- Singapore

- /

- Industrials

- /

- SGX:J36

Does Jardine Matheson’s (SGX:J36) Share Buyback Reflect Renewed Conviction in Long-Term Value Creation?

Reviewed by Sasha Jovanovic

- Jardine Matheson Holdings Limited recently announced a share repurchase program of up to US$250 million, with shares to be cancelled and the capital base reduced, following Board authorization effective until 2026.

- This action is often interpreted as a sign of management’s confidence in the company’s outlook and a potential boost for shareholder value.

- We will explore how Jardine Matheson's decision to reduce its capital through share buybacks may influence its future investment story.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Jardine Matheson Holdings Investment Narrative Recap

To invest in Jardine Matheson Holdings, I believe you need confidence in its ongoing ability to re-allocate capital efficiently across a diversified portfolio, while overcoming challenges in legacy sectors like property and automotive. The US$250 million share repurchase and capital reduction may support short-term sentiment, but it does not meaningfully alter the near-term impact of weakness in Greater China property, which remains the most critical risk right now.

One recent announcement of interest is the interim dividend of US$0.60 per share, reinforcing Jardine Matheson’s commitment to shareholder returns and offering some stability as the group pursues portfolio adjustments. This focus on capital returns, against a backdrop of operating headwinds, could shape both market perceptions and future catalysts for share price performance.

Yet, despite these positives, investors should be aware that continued pressure from subdued office rents and inventory revaluations in the property segment could...

Read the full narrative on Jardine Matheson Holdings (it's free!)

Jardine Matheson Holdings' outlook anticipates $37.4 billion in revenue and $2.7 billion in earnings by 2028. This scenario is based on 1.7% annual revenue growth and a $2.6 billion increase in earnings from the current level of $100 million.

Uncover how Jardine Matheson Holdings' forecasts yield a $70.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

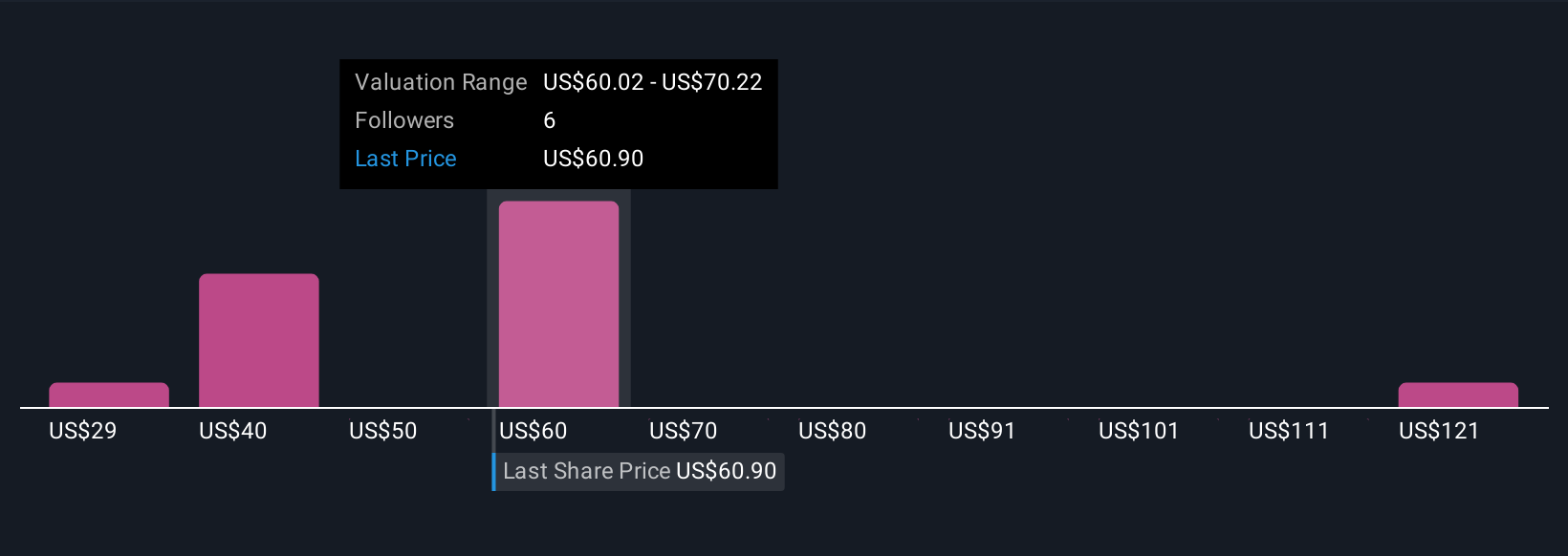

Five members of the Simply Wall St Community valued Jardine Matheson between US$29.44 and US$131.38 per share. Expectations for capital recycling and investment discipline remain high, but opinions in the market can vary significantly, making it worthwhile to consider several perspectives on the company’s future performance.

Explore 5 other fair value estimates on Jardine Matheson Holdings - why the stock might be worth as much as 99% more than the current price!

Build Your Own Jardine Matheson Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jardine Matheson Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Jardine Matheson Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jardine Matheson Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:J36

Jardine Matheson Holdings

Operates in motor vehicles and related operations, property investment and development, food retailing, health and beauty, home furnishings, engineering and construction, and transport businesses in China, Southeast Asia, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives