- Singapore

- /

- Hospitality

- /

- SGX:G13

3 Dividend Stocks On SGX With Yields Up To 6%

Reviewed by Simply Wall St

As the Singapore market navigates a period of economic uncertainty, investors are increasingly turning their attention to dividend stocks on the SGX as a potential source of steady income. In this environment, selecting stocks with strong fundamentals and attractive yields can be crucial for building a resilient investment portfolio.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.81% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.34% | ★★★★★☆ |

| Oversea-Chinese Banking (SGX:O39) | 5.88% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.12% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

| Tat Seng Packaging Group (SGX:T12) | 6.10% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.13% | ★★★★★☆ |

| QAF (SGX:Q01) | 5.95% | ★★★★★☆ |

| Aztech Global (SGX:8AZ) | 9.80% | ★★★★☆☆ |

| Tai Sin Electric (SGX:500) | 5.88% | ★★★★☆☆ |

Click here to see the full list of 23 stocks from our Top SGX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

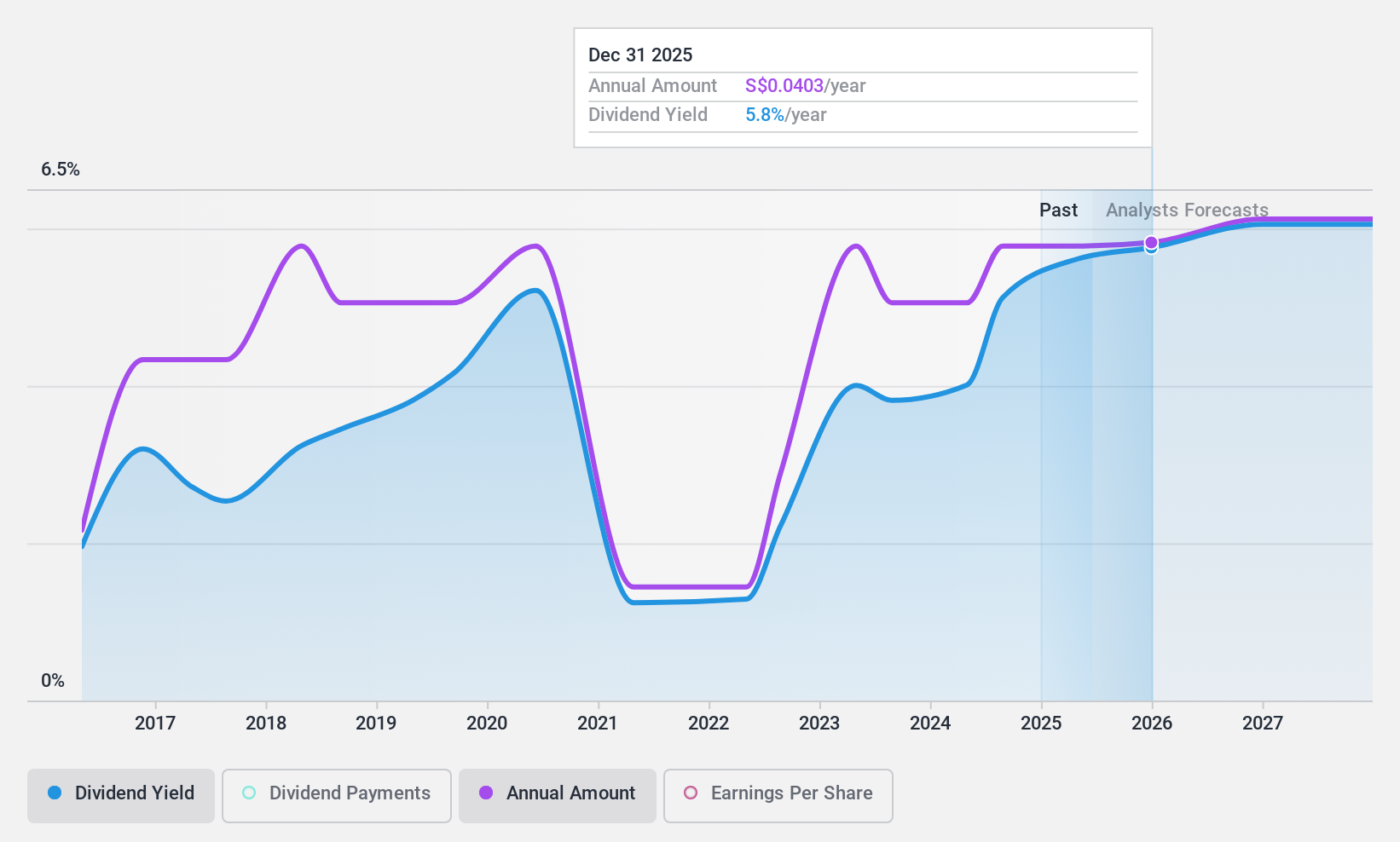

Genting Singapore (SGX:G13)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Genting Singapore Limited is an investment holding company focused on the construction, development, and operation of integrated resort destinations in Asia, with a market cap of SGD10.62 billion.

