David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Nam Cheong Limited (SGX:1MZ) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

How Much Debt Does Nam Cheong Carry?

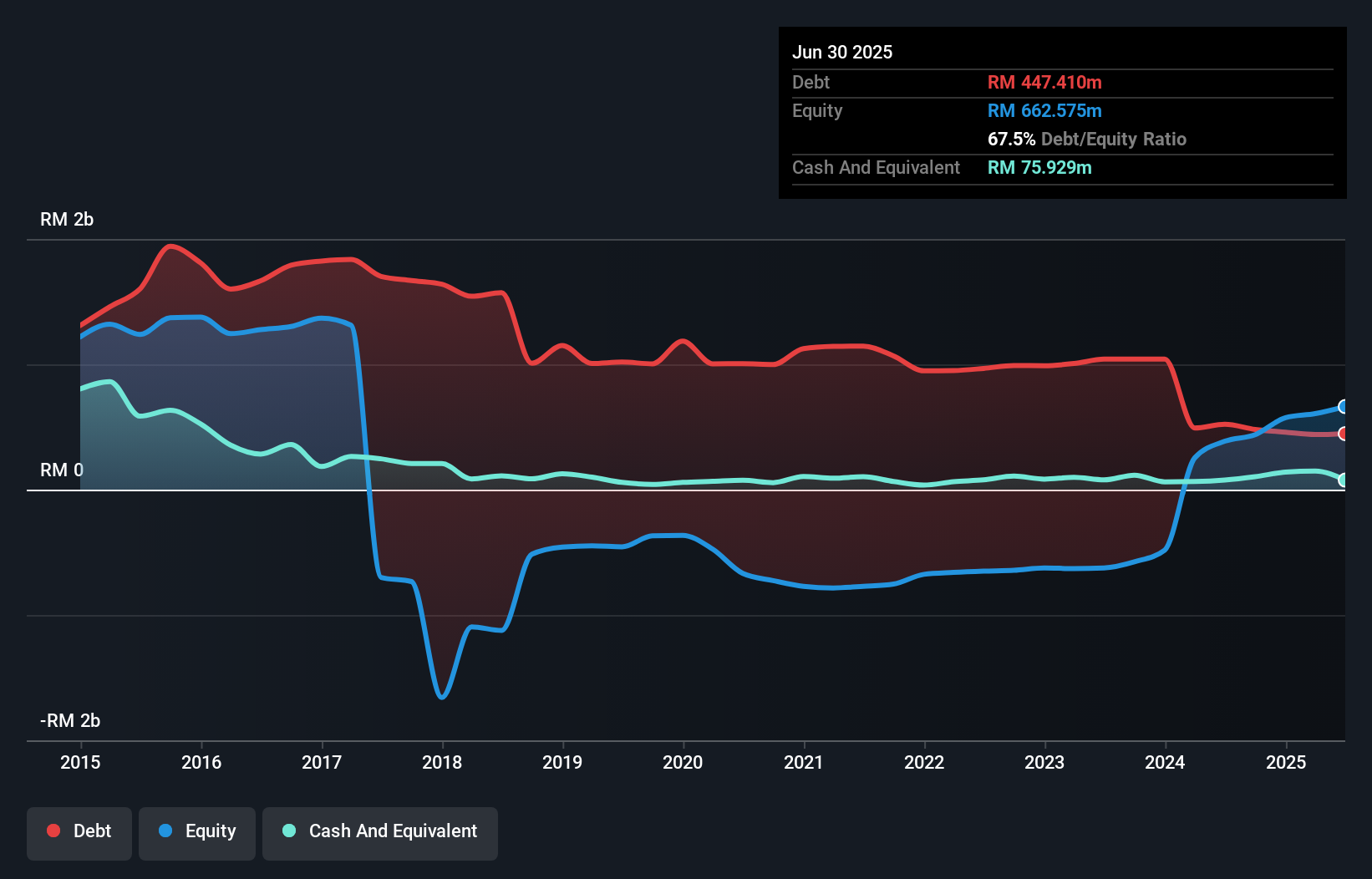

As you can see below, Nam Cheong had RM447.4m of debt at June 2025, down from RM521.9m a year prior. However, because it has a cash reserve of RM75.9m, its net debt is less, at about RM371.5m.

How Strong Is Nam Cheong's Balance Sheet?

The latest balance sheet data shows that Nam Cheong had liabilities of RM240.0m due within a year, and liabilities of RM390.3m falling due after that. Offsetting this, it had RM75.9m in cash and RM257.4m in receivables that were due within 12 months. So its liabilities total RM297.0m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Nam Cheong is worth RM993.7m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

View our latest analysis for Nam Cheong

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Nam Cheong's net debt is only 1.1 times its EBITDA. And its EBIT easily covers its interest expense, being 16.8 times the size. So we're pretty relaxed about its super-conservative use of debt. On the other hand, Nam Cheong saw its EBIT drop by 5.2% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Nam Cheong will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Nam Cheong recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Nam Cheong's conversion of EBIT to free cash flow and EBIT growth rate definitely weigh on it, in our esteem. But the good news is it seems to be able to cover its interest expense with its EBIT with ease. Looking at all the angles mentioned above, it does seem to us that Nam Cheong is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Nam Cheong , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Nam Cheong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:1MZ

Nam Cheong

An investment holding company, provides shipbuilding and vessel chartering.

Excellent balance sheet and good value.

Market Insights

Community Narratives