Discovering Hidden Potential: Undiscovered Gems To Watch In November 2024

Reviewed by Simply Wall St

In a week marked by cautious earnings reports and mixed economic signals, small-cap stocks have demonstrated resilience amidst broader market volatility, as evidenced by the Russell 2000's slight gain against declines in major indices. As investors navigate these uncertain waters, identifying stocks with strong fundamentals and growth potential becomes paramount; this article highlights three such undiscovered gems that may offer intriguing opportunities in November 2024.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Togami Electric Mfg | 1.39% | 3.97% | 10.23% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.32% | 13.06% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 31.99% | 4.24% | -8.75% | ★★★★★☆ |

| Toyo Kanetsu K.K | 47.92% | 2.34% | 15.44% | ★★★★☆☆ |

| Yukiguni Maitake | 170.63% | -6.51% | -39.66% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Katilimevim Tasarruf Finansman Anonim Sirketi (IBSE:KTLEV)

Simply Wall St Value Rating: ★★★★★★

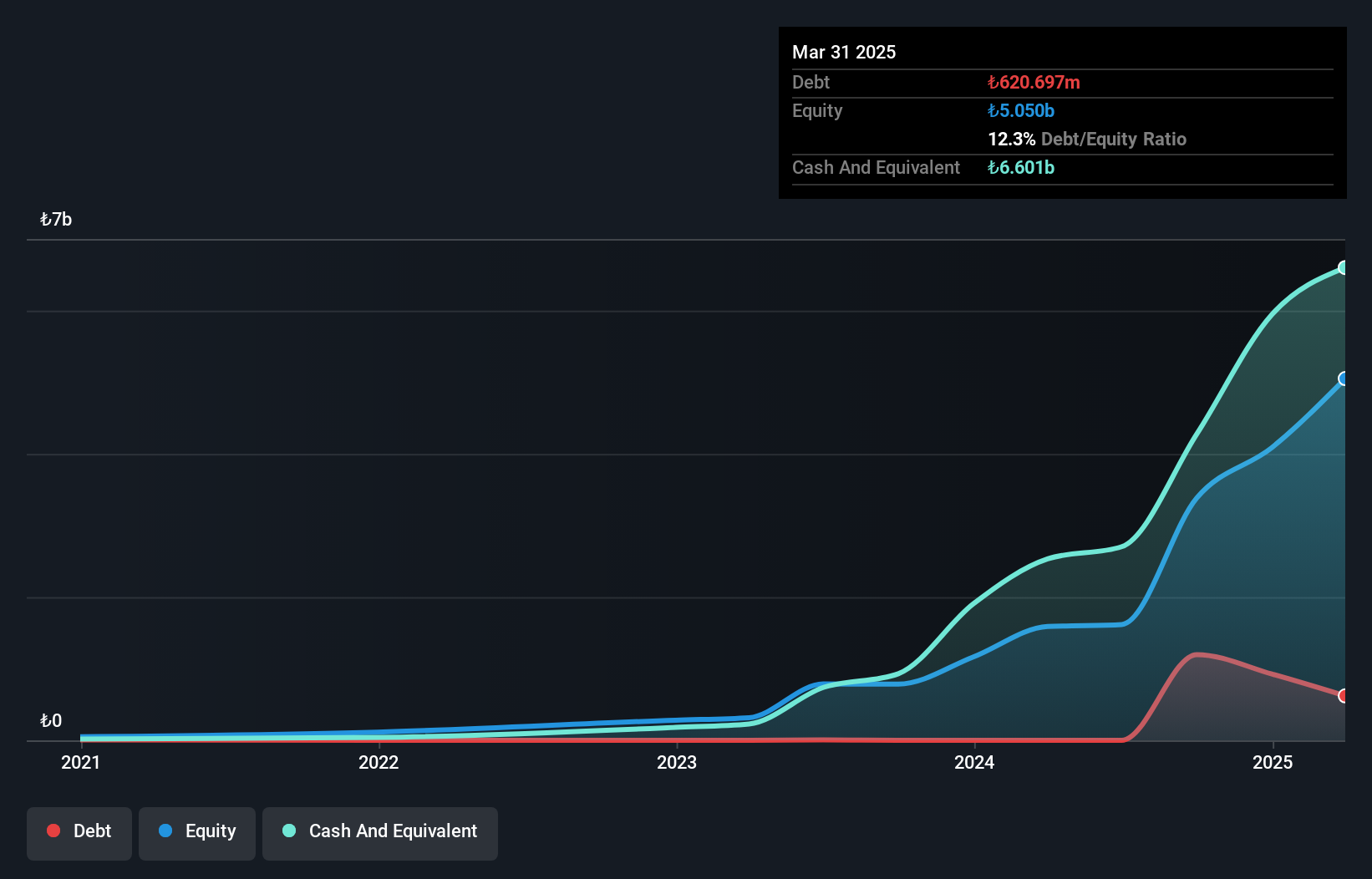

Overview: Katilimevim Tasarruf Finansman Anonim Sirketi operates in Turkey, offering savings finance solutions for purchasing houses and cars, with a market capitalization of TRY10.81 billion.

Operations: Katilimevim generates revenue primarily from its financial services for consumers, amounting to TRY2.47 billion. The company's net profit margin is a key indicator of its profitability.

Katilimevim Tasarruf Finansman Anonim Sirketi showcases a compelling profile with its high-quality earnings and impressive earnings growth of 541% over the past year, significantly outpacing the Consumer Finance industry's 15%. The company operates debt-free, eliminating concerns over interest coverage. Despite this financial strength, its share price has been highly volatile in recent months. Furthermore, Katilimevim's Price-To-Earnings ratio stands at 7.9x, which is attractively below the TR market average of 14.2x. These factors position it as an intriguing player within its industry context, balancing potential rewards with inherent risks.

Shandong Link Science and TechnologyLtd (SZSE:001207)

