- Singapore

- /

- Food and Staples Retail

- /

- SGX:K03

Khong Guan Limited's (SGX:K03) CEO Compensation Is Looking A Bit Stretched At The Moment

The underwhelming share price performance of Khong Guan Limited (SGX:K03) in the past three years would have disappointed many shareholders. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 30 December 2021. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Khong Guan

Comparing Khong Guan Limited's CEO Compensation With the industry

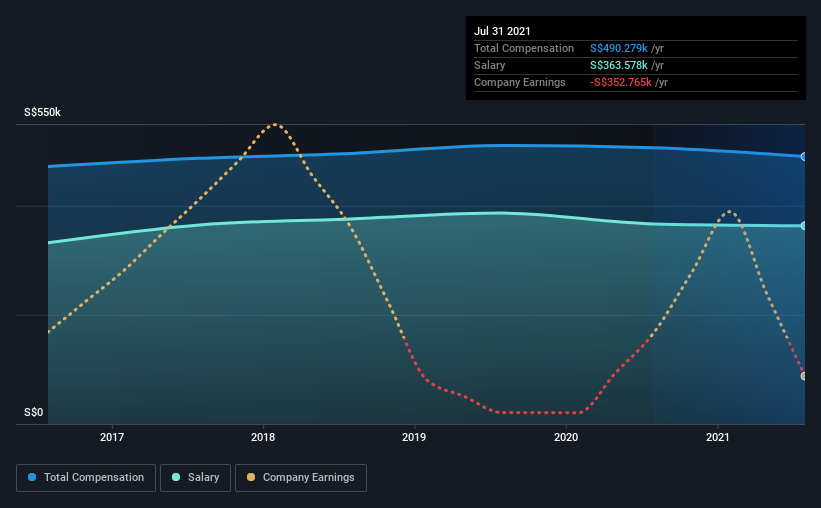

Our data indicates that Khong Guan Limited has a market capitalization of S$40m, and total annual CEO compensation was reported as S$490k for the year to July 2021. That's a slight decrease of 3.2% on the prior year. Notably, the salary which is S$363.6k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below S$273m, reported a median total CEO compensation of S$161k. Accordingly, our analysis reveals that Khong Guan Limited pays Soo Eng Chew north of the industry median. Furthermore, Soo Eng Chew directly owns S$340k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | S$364k | S$367k | 74% |

| Other | S$127k | S$140k | 26% |

| Total Compensation | S$490k | S$507k | 100% |

Speaking on an industry level, nearly 90% of total compensation represents salary, while the remainder of 10% is other remuneration. It's interesting to note that Khong Guan allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Khong Guan Limited's Growth Numbers

Khong Guan Limited's earnings per share (EPS) grew 15% per year over the last three years. Its revenue is up 3.6% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Khong Guan Limited Been A Good Investment?

Given the total shareholder loss of 23% over three years, many shareholders in Khong Guan Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 2 warning signs for Khong Guan you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Khong Guan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:K03

Khong Guan

An investment holding company, engages in trading of wheat flour and other edible products in Singapore and Malaysia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives