- China

- /

- Electrical

- /

- SHSE:603530

Discovering Hidden Gems with Potential in November 2024

Reviewed by Simply Wall St

As global markets continue to navigate geopolitical tensions and economic uncertainties, U.S. indexes have shown resilience with smaller-cap indices outperforming their larger counterparts, signaling potential opportunities in the small-cap sector. In this landscape of broad-based gains and a strong labor market, identifying stocks with solid fundamentals and growth potential becomes crucial for investors seeking to uncover hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

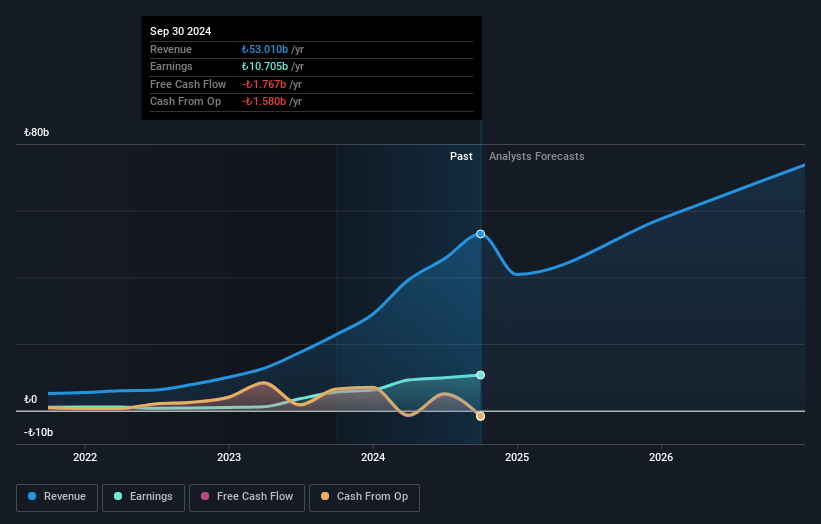

Türkiye Sigorta (IBSE:TURSG)

Simply Wall St Value Rating: ★★★★★★

Overview: Türkiye Sigorta A.S. is a non-life insurance company in Turkey with a market capitalization of TRY65.55 billion.

Operations: The company generates revenue primarily from segments such as Motor Vehicles Liability (TRY10.72 billion), Motor Vehicles (TRY9.55 billion), and Health (TRY5.84 billion). Fire insurance also contributes significantly with TRY5.15 billion in revenue.

Türkiye Sigorta, a notable player in the insurance sector, showcases robust growth with earnings surging 92.2% over the past year, outpacing the industry average of 79.1%. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 0.1%, highlighting strong financial management. Recent reports reveal net income for Q3 at TRY 3,081.68 million and basic EPS at TRY 0.95, both significantly higher than last year's figures of TRY 2,241.61 million and TRY 0.4483 respectively. With a price-to-earnings ratio of just 6.1x against the TR market's average of 15.7x, it offers compelling value prospects in its domain.

- Delve into the full analysis health report here for a deeper understanding of Türkiye Sigorta.

Gain insights into Türkiye Sigorta's past trends and performance with our Past report.

