- Singapore

- /

- Industrial REITs

- /

- SGX:O5RU

AIMS APAC REIT (SGX:O5RU) Margin Decline Challenges Stability Narrative Despite High Valuation

Reviewed by Simply Wall St

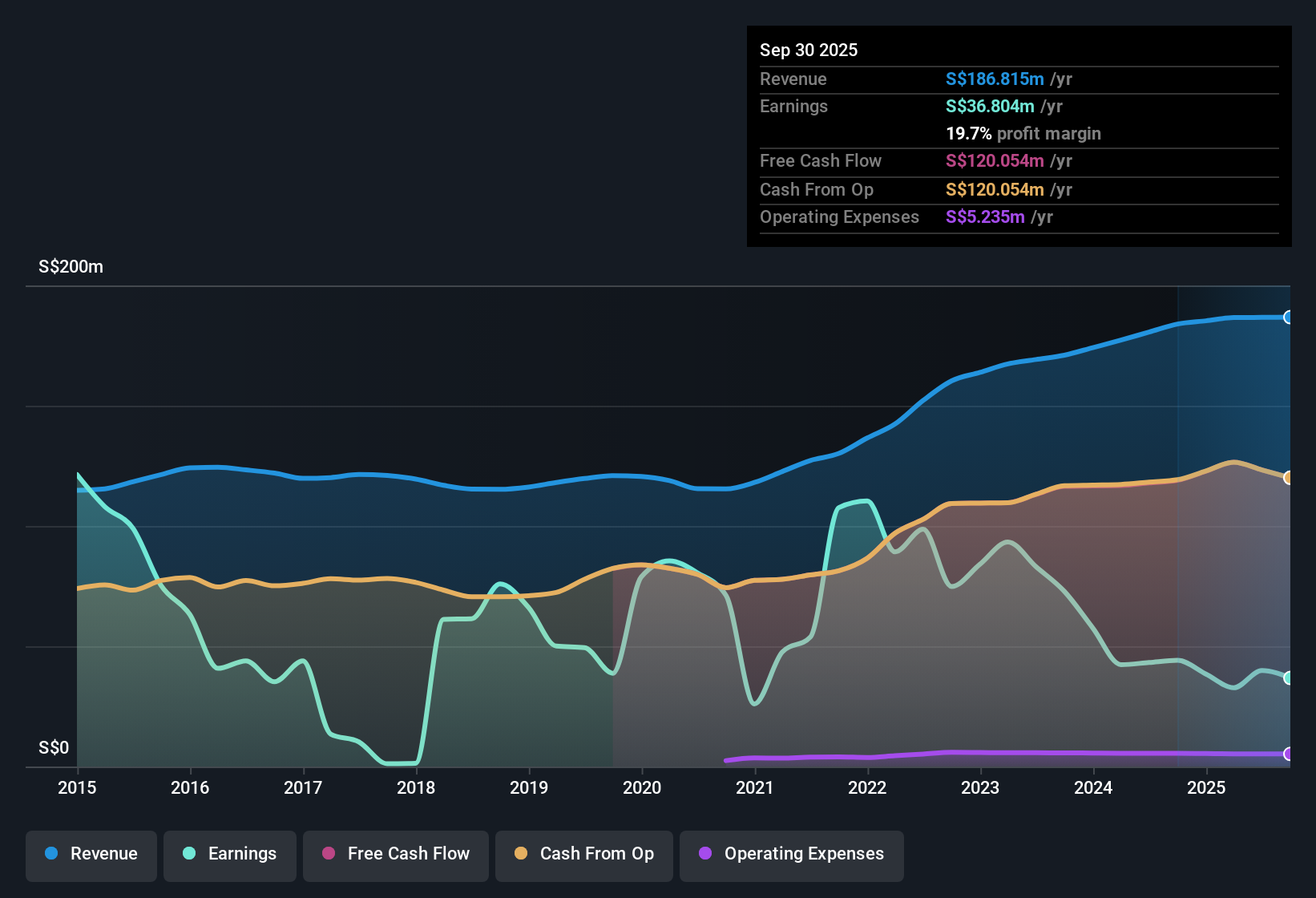

AIMS APAC REIT (SGX:O5RU) posted a 9.8% annual decline in earnings over the past five years, while net profit margins dropped to 17.5% from 23.9% a year earlier. Forward growth is muted, with earnings expected to rise just 0.5% per year and revenue gains forecast at 3.1% annually, both trailing the Singapore market. Despite attractive dividends and no significant risks flagged, a lofty 34.9x P/E ratio and ongoing margin pressure set a cautious tone for investors looking for stronger near-term improvements.

See our full analysis for AIMS APAC REIT.Next up, we will see how these headline numbers compare with the prevailing narratives among investors and analysts. This will spotlight where expectations are met, exceeded, or called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Dip to 17.5% Amid Industry Pressure

- Net profit margins decreased to 17.5%, sliding from 23.9% in the prior year. This marks a sharper contraction in profitability compared to peers, which average a 20.6% margin.

- With margin pressure intensifying, the prevailing market view emphasizes that AIMS APAC REIT’s previously steady occupancy and reliable distributions are facing a tougher landscape.

- Higher costs and subdued earnings momentum could gradually make it harder to maintain the REIT’s historical yield advantage.

- However, the REIT is still regarded as a relatively stable choice for those seeking defensive yield in Singapore’s sector environment.

Expected Revenue Growth Trails Singapore Peer Average

- Revenue is forecast to grow just 3.1% per year, underperforming the Singapore market’s 3.8% estimate and indicating limited top-line momentum.

- The prevailing market view underscores that this sluggish revenue outlook supports a more muted near-term stance.

- Growth-focused investors may be cautious about the REIT’s ability to match sector gains without fresh catalysts or market upswings.

- Ongoing demand for industrial and logistics assets could help anchor stability over the medium term if sector trends remain supportive.

34.9x P/E Commands Steep Premium Over Industry Norm

- AIMS APAC REIT trades at a price-to-earnings multiple of 34.9x, which is well above both the Singapore peer group average of 20x and the Asian Industrial REITs industry average of 20.6x.

- Despite nominal growth prospects, the prevailing market view calls attention to how this steep valuation premium raises the bar for any upside.

- Value-oriented investors may weigh the attractive dividend and low-risk profile against a share price that already reflects sector-leading stability.

- Without an acceleration in earnings or asset enhancement, justification for the premium may come under increased scrutiny.

See our latest analysis for AIMS APAC REIT.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on AIMS APAC REIT's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

AIMS APAC REIT’s slow revenue growth, shrinking margins, and high valuation premium emphasize its struggle to deliver the robust momentum some investors seek.

If you want more attractive upside, use our high growth potential stocks screener (51 results) to easily pinpoint established companies expected to deliver much stronger near-term earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O5RU

AIMS APAC REIT

Managed by the Manager, AIMS APAC REIT (“AA REIT”) is a real estate investment trust listed on the Mainboard of the SGX-ST since 2007.

Established dividend payer with moderate growth potential.

Market Insights

Community Narratives