Operations: Genting Singapore Limited generates its revenue primarily through the operation of integrated resort destinations in Asia.

Dividend Yield: 4.5%

Genting Singapore's dividend payments are covered by both earnings and cash flows, with payout ratios of 69.8% and 72.3%, respectively, indicating sustainability despite a historically volatile dividend track record. Recent earnings growth of 30% suggests improved financial health, yet the dividend yield of 4.55% remains below top-tier levels in Singapore. The company proposed an interim dividend of S$0.02 per share for FY2024, reflecting a cautious approach to increasing shareholder returns amidst stable earnings growth.

- Take a closer look at Genting Singapore's potential here in our dividend report.

- Our valuation report unveils the possibility Genting Singapore's shares may be trading at a discount.

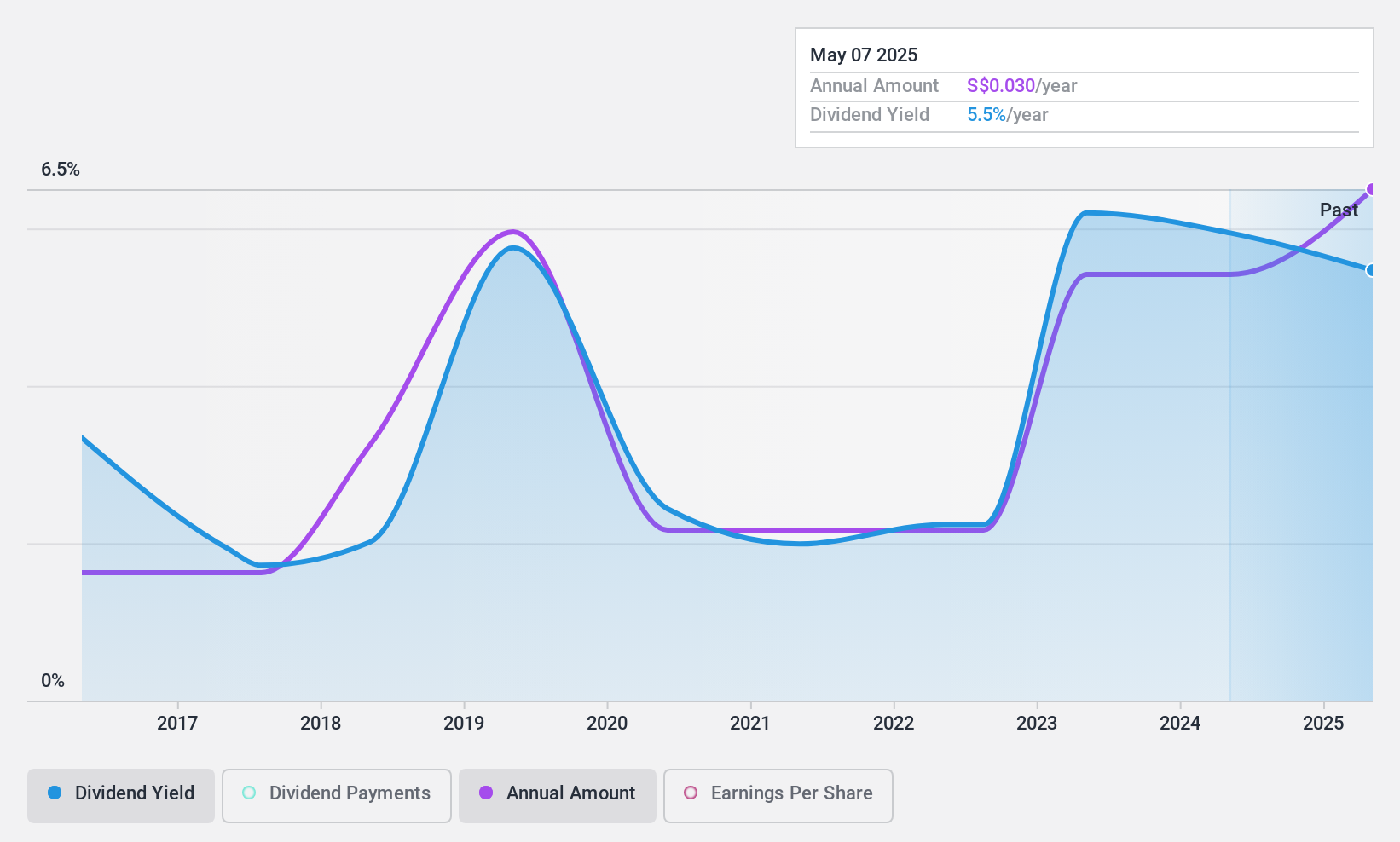

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market cap of SGD467.26 million.

Operations: China Sunsine Chemical Holdings Ltd. generates its revenue from several segments, with CN¥4.39 billion coming from Rubber Chemicals, CN¥203 million from Heating Power, and CN¥25.06 million from Waste Treatment.

Dividend Yield: 5%

China Sunsine Chemical Holdings' dividend payments are well-covered by earnings and cash flows, with payout ratios of 21.1% and 34%, respectively, indicating sustainability despite a history of volatility. The company's dividend yield is lower than the top quartile in Singapore's market. Recent half-year results showed stable sales at CNY 1.75 billion but a slight decline in net income to CNY 188.8 million, reflecting challenges in maintaining consistent profitability amidst fluctuating dividends.

- Unlock comprehensive insights into our analysis of China Sunsine Chemical Holdings stock in this dividend report.

- According our valuation report, there's an indication that China Sunsine Chemical Holdings' share price might be on the cheaper side.

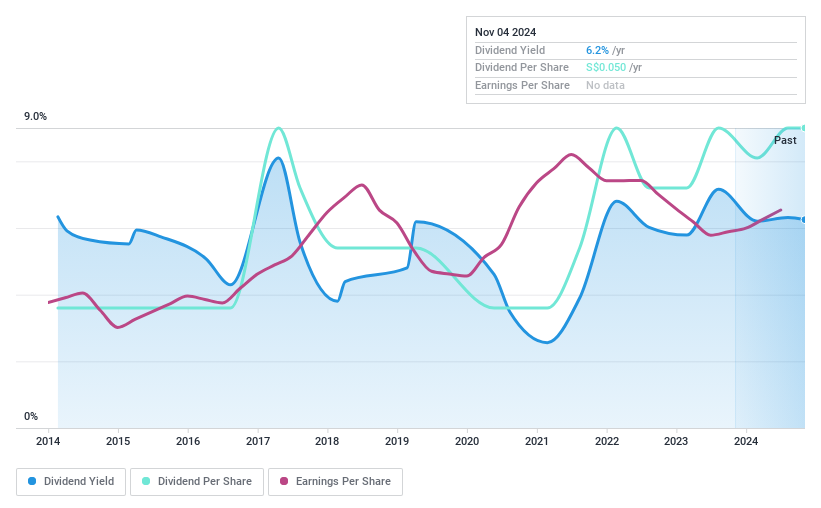

Tat Seng Packaging Group (SGX:T12)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tat Seng Packaging Group Ltd designs, manufactures, and sells corrugated paper and other packaging products in Singapore and the People's Republic of China, with a market cap of SGD128.90 million.

Operations: Tat Seng Packaging Group Ltd generates revenue primarily from its Packaging & Containers segment, amounting to SGD259.78 million.

Dividend Yield: 6.1%

Tat Seng Packaging Group's dividends are well-covered by earnings and cash flows, with payout ratios of 38.2% and 80.4%, respectively, despite a volatile dividend history over the past decade. The dividend yield (6.1%) remains competitive in Singapore's market. Recent board changes include appointing Mr. Tan Lye Heng Paul as Non-Executive Director, potentially enhancing governance amid stable financial performance, as evidenced by a rise in net income to S$10.13 million for the half-year ending June 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Tat Seng Packaging Group.

- Insights from our recent valuation report point to the potential overvaluation of Tat Seng Packaging Group shares in the market.

Where To Now?

- Unlock our comprehensive list of 23 Top SGX Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:G13

Genting Singapore

An investment holding company, primarily engages in the construction, development, and operation of integrated resort destinations in Asia.

Flawless balance sheet with solid track record and pays a dividend.