- Singapore

- /

- Capital Markets

- /

- SGX:AIY

3 Growth Stocks With Significant Insider Investment

Reviewed by Simply Wall St

In the midst of a busy earnings season, global markets have been experiencing notable fluctuations, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before facing sharp declines. Amid this backdrop, growth stocks have generally underperformed compared to value shares, highlighting the importance of insider ownership as a potential indicator of confidence and alignment with shareholders' interests. In such volatile times, companies with significant insider investment may offer reassurance to investors looking for strong commitment from those at the helm.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

iFAST (SGX:AIY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iFAST Corporation Ltd. offers investment products and services across Singapore, Hong Kong, Malaysia, China, and the United Kingdom with a market capitalization of SGD2.14 billion.

Operations: The company generates revenue from its investment products and services across multiple regions, including Singapore, Hong Kong, Malaysia, China, and the United Kingdom.

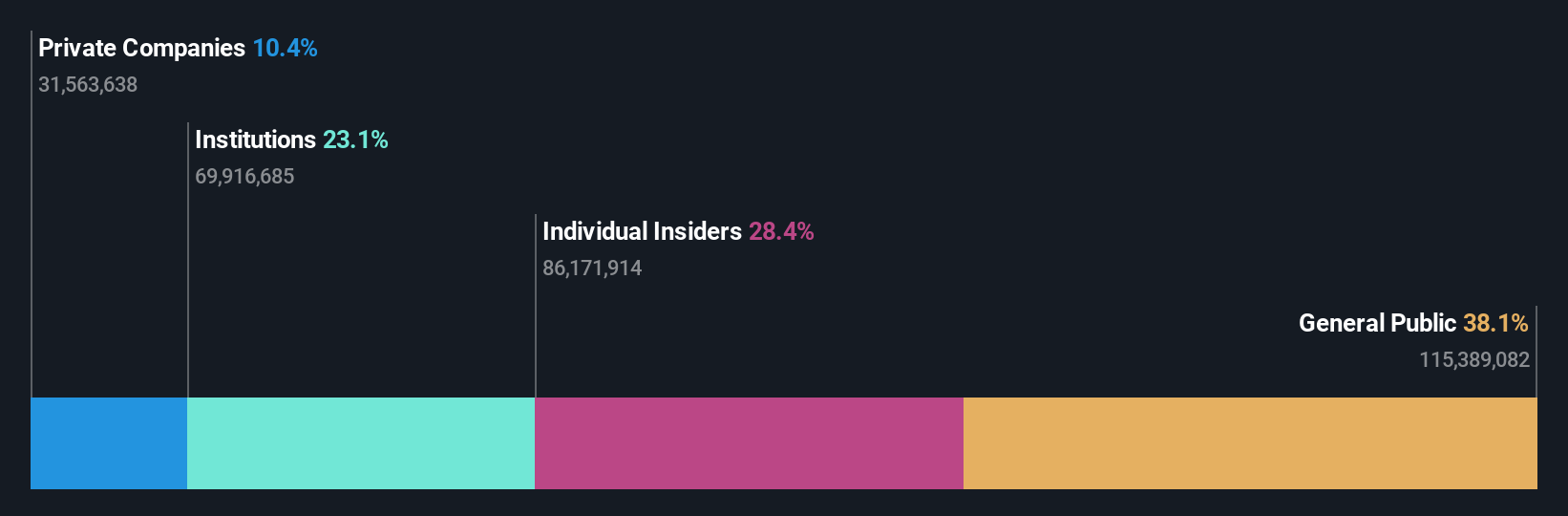

Insider Ownership: 28.7%

Return On Equity Forecast: 27% (2027 estimate)

iFAST Corporation Ltd. demonstrates significant growth potential with recent earnings showing a net income increase to S$16.81 million in Q3 2024 from S$8.52 million the previous year, reflecting a strong upward trajectory. Despite revenue growth forecasts of 9.5% annually, which is slower than some benchmarks, it still surpasses the Singapore market average of 3.7%. The company's high insider ownership aligns with its robust earnings performance and strategic board changes enhance governance stability.

- Click to explore a detailed breakdown of our findings in iFAST's earnings growth report.

- Upon reviewing our latest valuation report, iFAST's share price might be too optimistic.

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Jolly Pharmaceutical Co., LTD is involved in the research, production, and marketing of Chinese medicinal products both domestically in China and internationally, with a market cap of CN¥10.92 billion.

Operations: The company generates revenue through its research, production, and marketing of Chinese medicinal products within China and on an international scale.

Insider Ownership: 24%

Return On Equity Forecast: 23% (2027 estimate)

Zhejiang Jolly Pharmaceutical Co., LTD shows promising growth with recent earnings revealing a net income rise to CNY 421.48 million for the first nine months of 2024, up from CNY 286.87 million the previous year. The company's revenue is forecast to grow at 23.9% annually, outpacing the CN market average of 14%. Its Price-To-Earnings ratio of 21.5x suggests good value relative to peers, and recent share buybacks indicate confidence in its future prospects.

- Click here to discover the nuances of Zhejiang Jolly PharmaceuticalLTD with our detailed analytical future growth report.

- The analysis detailed in our Zhejiang Jolly PharmaceuticalLTD valuation report hints at an deflated share price compared to its estimated value.

Kinik (TWSE:1560)

Simply Wall St Growth Rating: ★★★★★☆

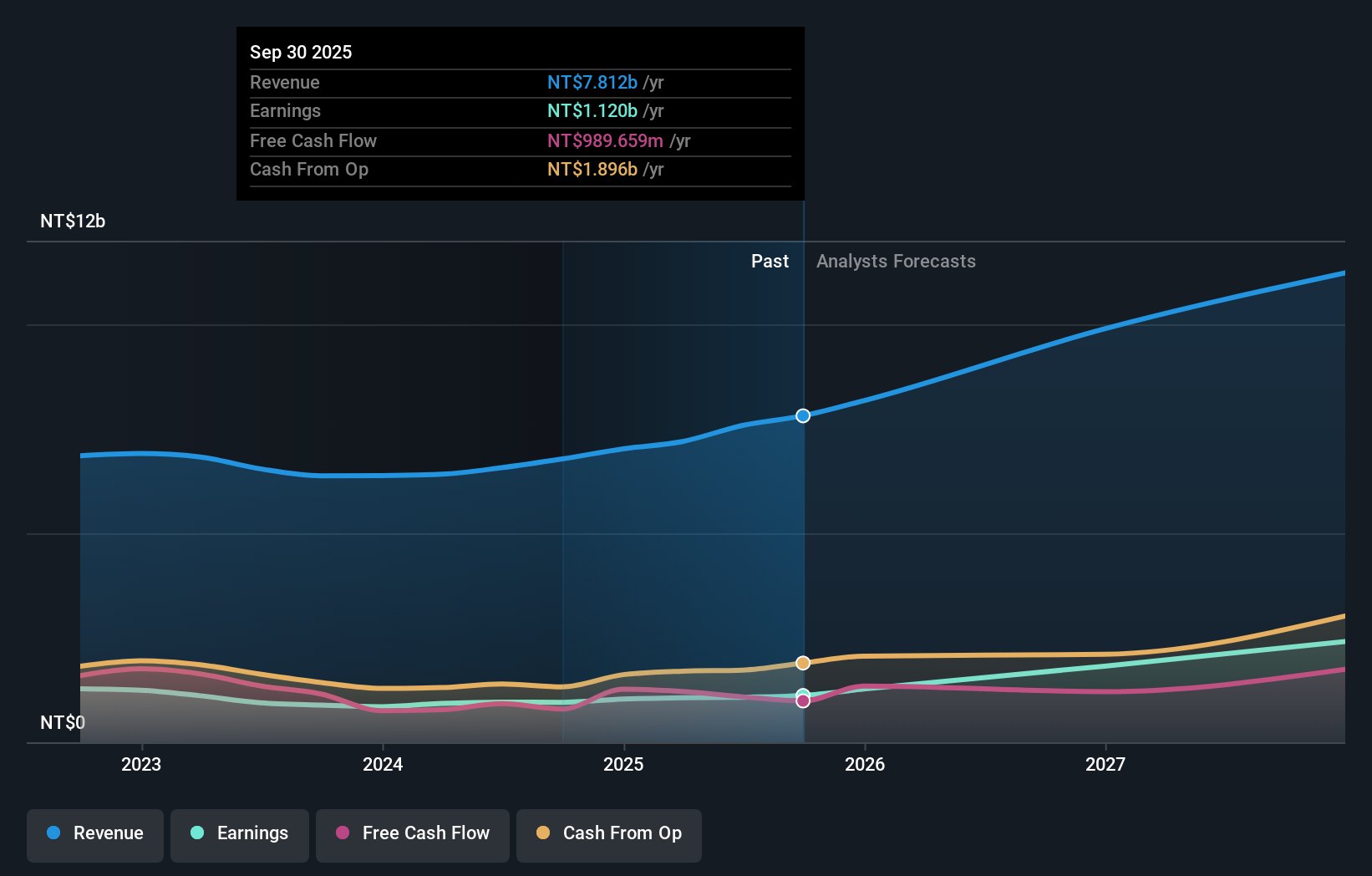

Overview: Kinik Company is involved in the production and sale of abrasives, cutting tools, and reclaimed wafers both in Taiwan and internationally, with a market cap of NT$43.89 billion.

Operations: The company's revenue is primarily derived from two segments: the Electronics Sector, contributing NT$3.39 billion, and the Traditional Sectors, also generating NT$3.39 billion.

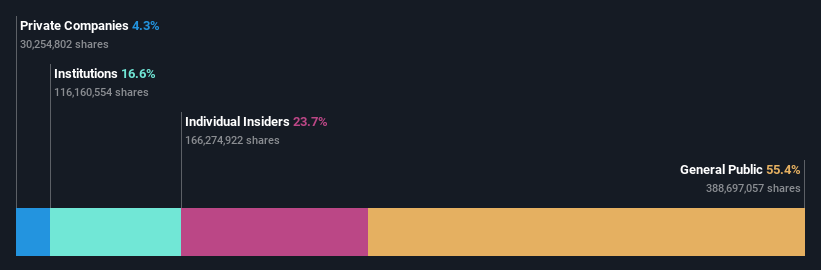

Insider Ownership: 15.9%

Return On Equity Forecast: 24% (2027 estimate)

Kinik reported Q3 2024 sales of TWD 1.86 billion, up from TWD 1.65 billion a year ago, with net income slightly lower at TWD 285.35 million compared to TWD 292.1 million previously. Despite recent share price volatility, the company trades at a significant discount to its fair value estimate and forecasts suggest robust earnings growth of over 35% annually, outpacing the Taiwan market average. High insider ownership supports long-term alignment with shareholder interests.

- Dive into the specifics of Kinik here with our thorough growth forecast report.

- Our expertly prepared valuation report Kinik implies its share price may be too high.

Taking Advantage

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1527 more companies for you to explore.Click here to unveil our expertly curated list of 1530 Fast Growing Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if iFAST might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AIY

iFAST

Provides investment products and services in Singapore, Hong Kong, Malaysia, China, the United Kingdom.

Outstanding track record with excellent balance sheet.