Major US$920 Million Vessel Contracts Could Be a Game Changer for Yangzijiang Shipbuilding (SGX:BS6)

Reviewed by Simply Wall St

- On August 29, 2025, Yangzijiang Shipbuilding (Holdings) announced it had secured additional contracts for twenty-two vessels with a combined value of US$920 million, including containerships, gas carriers, and bulk carriers for delivery between 2027 and 2029.

- This brings the group’s total year-to-date effective shipbuilding contracts to thirty-six, worth US$1.46 billion, underscoring sustained demand in the global shipping sector heading into the late 2020s.

- We’ll explore how a strengthened orderbook with multi-year deliveries shapes Yangzijiang Shipbuilding’s investment narrative and future prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Yangzijiang Shipbuilding (Holdings)'s Investment Narrative?

To stay interested in Yangzijiang Shipbuilding, you need to appreciate the enduring global demand for new, efficient vessels and the company's ability to capture these opportunities with an impressive, multi-year orderbook. The newly signed contracts for 22 ships, worth US$920 million, add visibility to future revenue and support a case for long-term operational stability. However, as these recent orders are slated for delivery between 2027 and 2029, their financial impact won’t show up in earnings for the current or next year, limiting their effect on any short term catalysts such as immediate profit growth or dividend boost. The key short-term drivers remain execution of existing projects and cost management, while the main risks continue to be possible order delays, pricing pressure, or changes in global shipping activity. The expanded backlog strengthens the long-term story but may not shift near-term sentiment substantially.

However, hidden risks from order delays or project execution remain relevant in the background.

Exploring Other Perspectives

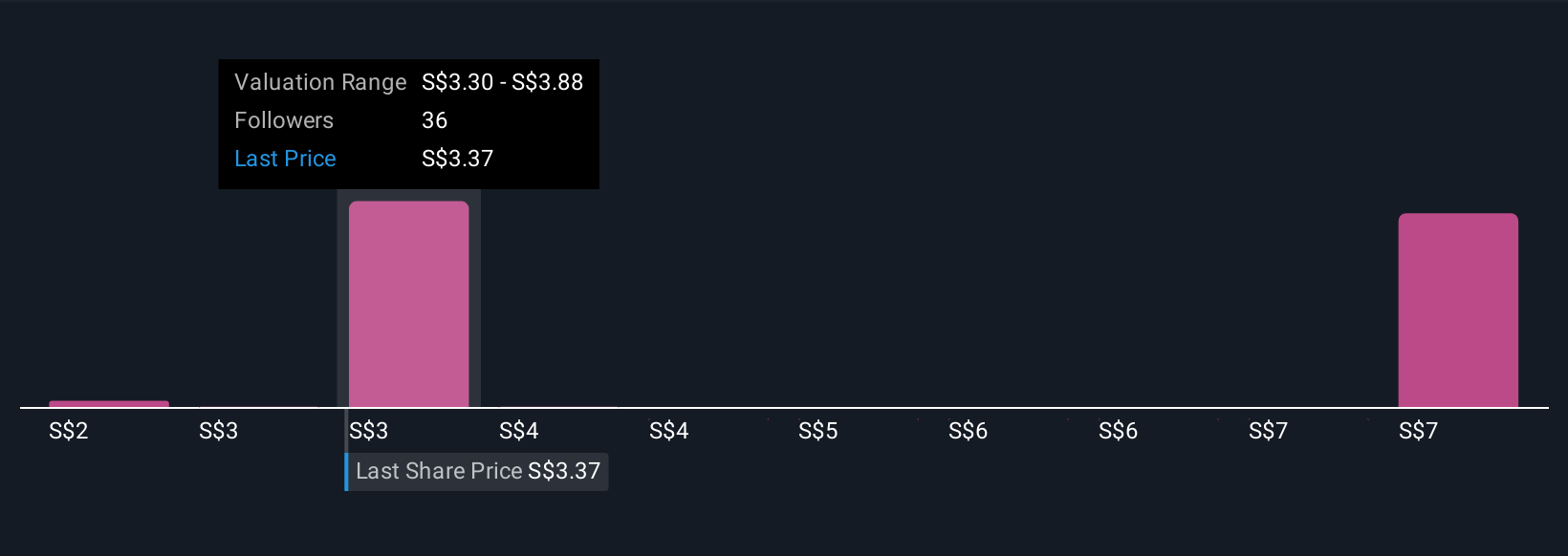

Explore 10 other fair value estimates on Yangzijiang Shipbuilding (Holdings) - why the stock might be worth over 2x more than the current price!

Build Your Own Yangzijiang Shipbuilding (Holdings) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yangzijiang Shipbuilding (Holdings) research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Yangzijiang Shipbuilding (Holdings) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yangzijiang Shipbuilding (Holdings)'s overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BS6

Yangzijiang Shipbuilding (Holdings)

An investment holding company, engages in the shipbuilding activities in the Greater China, Canada, Japan, Italy, Greece, Germany, Bulgaria, United Kingdom, Singapore, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives