- China

- /

- Communications

- /

- SZSE:001229

Undiscovered Gems On None Exchange In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to 2025, small-cap stocks have notably underperformed their larger counterparts, with the Russell 2000 Index slipping into correction territory amid inflation concerns and political uncertainties. Despite these challenges, the resilient U.S. labor market and ongoing corporate earnings releases provide a backdrop where undiscovered gems may emerge as potential opportunities for investors seeking growth in overlooked sectors. In such volatile conditions, identifying promising stocks often involves looking beyond immediate market sentiment to find companies with strong fundamentals and innovative business models that can withstand economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| CAC Holdings | 10.58% | 0.55% | 4.78% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| TOMONY Holdings | 68.34% | 6.88% | 13.82% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Techno Ryowa | 0.19% | 3.96% | 11.17% | ★★★★★☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Net Holding (IBSE:NTHOL)

Simply Wall St Value Rating: ★★★★☆☆

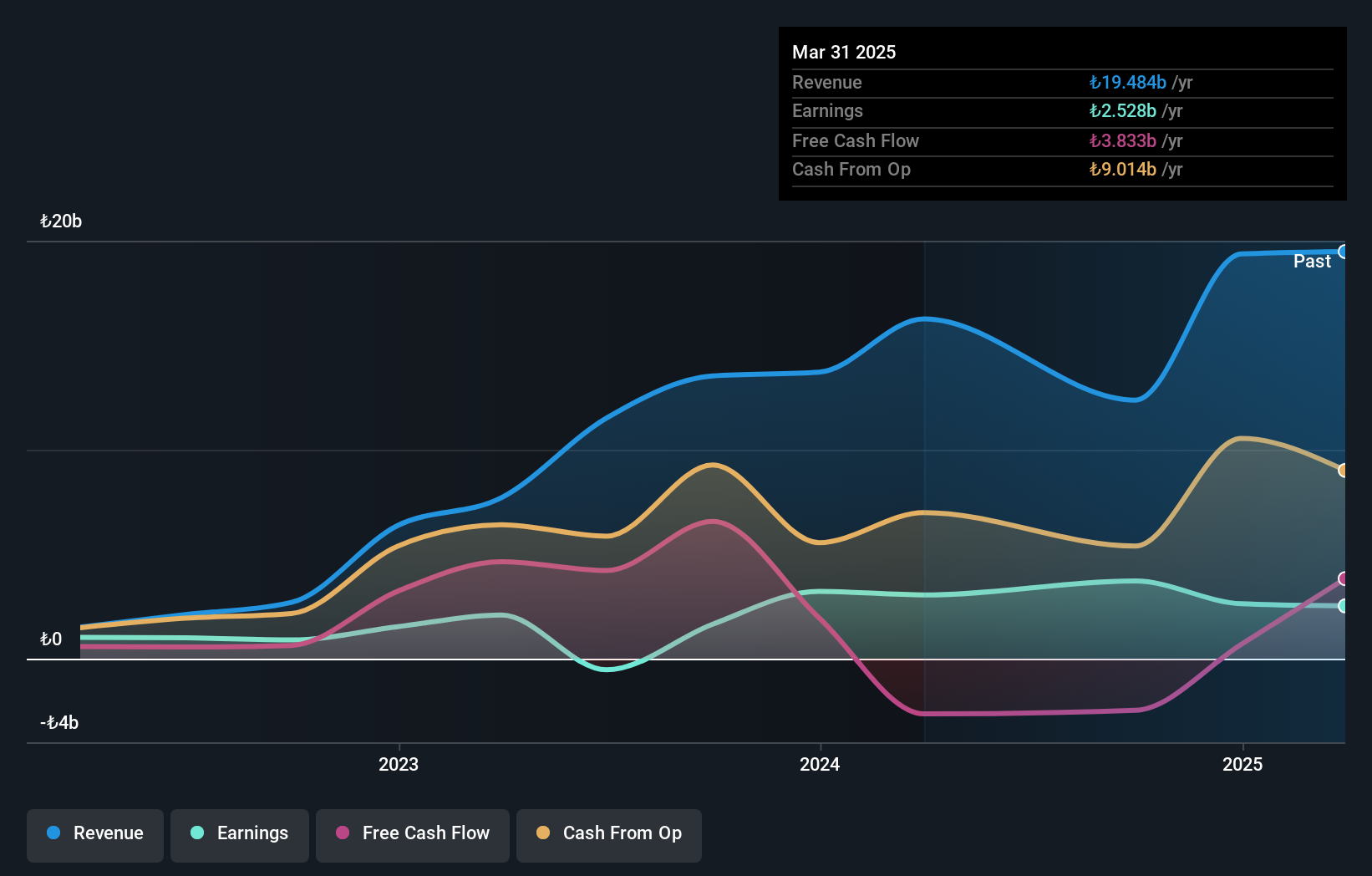

Overview: Net Holding A.S. operates in tourism, publication, and holding activities across Turkey, Croatia, Bulgaria, Montenegro, and the Turkish Republic of Northern Cyprus with a market capitalization of TRY20.91 billion.

Operations: Net Holding A.S. generates revenue primarily from its tourism and publication activities across multiple countries. The company's financial performance is influenced by its market presence in Turkey, Croatia, Bulgaria, Montenegro, and the Turkish Republic of Northern Cyprus.

Net Holding, with its relatively modest market presence, has shown impressive financial resilience and growth. Its debt to equity ratio improved significantly from 31.5% to 11.2% over five years, indicating a stronger balance sheet. The company's earnings surged by 125.3%, outpacing the hospitality sector's average of 13.2%, a testament to its robust operational performance. Despite not being free cash flow positive recently, Net Holding's net income for the nine months ending September 2024 was TRY 1,333 million compared to a loss last year, reflecting a substantial turnaround in profitability and suggesting potential for future growth in the industry landscape.

Guangdong AVCiT Technology Holding (SZSE:001229)

Simply Wall St Value Rating: ★★★★★★

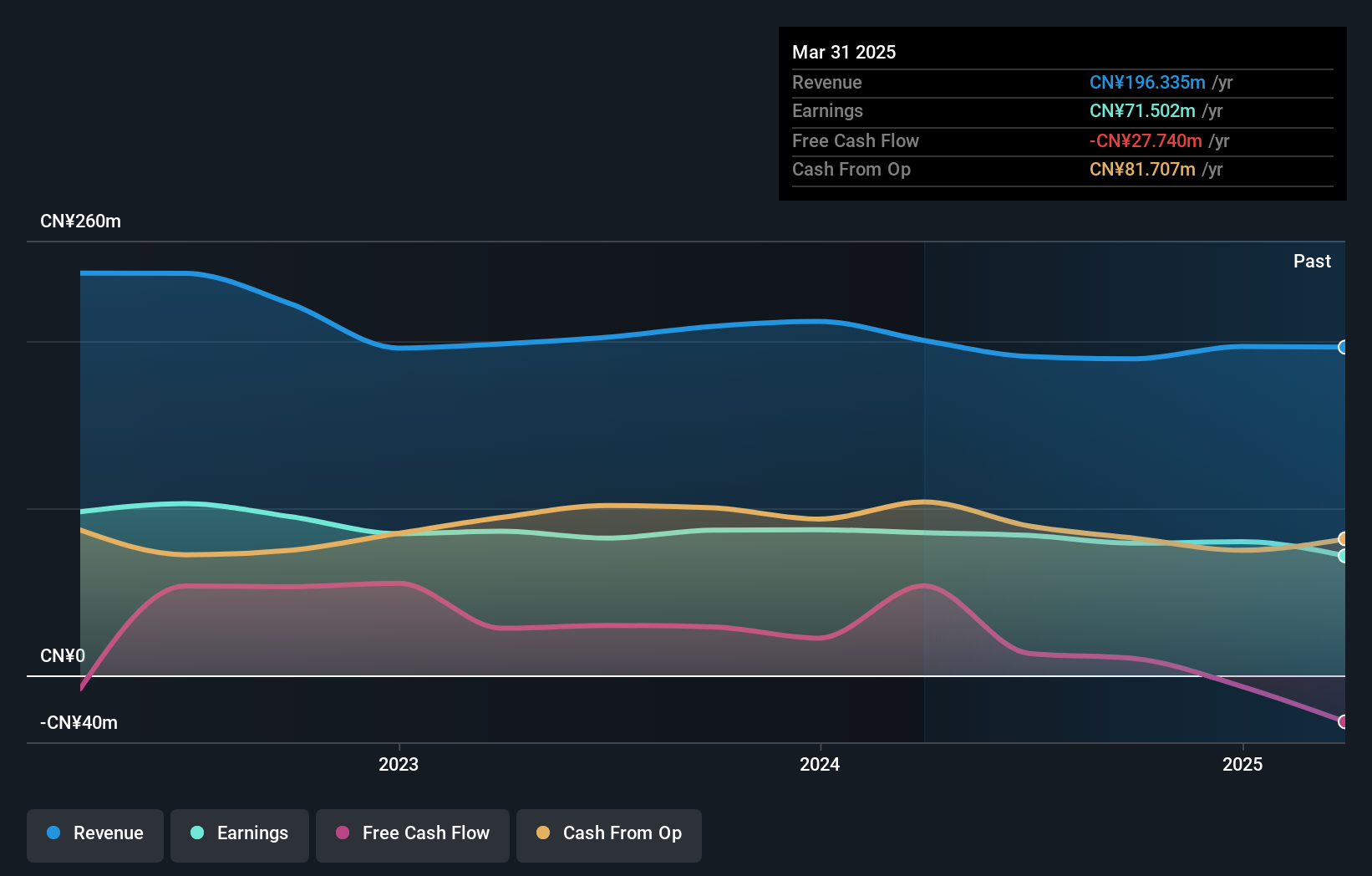

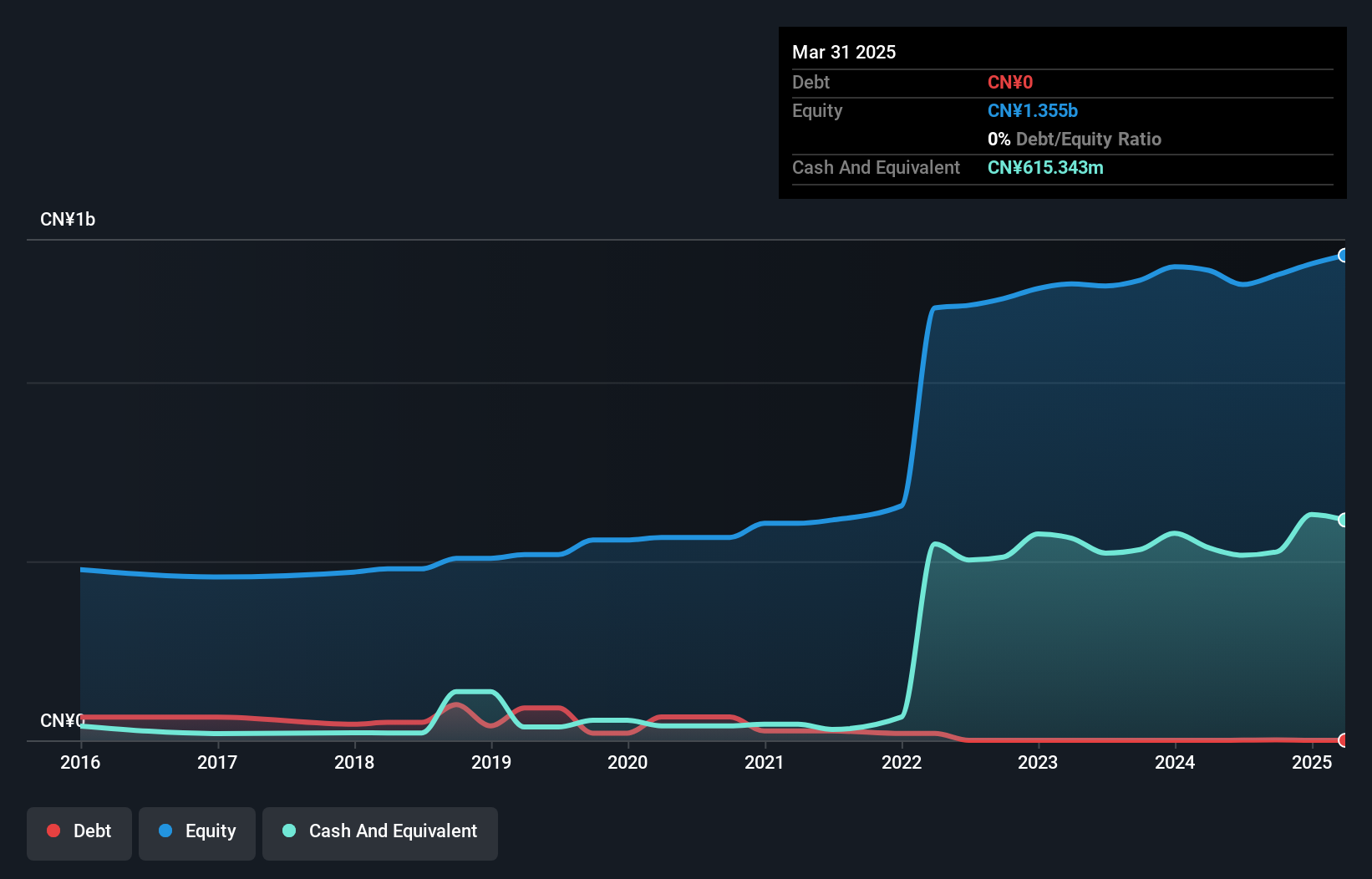

Overview: Guangdong AVCiT Technology Holding Co., Ltd. operates in the technology sector, focusing on providing advanced solutions and products, with a market cap of CN¥3.35 billion.

Operations: Guangdong AVCiT Technology Holding generates revenue primarily from its technology solutions and products. The company reports a gross profit margin of 43.5%, reflecting its cost management and pricing strategies within the competitive tech sector.

Guangdong AVCiT Technology Holding shows a mixed financial landscape. The company reported sales of CNY 117.4 million for the nine months ending September 2024, down from CNY 139.74 million the previous year, with net income also decreasing to CNY 52.13 million from CNY 60.15 million. Despite this dip, the firm remains debt-free and boasts high-quality earnings, providing some stability amidst its highly volatile share price over recent months. Its Price-To-Earnings ratio of 42x is notably lower than the industry average of 59x, suggesting potential value for investors seeking opportunities in smaller-cap stocks within the communications sector.

Dezhou United Petroleum TechnologyLtd (SZSE:301158)

Simply Wall St Value Rating: ★★★★★★

Overview: Dezhou United Petroleum Technology Co., Ltd. operates in the petroleum technology sector and has a market cap of CN¥2.03 billion.

Operations: The company generates revenue primarily from its operations in the petroleum technology sector. It has a market capitalization of CN¥2.03 billion.

Dezhou United Petroleum Technology, a smaller player in the energy services sector, has demonstrated significant financial improvements. Over five years, its debt to equity ratio impressively shrank from 3.6% to 0.08%, indicating robust financial health. The company outpaced industry growth with a 21% earnings boost last year and reported CNY 396 million in sales for the first nine months of 2024, up from CNY 320 million previously. Net income rose to CNY 63 million compared to CNY 50 million a year earlier, reflecting strong operational performance and potential value at current trading levels below estimated fair value by about three-quarters.

- Dive into the specifics of Dezhou United Petroleum TechnologyLtd here with our thorough health report.

Understand Dezhou United Petroleum TechnologyLtd's track record by examining our Past report.

Seize The Opportunity

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4509 more companies for you to explore.Click here to unveil our expertly curated list of 4512 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001229

Guangdong AVCiT Technology Holding

Guangdong AVCiT Technology Holding Co., Ltd.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives