As global markets navigate a landscape marked by fluctuating consumer sentiment and economic uncertainties, investors are increasingly exploring diverse opportunities across different regions. Penny stocks, often representing smaller or emerging companies, continue to capture attention due to their potential for significant value creation despite the term's outdated connotation. By focusing on companies with strong financial foundations and growth potential, investors may uncover promising opportunities among Asian penny stocks like Ausnutria Dairy and others that demonstrate resilience and stability.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.85 | HK$2.32B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.54 | HK$952.52M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.09 | SGD441.77M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.90 | THB2.94B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.40 | SGD13.38B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.06 | HK$2.85B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.36 | THB8.81B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 942 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Ausnutria Dairy (SEHK:1717)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ausnutria Dairy Corporation Ltd is an investment holding company involved in the research, development, production, marketing, processing, packaging, and distribution of dairy and nutrition products with a market cap of HK$4 billion.

Operations: The company generates revenue primarily from two segments: Dairy and Related Products, contributing CN¥7.29 billion, and Nutrition Products, accounting for CN¥314.75 million.

Market Cap: HK$4B

Ausnutria Dairy has shown significant earnings growth over the past year, with net income rising to CN¥180.45 million for the half-year ending June 2025. The company is trading at a favorable price-to-earnings ratio of 13.5x, slightly below the industry average, indicating good relative value. However, its debt coverage by operating cash flow is insufficient, and its return on equity remains low at 4.5%. Despite these challenges, Ausnutria's recent share buyback may reflect management's confidence in its future prospects and could provide some support to shareholder value in this volatile segment of the market.

- Jump into the full analysis health report here for a deeper understanding of Ausnutria Dairy.

- Gain insights into Ausnutria Dairy's future direction by reviewing our growth report.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ever Sunshine Services Group Limited is an investment holding company that offers property management services in the People's Republic of China, with a market cap of HK$3.25 billion.

Operations: The company's revenue primarily comes from its property management services, amounting to CN¥6.93 billion.

Market Cap: HK$3.25B

Ever Sunshine Services Group, with a market cap of HK$3.25 billion, is trading at a favorable price-to-earnings ratio of 7x, significantly below the Hong Kong market average. The company maintains strong financial health with more cash than total debt and operating cash flow well covering its debt. However, its net profit margin has slightly decreased to 6.2% from last year’s 6.8%. Recent strategic changes include board re-designations aimed at enhancing management effectiveness. An M&A transaction involving an 8.24% stake sale could impact the company's future dynamics but does not involve management changes or board seats for the acquirer.

- Click to explore a detailed breakdown of our findings in Ever Sunshine Services Group's financial health report.

- Evaluate Ever Sunshine Services Group's prospects by accessing our earnings growth report.

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Simply Wall St Financial Health Rating: ★★★★★☆

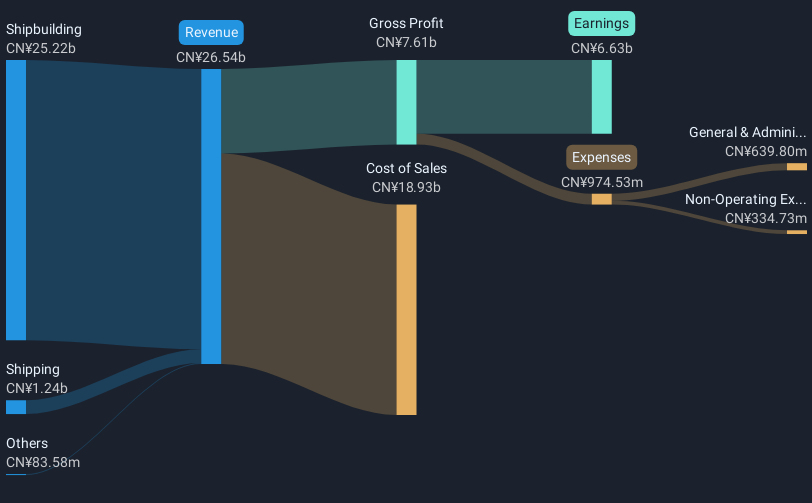

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD13.38 billion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, which generated CN¥25.07 billion, followed by the shipping segment with CN¥1.15 billion.

Market Cap: SGD13.38B

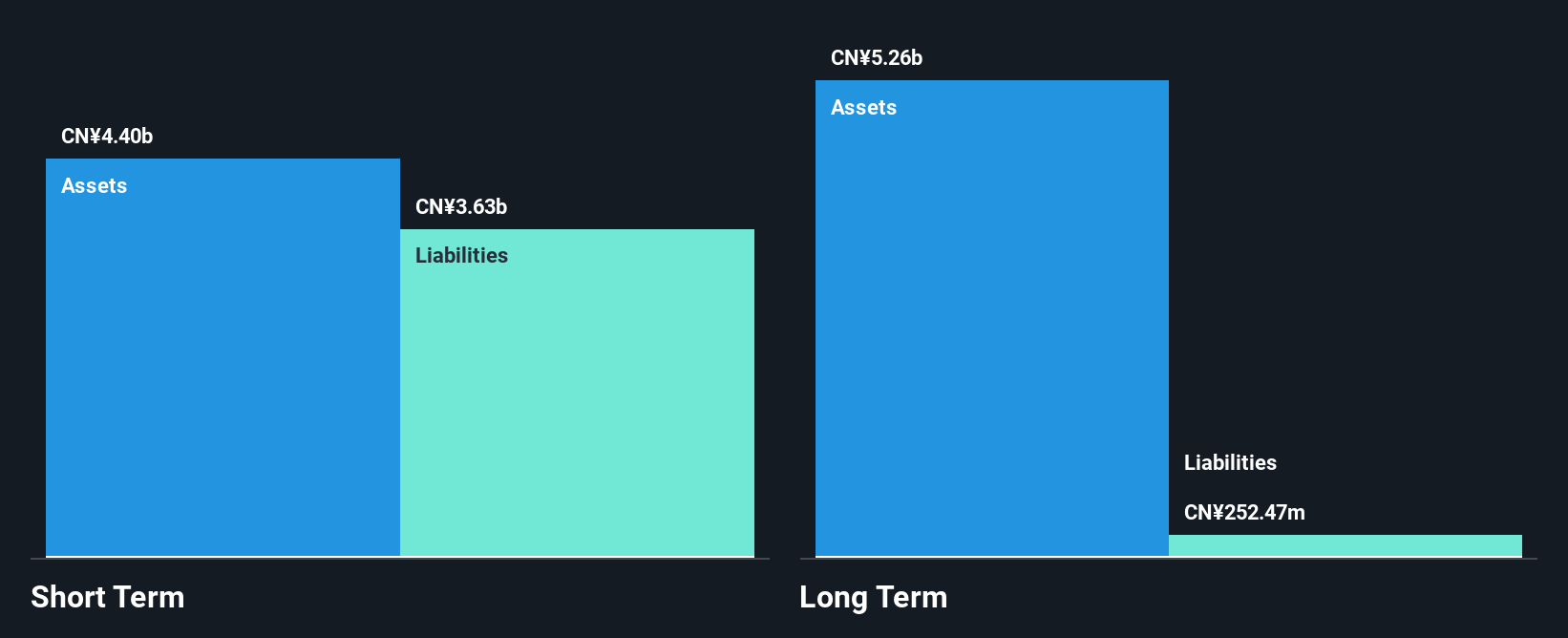

Yangzijiang Shipbuilding (Holdings) Ltd. demonstrates robust financial health, with its cash reserves exceeding total debt and operating cash flow covering debt obligations well. The company has secured significant shipbuilding contracts, totaling US$1.90 billion this year, enhancing its orderbook without diluting shareholder value recently. Its earnings have shown impressive growth, outpacing the broader machinery industry and accelerating beyond its five-year average rate. Despite a slight increase in the debt-to-equity ratio over five years, Yangzijiang maintains strong asset coverage for liabilities and delivers high return on equity at 27.8%. The board's experience further supports strategic execution capabilities.

- Get an in-depth perspective on Yangzijiang Shipbuilding (Holdings)'s performance by reading our balance sheet health report here.

- Understand Yangzijiang Shipbuilding (Holdings)'s earnings outlook by examining our growth report.

Where To Now?

- Jump into our full catalog of 942 Asian Penny Stocks here.

- Curious About Other Options? Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BS6

Yangzijiang Shipbuilding (Holdings)

An investment holding company, engages in the shipbuilding activities in the Greater China, Canada, Japan, Italy, Greece, Germany, Bulgaria, United Kingdom, Singapore, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives