Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:600366

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to reach new heights, with U.S. small-cap indices like the Russell 2000 hitting record intraday highs, investor sentiment is buoyed by a mix of domestic policy shifts and geopolitical developments. In this dynamic environment, identifying high growth tech stocks involves assessing companies that can leverage technological advancements and adapt to evolving economic conditions while navigating potential challenges such as tariff changes and manufacturing slumps.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Logo Yazilim Sanayi ve Ticaret (IBSE:LOGO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Logo Yazilim Sanayi ve Ticaret A.S. is a company that develops and markets software solutions in Turkey and Romania, with a market capitalization of TRY11.35 billion.

Operations: Logo Yazilim generates revenue primarily from the software industry, amounting to TRY3.56 billion. The company operates in Turkey and Romania, focusing on developing and marketing software solutions.

Logo Yazilim Sanayi ve Ticaret has demonstrated a robust recovery, with its recent earnings report showing a swing from a net loss to a substantial profit, highlighting the company's ability to navigate market fluctuations effectively. The firm’s sales surged by 20% year-over-year in the third quarter of 2024, reaching TRY 1.17 billion, signaling strong demand for its software solutions. This growth trajectory is underpinned by an impressive forecast of revenue growth at 28.3% annually, outpacing the Turkish market's average of 25.8%. Moreover, Logo Yazilim is poised for significant earnings expansion with an anticipated annual increase of 94.7%, which starkly contrasts with the broader TR market expectation of 38.1%. This financial vigor is complemented by strategic R&D investments that not only fuel innovation but also enhance competitive advantage in the rapidly evolving tech landscape.

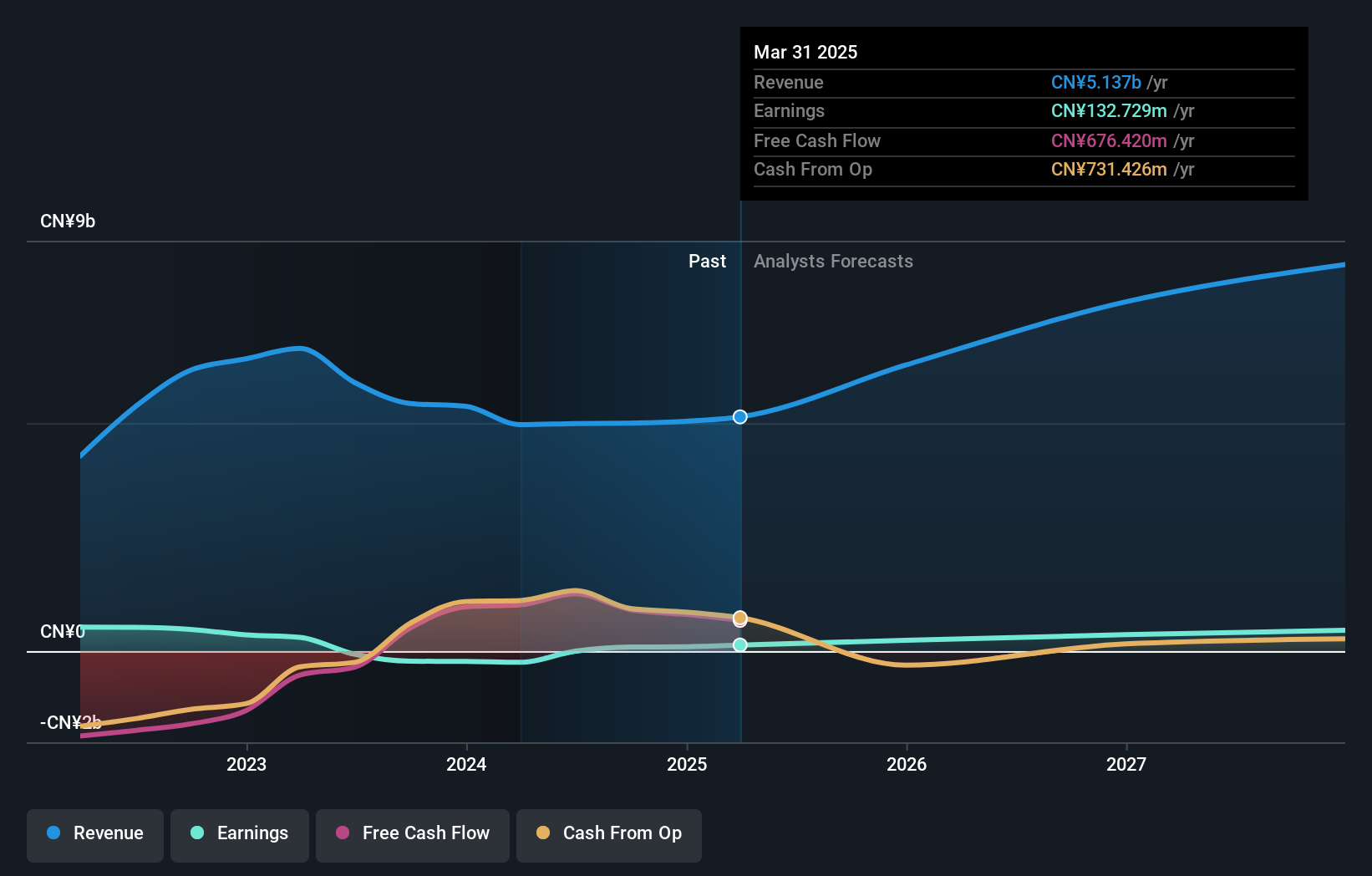

Ningbo Yunsheng (SHSE:600366)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Yunsheng Co., Ltd. focuses on the research, development, manufacture, and sale of rare earth permanent magnet materials in China, with a market cap of CN¥7.90 billion.

Operations: Ningbo Yunsheng Co., Ltd. generates revenue primarily from the sale of Neodymium Iron Boron materials, amounting to CN¥4.99 billion. The company's operations are centered around the rare earth permanent magnet sector in China.

Ningbo Yunsheng has pivoted from a net loss to a profit, marking a striking turnaround with net income reaching CNY 69.14 million, up from last year's significant loss. This resurgence is mirrored in its aggressive share repurchase strategy, buying back 1.25% of its shares for CNY 75.86 million, underscoring confidence in its financial health and future prospects. The company's commitment to innovation is evident from its R&D focus, crucial for sustaining the 23.5% annual revenue growth rate that outstrips the Chinese market's average of 13.8%. Moreover, projected earnings growth at an impressive rate of 64.6% annually highlights not just recovery but robust forward momentum in an increasingly competitive landscape.

Systena (TSE:2317)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Systena Corporation operates in Japan, focusing on solution and framework design, IT services, business solutions, and cloud businesses with a market cap of ¥126.18 billion.

Operations: The company generates revenue through its diverse operations in solution and framework design, IT services, business solutions, and cloud businesses. With a market capitalization of ¥126.18 billion, it plays a significant role in the Japanese technology sector.

Systena Corporation's recent upward revision in earnings guidance for FY 2025, with net sales expected between JPY 85 billion and JPY 90 billion, underscores its strong market positioning. This optimism is further bolstered by a robust R&D investment strategy, crucial for maintaining technological competitiveness; notably, the company has consistently allocated significant resources to innovation, as evidenced by R&D expenses comprising a substantial portion of revenue. Additionally, Systena's recent share repurchase of over 5 million shares for approximately JPY 1.93 billion signals confidence in its financial stability and commitment to shareholder value. These strategic moves reflect not only Systena’s resilience but also its proactive stance in navigating the fast-evolving tech landscape.

- Dive into the specifics of Systena here with our thorough health report.

Explore historical data to track Systena's performance over time in our Past section.

Taking Advantage

- Take a closer look at our High Growth Tech and AI Stocks list of 1289 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Yunsheng might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600366

Ningbo Yunsheng

Engages in the research and development, manufacture, and sale of rare earth permanent magnet materials in China.