Stock Analysis

- Singapore

- /

- Real Estate

- /

- SGX:F86

Investors five-year losses continue as MYP (SGX:F86) dips a further 21% this week, earnings continue to decline

Some stocks are best avoided. We don't wish catastrophic capital loss on anyone. Spare a thought for those who held MYP Ltd. (SGX:F86) for five whole years - as the share price tanked 78%. And it's not just long term holders hurting, because the stock is down 32% in the last year. The last week also saw the share price slip down another 21%. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

If the past week is anything to go by, investor sentiment for MYP isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for MYP

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, MYP moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 12% per year is viewed as evidence that MYP is shrinking. This has probably encouraged some shareholders to sell down the stock.

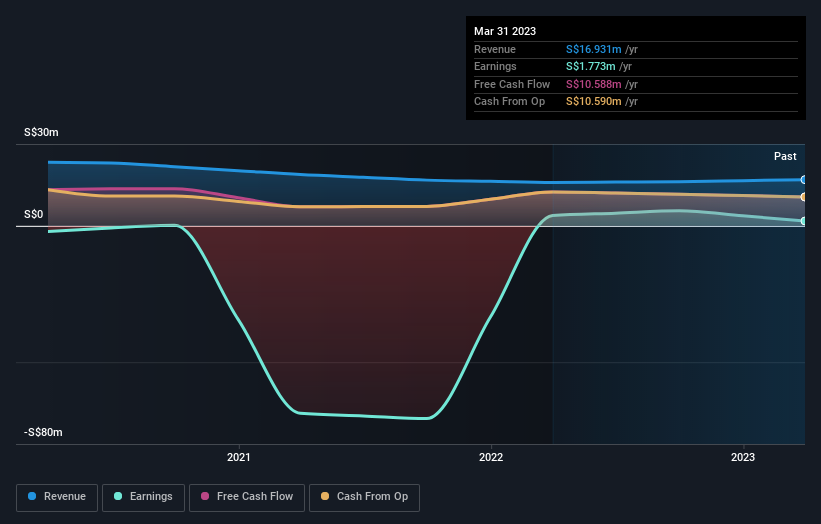

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on MYP's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

MYP shareholders are down 32% for the year, but the market itself is up 0.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand MYP better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for MYP you should be aware of, and 2 of them make us uncomfortable.

Of course MYP may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether MYP is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:F86

MYP

MYP Ltd., an investment holding company, invests in real estate assets in Singapore.

Adequate balance sheet and slightly overvalued.