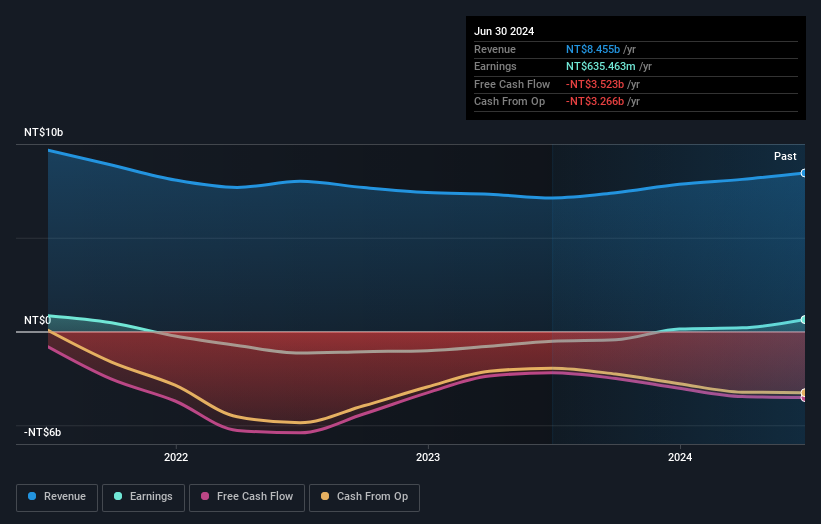

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Nankang Rubber TireLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Nankang Rubber TireLtd shareholders gained a total return of 27% during the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 2% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand Nankang Rubber TireLtd better, we need to consider many other factors. For example, we've discovered 2 warning signs for Nankang Rubber TireLtd that you should be aware of before investing here.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nankang Rubber TireLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2101

Nankang Rubber TireLtd

Engages in the manufacture and sale of tires under the Nankang brand name in Taiwan, Mainland China, the United States, Europe, rest of Asia, and internationally.

Mediocre balance sheet with questionable track record.