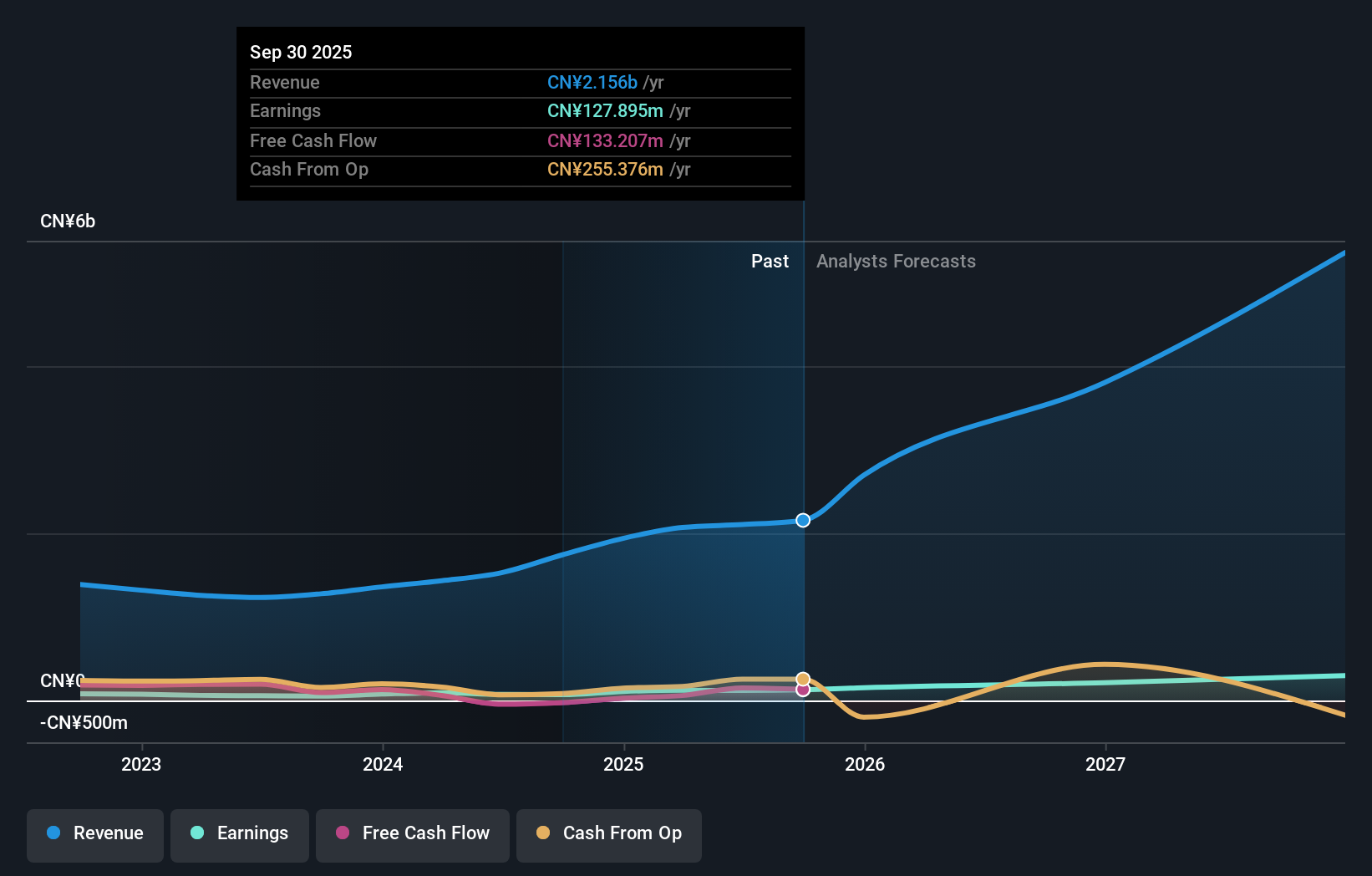

Jiangsu Shemar ElectricLtd (SHSE:603530)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Shemar Electric Co., Ltd focuses on the R&D, production, and sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals in China, with a market cap of CN¥10.05 billion.

Operations: Shemar Electric generates revenue primarily from the sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals. The company's net profit margin shows a trend worth noting at 15.2%.

Jiangsu Shemar Electric, a dynamic player in the electrical sector, showcases impressive growth with earnings skyrocketing by 131% over the past year, significantly outpacing the industry's 1.1%. The company reported robust sales of CNY 895 million for nine months ending September 2024, up from CNY 673 million last year. Net income also surged to CNY 216 million from CNY 96 million previously. Despite an increased debt-to-equity ratio from 0.04% to 1.8% over five years, it holds more cash than its total debt and maintains a positive free cash flow position, indicating financial resilience and potential for future expansion.

- Click here and access our complete health analysis report to understand the dynamics of Jiangsu Shemar ElectricLtd.

Learn about Jiangsu Shemar ElectricLtd's historical performance.

