Stock Analysis

Global markets have recently experienced significant shifts, with U.S. stocks rallying to record highs following a "red sweep" in the elections, which has fueled expectations of faster earnings growth and lower corporate taxes. Against this backdrop, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities for investors seeking growth at accessible price points. Although the term "penny stocks" may seem outdated, these investments can still be valuable when they boast strong financials and clear growth paths, providing potential stability and upside in today's evolving market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.79 | MYR136.84M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.495 | MYR2.46B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.87 | MYR288.79M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.12 | THB1.72B | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR2.96 | MYR2.04B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.87 | £384.89M | ★★★★☆☆ |

Click here to see the full list of 5,741 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Cairo Communication (BIT:CAI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cairo Communication S.p.A. operates as a communication company primarily in Italy and Spain, with a market cap of €292.35 million.

Operations: The company's revenue segments include RCS generating €861.2 million, Licensees contributing €358.1 million, and La7 television publishing and network operator providing €120.3 million, along with Editoria periodici Cairo Editore at €83.2 million.

Market Cap: €292.35M

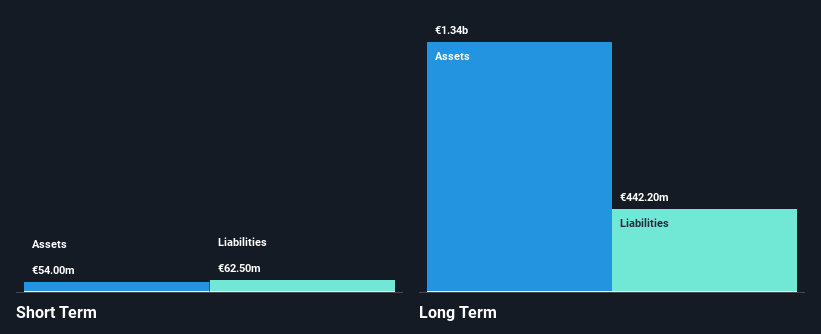

Cairo Communication demonstrates several strengths and challenges relevant to penny stock investors. The company has shown stable weekly volatility and improved net profit margins, with earnings growth of 16.6% over the past year, surpassing both its historical average and industry peers. Its debt management is commendable, with a reduced debt-to-equity ratio and strong coverage by operating cash flow. However, short-term liabilities exceed assets, indicating potential liquidity concerns. Despite trading significantly below estimated fair value and offering high-quality earnings, its dividend track record remains unstable. Recent inclusion in the S&P Global BMI Index may enhance visibility among investors.

- Navigate through the intricacies of Cairo Communication with our comprehensive balance sheet health report here.

- Explore Cairo Communication's analyst forecasts in our growth report.

China Ruifeng Renewable Energy Holdings (SEHK:527)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Ruifeng Renewable Energy Holdings Limited is an investment holding company that generates wind power in the People’s Republic of China, with a market cap of approximately HK$1.10 billion.

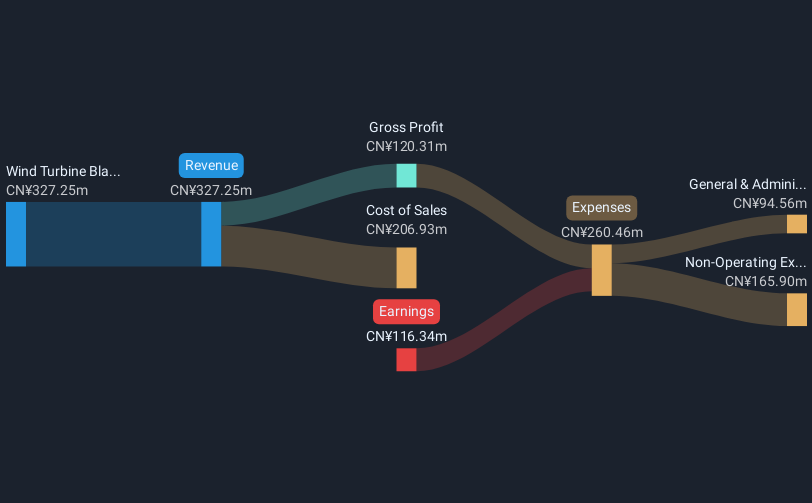

Operations: The company generates revenue primarily from its wind turbine blades segment, amounting to CN¥327.25 million.

Market Cap: HK$1.1B

China Ruifeng Renewable Energy Holdings faces both opportunities and challenges typical of penny stocks. The company is currently unprofitable, with a negative return on equity and increasing losses over the past five years. Despite this, it maintains a strong cash runway for over three years due to positive free cash flow. However, its high net debt-to-equity ratio of 725.5% raises concerns about financial stability. Recent earnings reports show declining sales and widening net losses compared to the previous year. While trading below estimated fair value, shareholder dilution remains an issue with increased shares outstanding last year.

- Dive into the specifics of China Ruifeng Renewable Energy Holdings here with our thorough balance sheet health report.

- Learn about China Ruifeng Renewable Energy Holdings' historical performance here.

Grand Venture Technology (SGX:JLB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Grand Venture Technology Limited provides precision manufacturing solutions for the semiconductor, life sciences, electronics, aerospace, and medical industries across Singapore, Malaysia, the United States, China, and internationally with a market capitalization of SGD191.70 million.

Operations: The company generates revenue from three main segments: Semiconductor (SGD61.51 million), Electronics, Aerospace, Medical and Others (SGD43.21 million), and Life Sciences (SGD21.02 million).

Market Cap: SGD191.7M

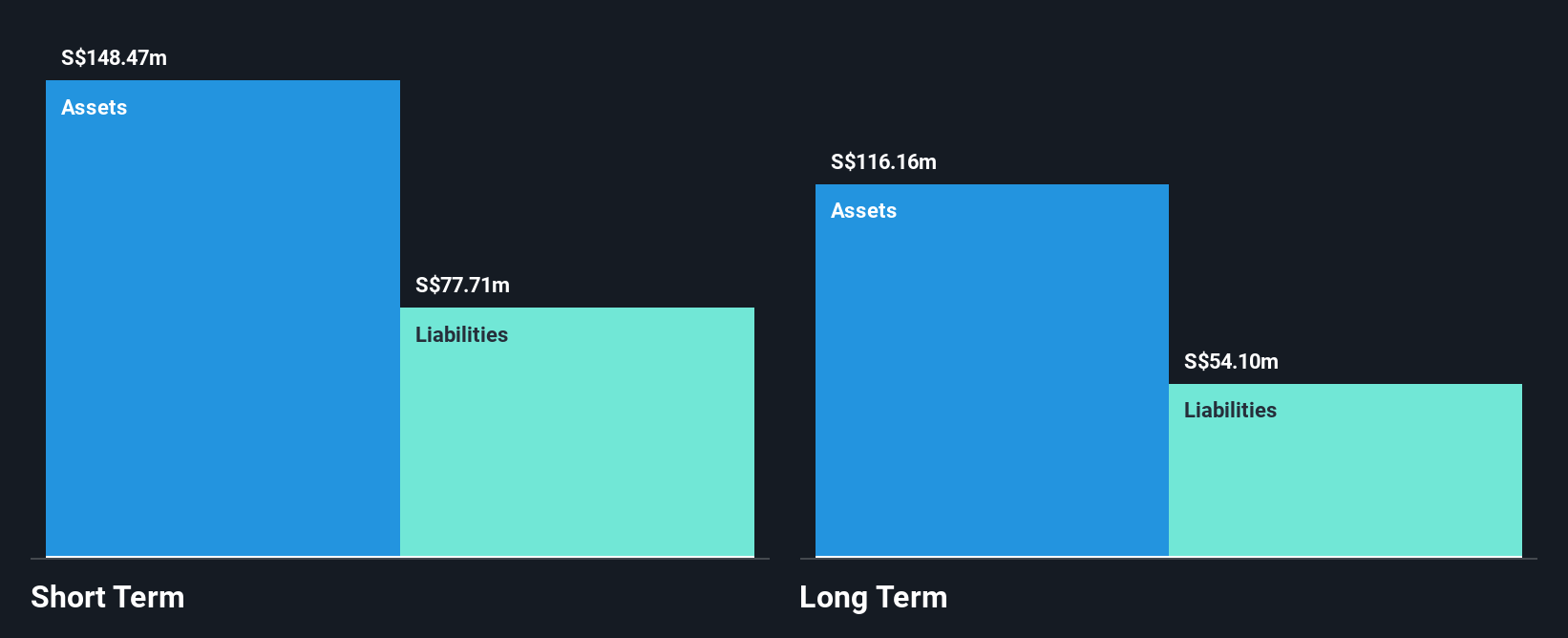

Grand Venture Technology Limited presents a mixed picture for investors in the penny stock space. Recent earnings show revenue growth to SGD68.31 million for the half-year ended June 2024, up from SGD53.87 million a year ago, with net income improving to SGD4.31 million. Despite trading significantly below estimated fair value, challenges include low return on equity at 5.2% and declining profit margins from 8.1% to 5.1%. The company’s debt is well covered by operating cash flow, though interest coverage remains weak at 2.9 times EBIT, and its short-term assets comfortably exceed liabilities, suggesting financial stability amidst volatility concerns.

- Take a closer look at Grand Venture Technology's potential here in our financial health report.

- Assess Grand Venture Technology's future earnings estimates with our detailed growth reports.

Taking Advantage

- Access the full spectrum of 5,741 Penny Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:JLB

Grand Venture Technology

Offers precision manufacturing solutions for the semiconductor, life sciences, electronics, aerospace, and medical industries in Singapore, Malaysia, the United States, China, and internationally.