Simply Wall St Value Rating: ★★★★★★

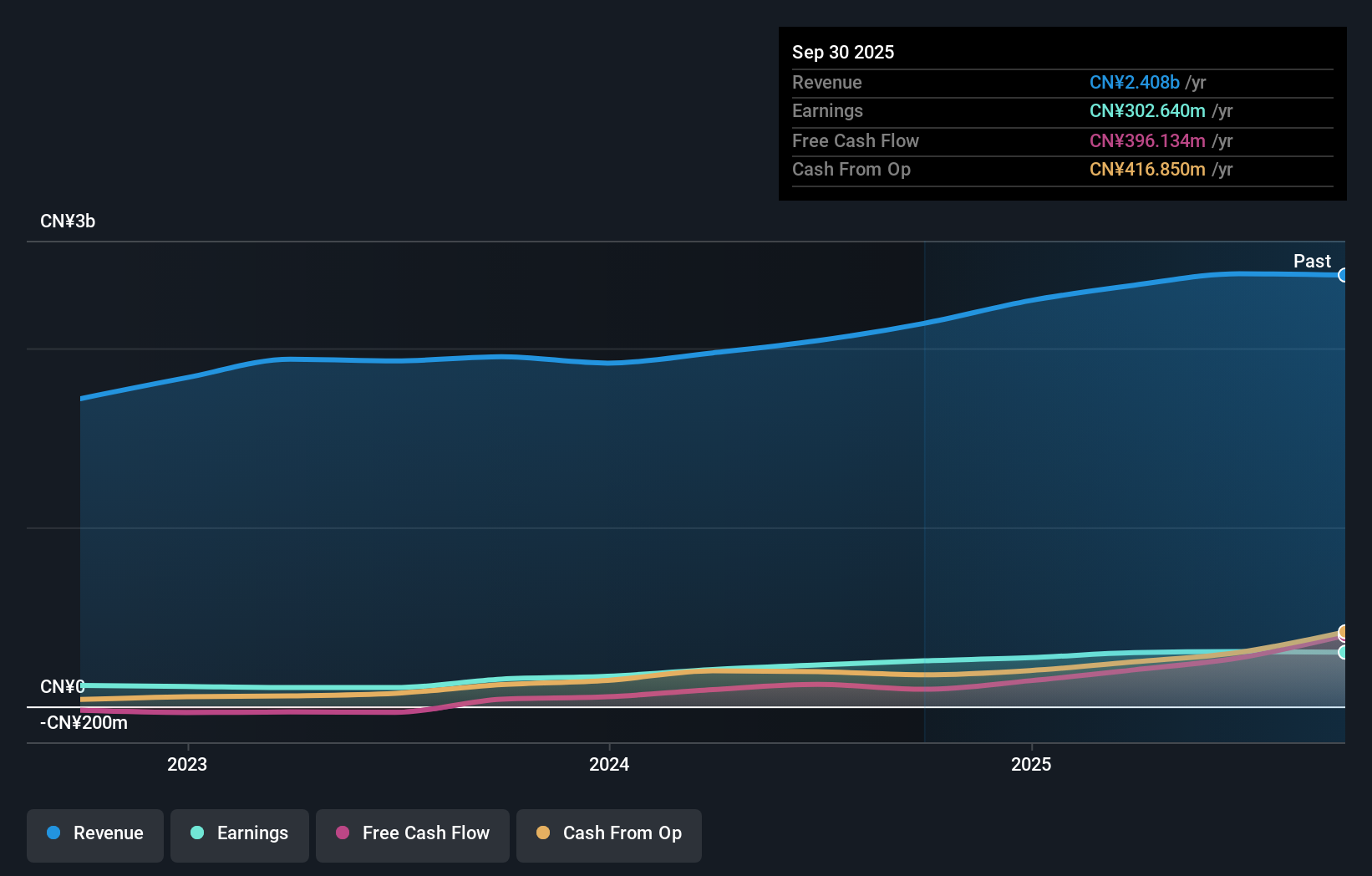

Overview: Shandong Link Science and Technology Co., Ltd. operates in the technology sector with a market capitalization of CN¥4.28 billion.

Operations: The company generates revenue primarily from its technology-related products and services. It has reported a gross profit margin of 35.7%, indicating the percentage of revenue remaining after accounting for the cost of goods sold.

Shandong Link Science and Technology, a dynamic player in its field, has shown impressive financial strides. Over the past year, earnings surged by 66.9%, outpacing the chemicals industry's -3.8%. The company trades at 30.3% below its estimated fair value, suggesting potential undervaluation. Recent changes include electing new independent directors and revising company bylaws to abolish the supervisory committee. For nine months ending September 2024, sales reached ¥1.65 billion (up from ¥1.42 billion), with net income climbing to ¥199.76 million from ¥113.57 million last year—demonstrating robust growth and strategic management decisions enhancing shareholder value.

Taiwan Speciality Chemicals (TPEX:4772)

Simply Wall St Value Rating: ★★★★★★

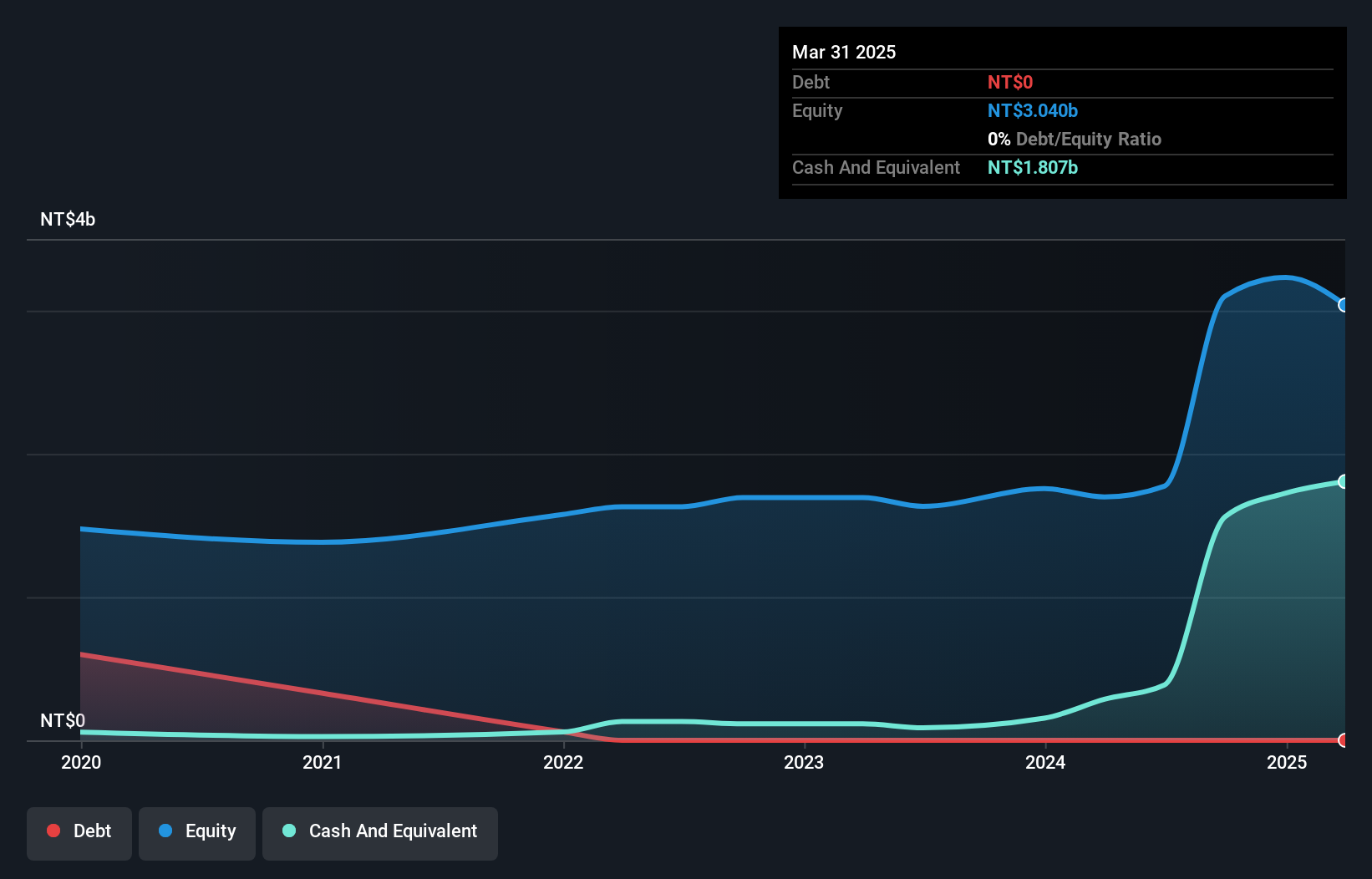

Overview: Taiwan Speciality Chemicals Corporation focuses on the manufacturing and sale of specialty electronic-graded gases and chemicals in Taiwan, with a market capitalization of NT$24.96 billion.

Operations: The primary revenue stream for Taiwan Speciality Chemicals Corporation comes from the research, development, and sales of precision chemical materials, generating NT$751.68 million.

Taiwan Speciality Chemicals has been making waves with its impressive financial performance over the past year. The company's earnings surged by 188%, outpacing the broader chemicals industry, which grew at 16%. Despite recent shareholder dilution, it remains debt-free, ensuring no concerns about interest coverage. Recent figures show a strong net income of TWD 75 million for Q2 2024 compared to TWD 21 million a year ago, and sales jumped to TWD 188 million from TWD 113 million. Additionally, their recent follow-on equity offering raised approximately US$32.3 million (TWD 1.04 billion), bolstering their capital base for future growth initiatives.

- Click to explore a detailed breakdown of our findings in Taiwan Speciality Chemicals' health report.

Learn about Taiwan Speciality Chemicals' historical performance.

Taking Advantage

- Gain an insight into the universe of 4736 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Speciality Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4772

Taiwan Speciality Chemicals

Manufactures and sells specialty electronic-graded gases and chemicals in Taiwan.

Flawless balance sheet with solid track record.