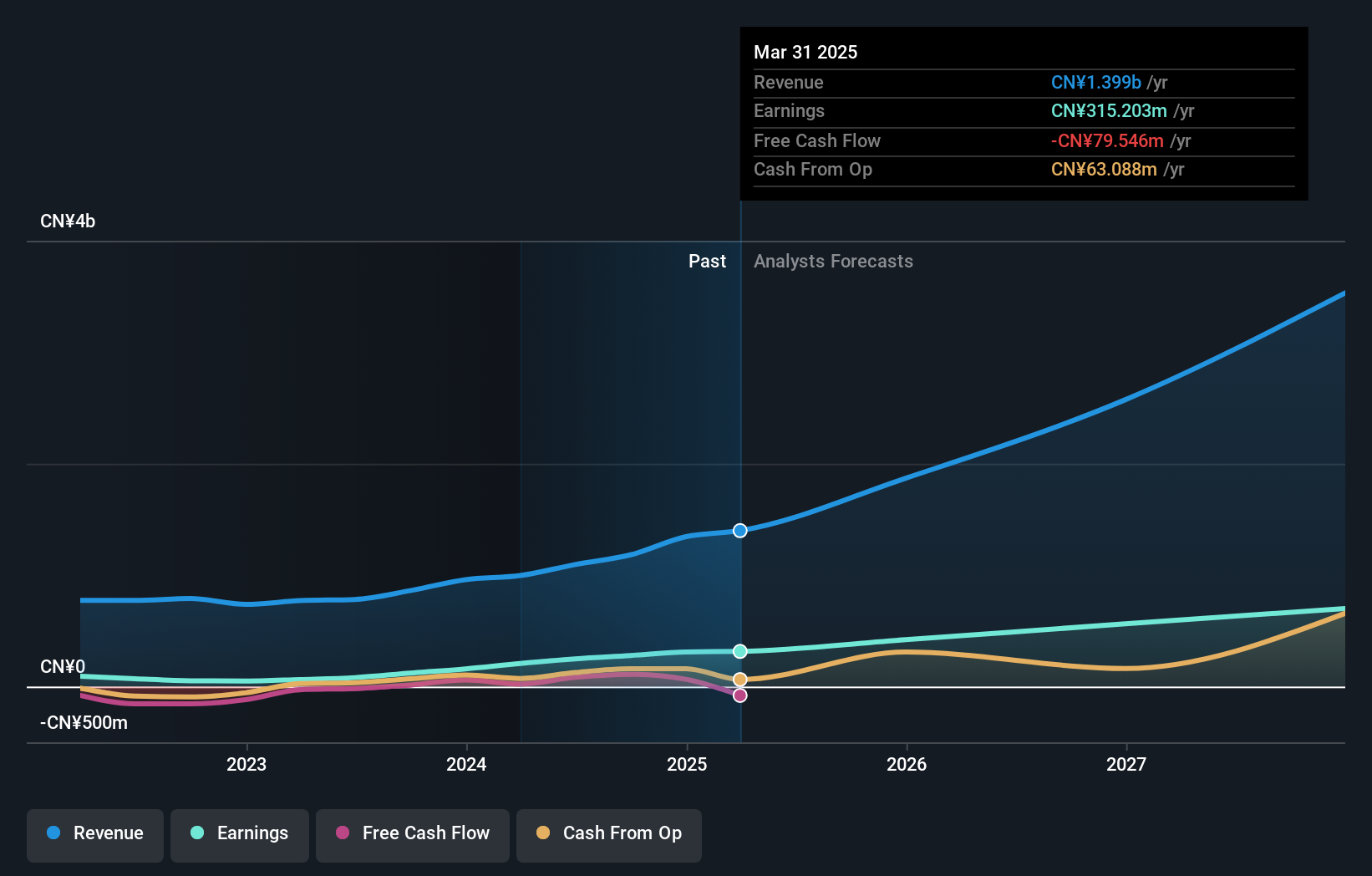

Cre8 Direct (NingBo) (SZSE:300703)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cre8 Direct (NingBo) Co., Ltd. is engaged in the design, development, production, and sale of paper-based products with a market capitalization of approximately CN¥2.62 billion.

Operations: Cre8 Direct generates revenue primarily from its paper and paper products segment, amounting to CN¥1.74 billion.

Cre8 Direct (NingBo) is carving out its space with recent sales of CNY 1.39 billion, a notable rise from CNY 1 billion last year, reflecting strong momentum despite net income slipping to CNY 59.69 million from CNY 66.66 million. The company's earnings have surged by 32.9% over the past year, outpacing the broader Forestry industry growth of 19%. However, earnings have seen a yearly drop of 6.3% over five years, indicating some volatility in performance metrics. Its net debt to equity ratio stands at a satisfactory level of 6.8%, suggesting prudent financial management amidst these dynamics.

- Get an in-depth perspective on Cre8 Direct (NingBo)'s performance by reading our health report here.

Evaluate Cre8 Direct (NingBo)'s historical performance by accessing our past performance report.

Next Steps

- Investigate our full lineup of 4634 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603530

Jiangsu Shemar ElectricLtd

Engages in the research and development, production, and sale of power system substation composite external insulation, transmission and distribution lines, and rubber seals in China.

Solid track record with excellent balance sheet.