As the Middle East markets navigate a dynamic landscape, Abu Dhabi's benchmark index has shown resilience with recent gains, while Dubai's index edges up amid cautious global sentiment. In this environment, identifying promising stocks often involves looking for companies that demonstrate robust financial health and strategic positioning to capitalize on regional economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.85% | 5.17% | 7.38% | ★★★★★★ |

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 29.00% | 42.23% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Y.D. More Investments | 50.84% | 28.28% | 35.02% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 55.06% | 42.78% | ★★★★★☆ |

| Rotshtein Realestate | 142.50% | 22.29% | 13.79% | ★★★★☆☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Katilimevim Tasarruf Finansman Anonim Sirketi (IBSE:KTLEV)

Simply Wall St Value Rating: ★★★★☆☆

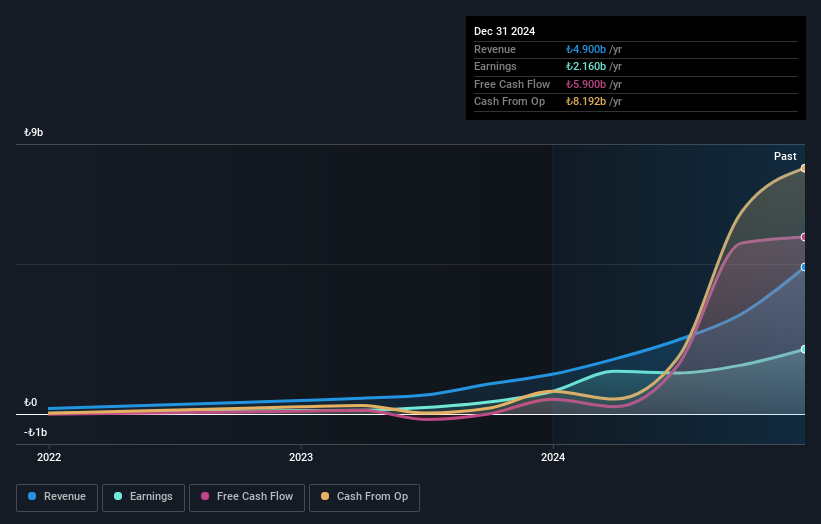

Overview: Katilimevim Tasarruf Finansman Anonim Sirketi operates in Turkey, offering savings finance solutions for purchasing houses and cars, with a market capitalization of TRY30.47 billion.

Operations: Katilimevim generates revenue primarily from its financial services in the consumer segment, totaling TRY8.95 billion. The company's net profit margin is 15%, reflecting its efficiency in converting revenue into actual profit.

Katilimevim Tasarruf Finansman Anonim Sirketi has been turning heads with its remarkable earnings growth of 210.7% over the past year, outpacing the Consumer Finance industry's 9.8%. The company's net income for Q2 soared to TRY 1,710.73 million from TRY 26 million a year ago, showcasing substantial profitability improvements. Despite high share price volatility recently, KTLEV's Price-To-Earnings ratio of 7.2x suggests it is undervalued compared to the TR market average of 21.3x. With more cash than total debt and inclusion in the S&P Global BMI Index, KTLEV seems poised for continued attention in financial circles.

Sönmez Filament Sentetik Iplik ve Elyaf Sanayi (IBSE:SONME)

Simply Wall St Value Rating: ★★★★★☆

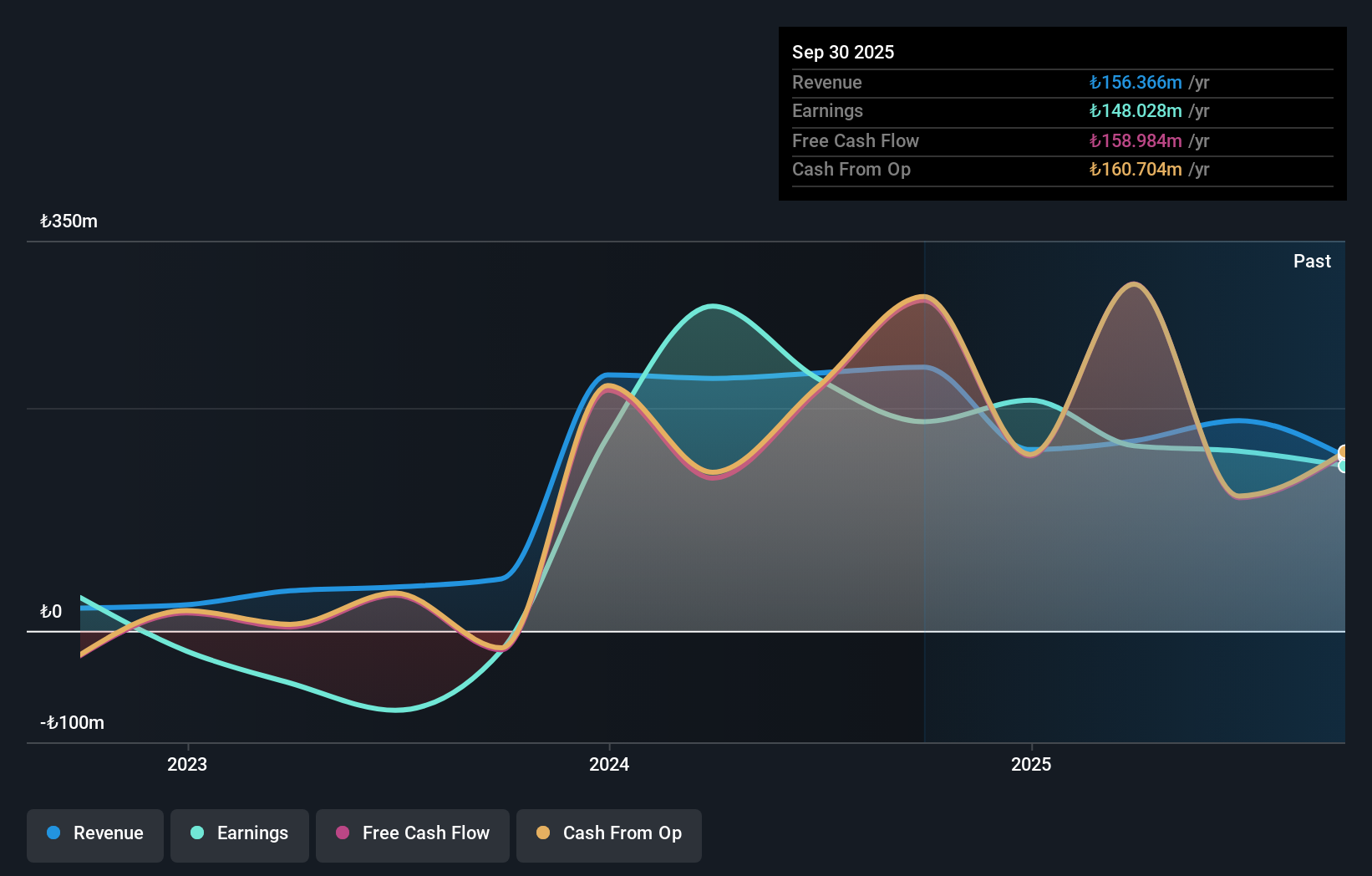

Overview: Sönmez Filament Sentetik Iplik ve Elyaf Sanayi A.S. operates in the synthetic yarn and fiber industry, with a market capitalization of TRY11.35 billion.

Operations: Sönmez Filament generates revenue primarily from the synthetic yarn and fiber industry. The company's financial performance is highlighted by a net profit margin of 8.5%, reflecting its efficiency in managing costs relative to its revenue streams.

Sönmez Filament Sentetik Iplik ve Elyaf Sanayi, a smaller player in the market, showcases a mixed financial picture. Despite being debt-free and generating high-quality earnings, its recent performance indicates challenges. The company reported sales of TRY 12 million for Q3 2025 compared to TRY 13.64 million the previous year, with net income dropping sharply to TRY 8.74 million from TRY 25.27 million. Over nine months, it faced a net loss of TRY 34.25 million against last year's net income of TRY 29.72 million. Although free cash flow remains positive at approximately TRY 215M recently, revenue levels are not substantial at around TRY156M annually, highlighting potential growth hurdles amid industry pressures with negative earnings growth (-21%) slightly better than the luxury sector's average (-28%).

Gold Bond Group (TASE:GOLD)

Simply Wall St Value Rating: ★★★★★☆

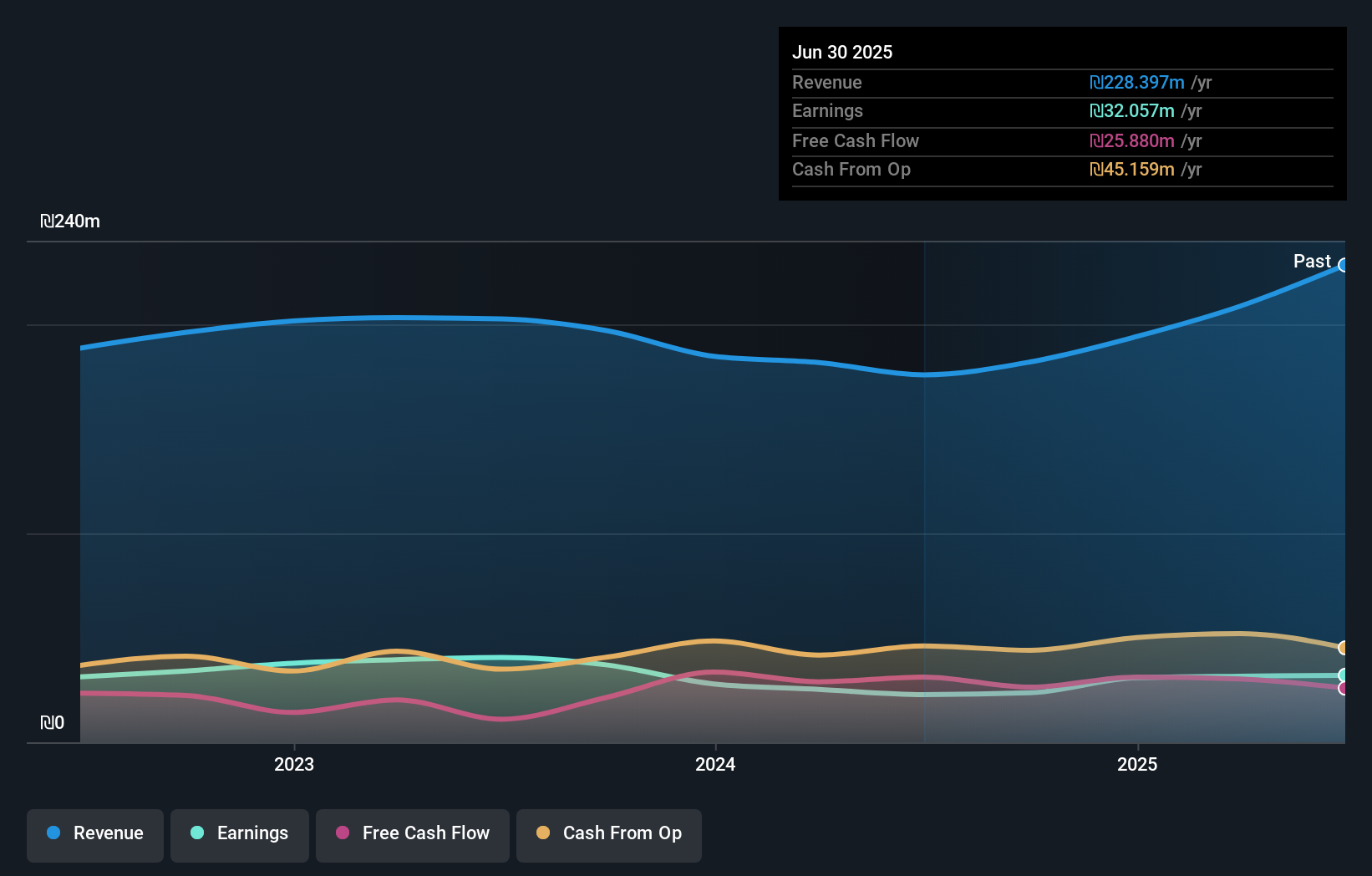

Overview: The Gold Bond Group Ltd. provides storage, conveyance, and logistical solutions for cargoes and containers, with a market capitalization of ₪826.42 million.

Operations: Gold Bond Group generates revenue primarily from Free Activities (₪89.80 million), FCL Terminal Operations (₪68.95 million), and LCL Terminal Operations (₪53.97 million).

Gold Bond Group, a smaller player in the Middle East market, has shown notable financial resilience. Over the past year, earnings surged by 40.6%, outpacing the Infrastructure industry's 7% growth. The company reported second-quarter sales of ILS 62.79 million and net income of ILS 6.38 million, reflecting solid performance compared to last year's figures. Its debt-to-equity ratio improved significantly from 17.6% to just 2.8% over five years, indicating strong financial management with more cash than total debt on hand and positive free cash flow further supporting its robust position in the market landscape.

- Get an in-depth perspective on Gold Bond Group's performance by reading our health report here.

Gain insights into Gold Bond Group's past trends and performance with our Past report.

Where To Now?

- Unlock our comprehensive list of 206 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:SONME

Sönmez Filament Sentetik Iplik ve Elyaf Sanayi

Sönmez Filament Sentetik Iplik ve Elyaf Sanayi A.S.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives