Exploring Singtel's (SGX:Z74) Valuation After a Strong Half-Year Run

Reviewed by Simply Wall St

Singapore Telecommunications (SGX:Z74) has shown steady upward movement in recent weeks, catching the attention of investors curious about its value after a solid half-year run. Shares have climbed nearly 50% year-to-date, fueled by renewed interest in defensive sectors such as telecom.

See our latest analysis for Singapore Telecommunications.

The recent surge in Singapore Telecommunications’ share price, up nearly 50% so far this year, is a clear signal that momentum has been building as investors warm to the sector’s defensive appeal. With a 1-year total shareholder return of 50% and a rewarding 5-year run that more than doubled investors’ money, long-term performance has stayed robust. At the same time, near-term gains suggest shifting sentiment and growth prospects are firmly in focus.

If you want to see what’s next among high-momentum stocks, consider taking a look at fast growing stocks with high insider ownership

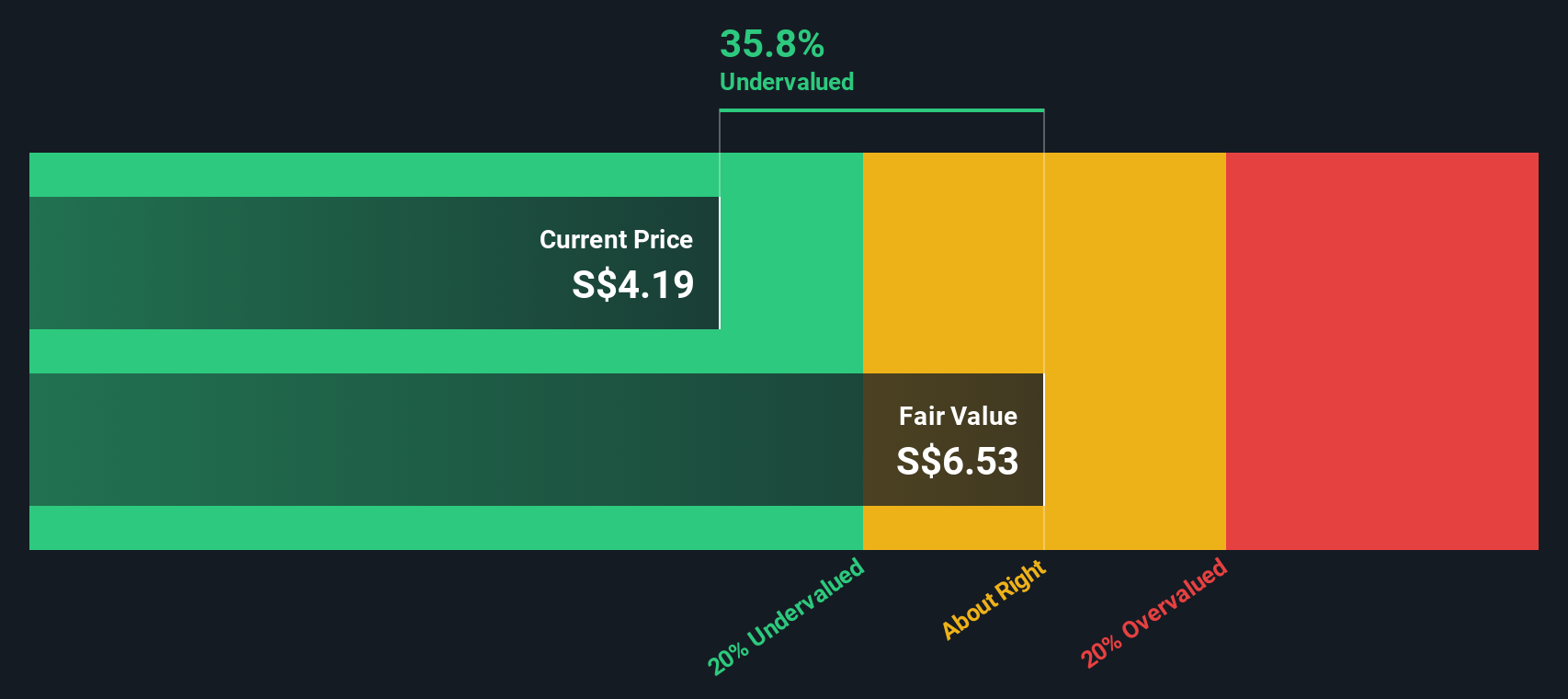

With such impressive gains already recorded, the big question is whether Singapore Telecommunications remains undervalued relative to its future potential, or if the recent surge has already priced in the next leg of growth. Could there still be a buying opportunity, or is the market a step ahead?

Price-to-Earnings of 12.3x: Is it justified?

Singapore Telecommunications currently trades at a price-to-earnings (P/E) ratio of 12.3x, which places it below both the industry and peer benchmarks. This raises the question of whether the stock is being underappreciated despite its strong rally.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of company earnings, providing a snapshot of market expectations for profitability and growth. For a mature telecom company like Singapore Telecommunications, this multiple is a key reference as it reflects how investors balance defensive qualities with future growth outlook.

Singapore Telecommunications’ P/E is comfortably lower than the Asian telecom industry average of 16.4x and is also below the peer average of 23.5x. This implies a potential disconnect between its current price and both sector and peer valuations. Regression analysis suggests that a fair value P/E ratio could be closer to 20x, indicating there may be room for upward movement if market sentiment shifts towards recognizing its earnings stability.

Explore the SWS fair ratio for Singapore Telecommunications

Result: Price-to-Earnings of 12.3x (UNDERVALUED)

However, flat annual revenue growth and a recent decline in net income highlight the challenges facing Singapore Telecommunications as competitive dynamics continue to evolve.

Find out about the key risks to this Singapore Telecommunications narrative.

Another View: Discounted Cash Flow Perspective

Stepping back from earnings multiples, the SWS DCF model provides a different assessment. According to our DCF estimate, Singapore Telecommunications’ shares currently trade at nearly 29% below their fair value. This suggests there may be a larger margin of safety than the market indicates. Could the gap between market price and intrinsic value signal untapped opportunity, or is it simply reflecting caution about future growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Singapore Telecommunications for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Singapore Telecommunications Narrative

If you have a different perspective, or want to dig into the numbers yourself, you can build your own view of the story in just a few minutes with Do it your way.

A great starting point for your Singapore Telecommunications research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Ready to Unlock More Opportunities?

Turn your curiosity into action by spotting stocks that could give your portfolio an edge. Don’t sit on the sidelines when fresh opportunities are just a click away.

- Seize higher yields by targeting income with these 16 dividend stocks with yields > 3%, spotlighting companies offering attractive and stable dividends above 3% for savvy investors.

- Capitalize on the boom in artificial intelligence by starting with these 24 AI penny stocks, where trailblazing tech players are making headlines and shaping tomorrow’s AI landscape.

- Grow your wealth by tapping into growth stories priced below fair value. Start your search among these 870 undervalued stocks based on cash flows that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:Z74

Singapore Telecommunications

Provides telecommunication services to consumers and small businesses in Singapore, Australia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives