- China

- /

- Entertainment

- /

- SZSE:000892

Global Penny Stocks: 3 Hidden Gems With Market Caps Above US$100M

Reviewed by Simply Wall St

Global markets have shown resilience, with U.S. stocks climbing for the second consecutive week and small-cap stocks leading the charge, while trade tensions between major economies continue to capture investor attention. Amidst these developments, investors often look beyond well-known names to find opportunities in lesser-known areas of the market. Penny stocks, though an older term, still represent a space where smaller or newer companies can offer growth potential at lower price points when they exhibit strong financial health.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.15 | HK$725.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.03 | £453.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.66 | SEK274.45M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 3 ⚠️ 2 View Analysis > |

| Tasmea (ASX:TEA) | A$3.10 | A$695.08M | ✅ 3 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.385 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.60 | HK$52.47B | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 5,580 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Rex International Holding (SGX:5WH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Rex International Holding Limited is an investment holding company focused on oil exploration and production, with a market cap of SGD234.42 million.

Operations: The company's revenue primarily stems from its Oil and Gas segment, which generated $298.14 million, complemented by $1.74 million from Non-Oil and Gas activities.

Market Cap: SGD234.42M

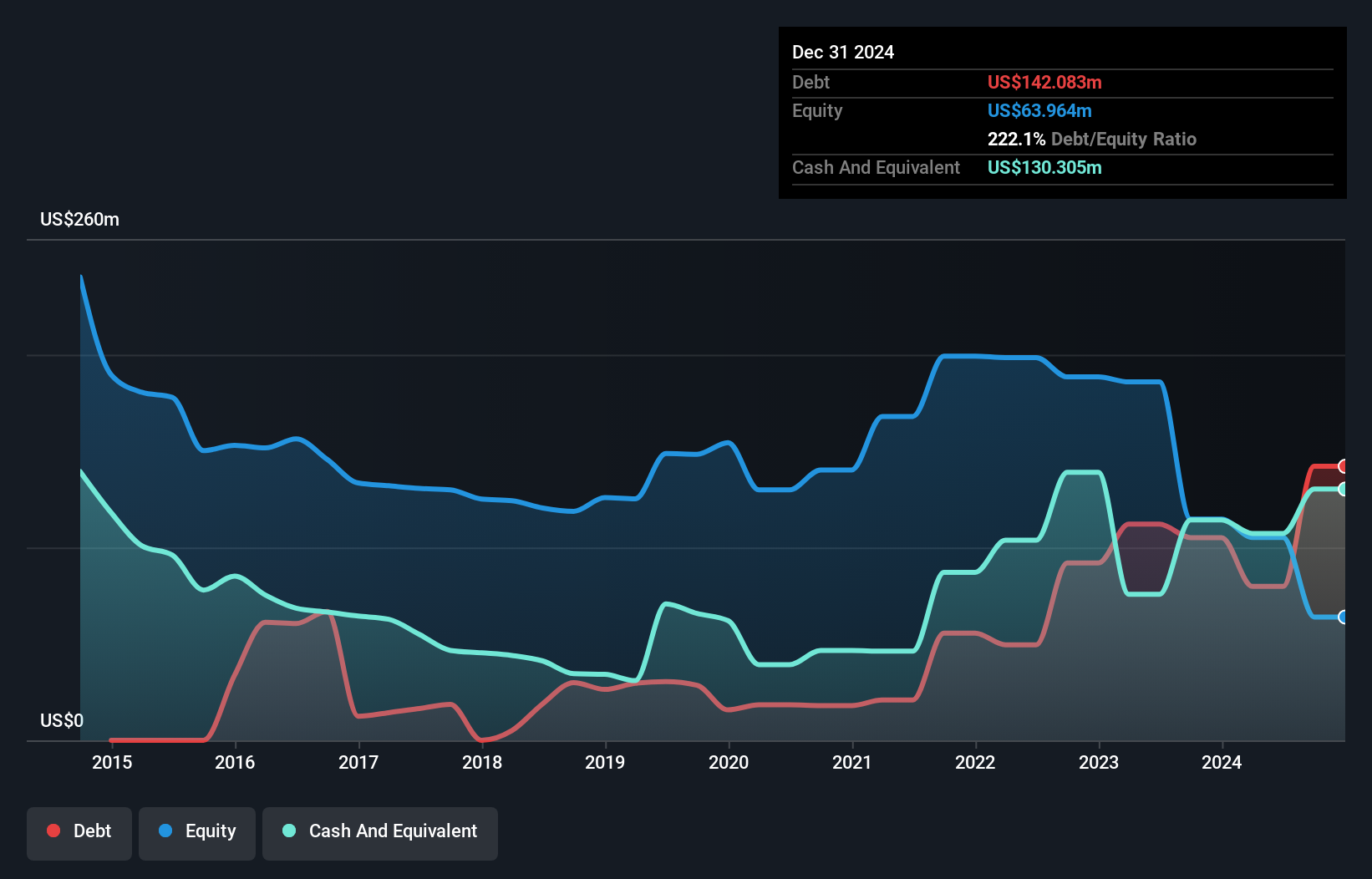

Rex International Holding, with a market cap of SGD234.42 million, primarily generates revenue from its Oil and Gas segment at $298.14 million. Despite its unprofitability and increased losses over the past five years, the company maintains a satisfactory net debt to equity ratio of 18.4% and has sufficient cash runway for more than three years based on current free cash flow. However, its long-term liabilities exceed short-term assets by $155.5 million, indicating potential financial pressures ahead despite stable weekly volatility and an experienced management team averaging 9.7 years tenure.

- Get an in-depth perspective on Rex International Holding's performance by reading our balance sheet health report here.

- Explore historical data to track Rex International Holding's performance over time in our past results report.

Nanjing Central Emporium (Group) Stocks (SHSE:600280)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nanjing Central Emporium (Group) Stocks Co., Ltd. operates in the retail sector, focusing on department store management and related services, with a market cap of CN¥3.99 billion.

Operations: The company's revenue is derived entirely from its operations in China, totaling CN¥2.31 billion.

Market Cap: CN¥3.99B

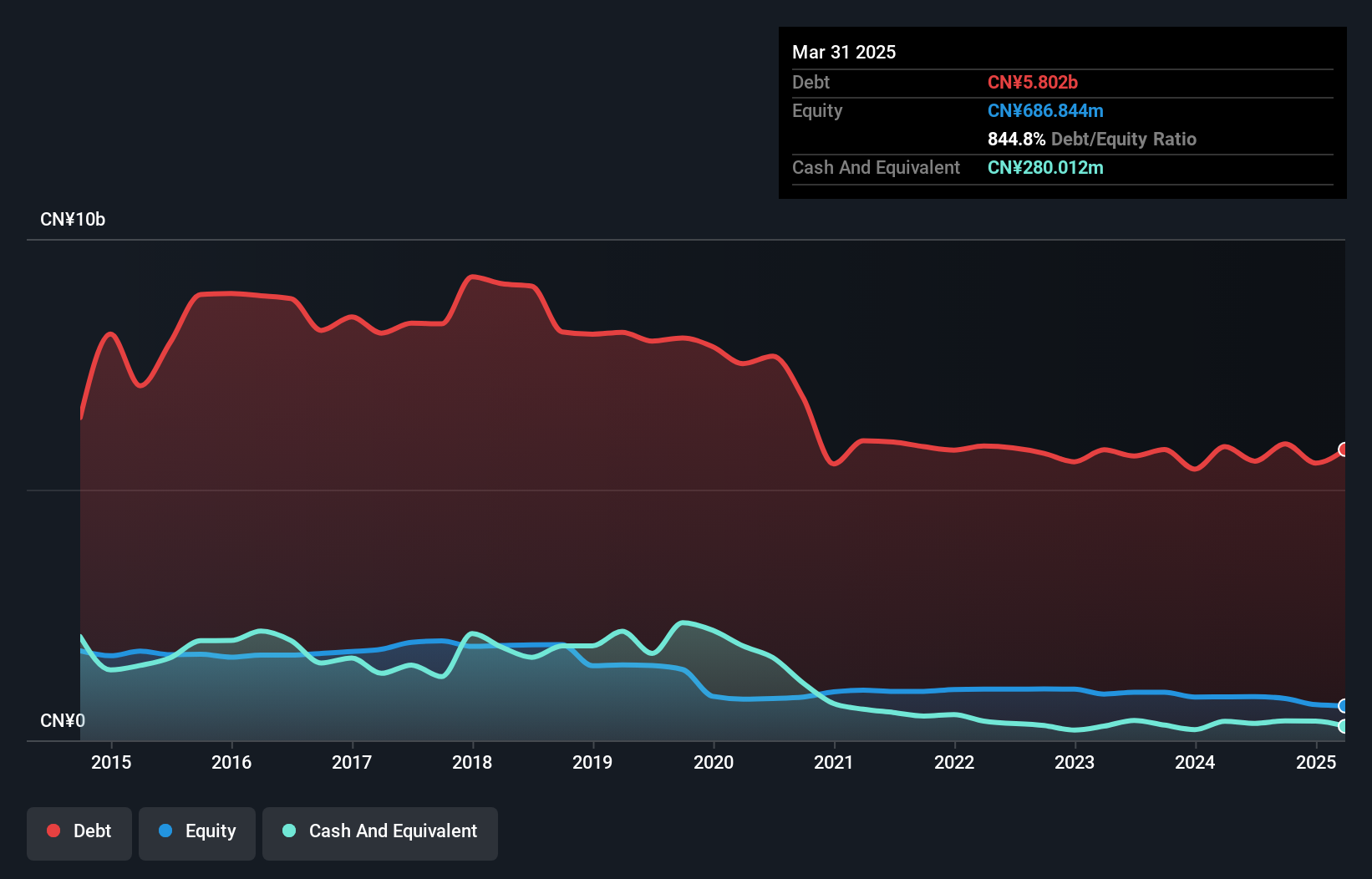

Nanjing Central Emporium (Group) Stocks Co., Ltd., with a market cap of CN¥3.99 billion, operates within the retail sector, focusing on department store management. Despite being unprofitable, the company has reduced its losses by 20% annually over five years and maintains a positive free cash flow sufficient for over three years. However, it faces financial challenges with short-term liabilities exceeding its assets by CN¥4.1 billion and a high net debt to equity ratio of 804%. Recent earnings showed revenue growth to CN¥646.93 million but declining net income compared to the previous year, reflecting ongoing profitability issues.

- Navigate through the intricacies of Nanjing Central Emporium (Group) Stocks with our comprehensive balance sheet health report here.

- Learn about Nanjing Central Emporium (Group) Stocks' historical performance here.

H&R Century Union (SZSE:000892)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: H&R Century Union Corporation operates in China, focusing on drama series production and artist brokerage, with a market cap of CN¥3.80 billion.

Operations: H&R Century Union has not reported any specific revenue segments.

Market Cap: CN¥3.8B

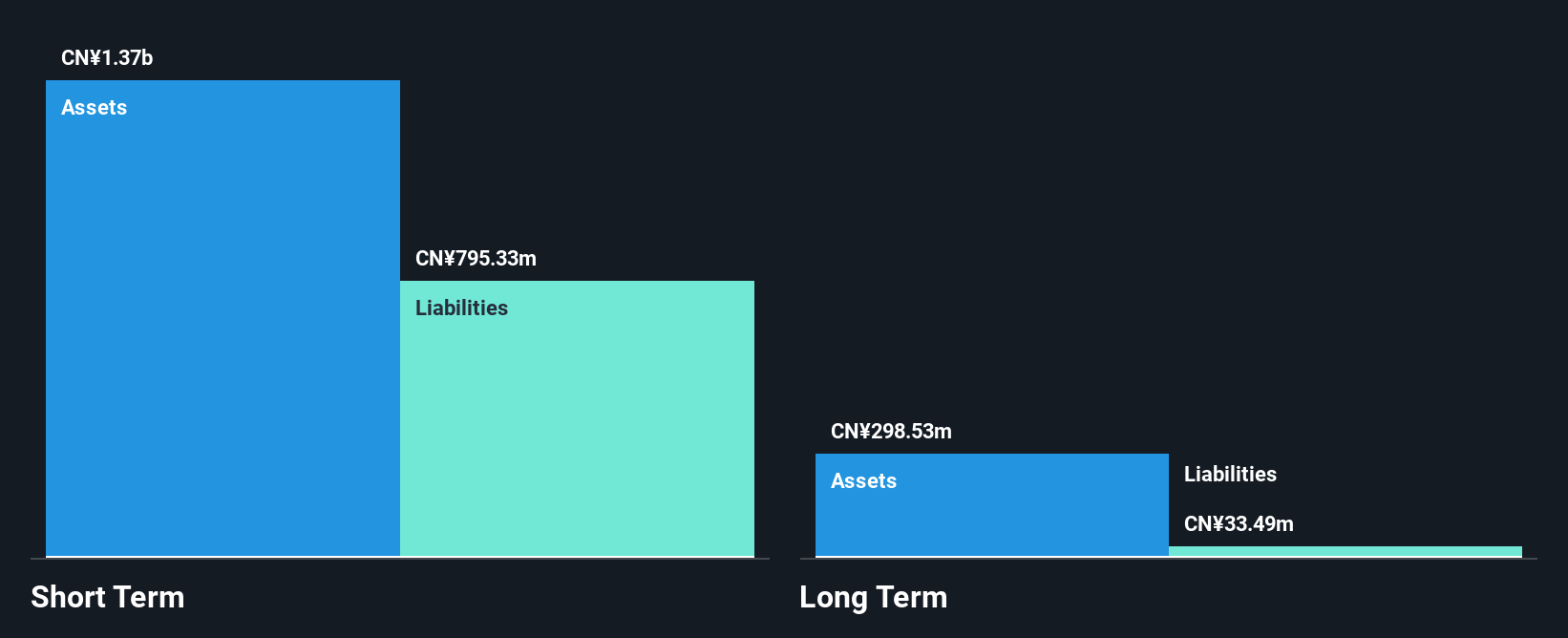

H&R Century Union Corporation, with a market cap of CN¥3.80 billion, operates in China's entertainment sector. The company is unprofitable but has reduced losses by 26.1% annually over five years and reported revenue growth to CN¥384.88 million for 2024 from CN¥335.85 million the previous year, though it still recorded a net loss of CN¥241.11 million. The firm has more cash than debt and its short-term assets exceed both short- and long-term liabilities, indicating some financial stability despite less than one year of cash runway if current free cash flow trends continue.

- Jump into the full analysis health report here for a deeper understanding of H&R Century Union.

- Examine H&R Century Union's past performance report to understand how it has performed in prior years.

Next Steps

- Click here to access our complete index of 5,580 Global Penny Stocks.

- Seeking Other Investments? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H&R Century Union might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000892

H&R Century Union

Engages in the drama series production and artist brokerage business in China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives