- Sweden

- /

- Telecom Services and Carriers

- /

- OM:TELIA

Is Telia’s New Ericsson and Nokia 5G Partnerships Shaping Its Investment Story (OM:TELIA)?

Reviewed by Sasha Jovanovic

- In recent days, Telia Company announced renewed and expanded multi-year network partnerships with Ericsson and Nokia, covering advanced Radio Access Network upgrades and 5G Standalone Core deployments across Sweden, Norway, Finland, Estonia, and Lithuania. These collaborations aim to enhance network speed, capacity, and mission-critical capabilities for key sectors such as transportation and defense.

- A standout aspect of these agreements is Telia’s targeted focus on future-proofing infrastructure for emerging business, public safety, and defense needs, including upgraded 5G coverage along railway routes and advanced communications for military and enterprise clients.

- We’ll explore how Telia’s strengthened collaborations in 5G and next-generation networks could reshape its investment narrative and future outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Telia Company Investment Narrative Recap

To see Telia as a compelling investment, you typically have to believe its transformation efforts, especially digitalization and next-generation network upgrades, can offset stagnant demographic trends and intensifying competition. The latest multi-year partnerships with Ericsson and Nokia are a push toward advanced 5G and mission-critical services, but they do not directly impact the key short-term catalyst: actual subscriber and ARPU growth in core markets. The principal risk remains that significant capital expenditures may still outpace immediate revenue gains.

Among recent announcements, Telia’s strategic partnership expansion with Ericsson to modernize its Radio Access Network in Sweden, Norway, Lithuania, and Estonia is especially relevant. This deal directly underpins its ambition to deliver better coverage for transportation and defense, which may help attract enterprise and public sector clients, making it a potential incremental growth lever, even as broader demand trends remain a hurdle.

However, against these network investments, investors should be aware that rising CapEx and regulatory costs could...

Read the full narrative on Telia Company (it's free!)

Telia Company’s outlook anticipates revenue of SEK83.7 billion and earnings of SEK8.7 billion by 2028. This is based on an annual revenue decline of 2.2% and an earnings increase of SEK3.3 billion from the current earnings of SEK5.4 billion.

Uncover how Telia Company's forecasts yield a SEK37.33 fair value, in line with its current price.

Exploring Other Perspectives

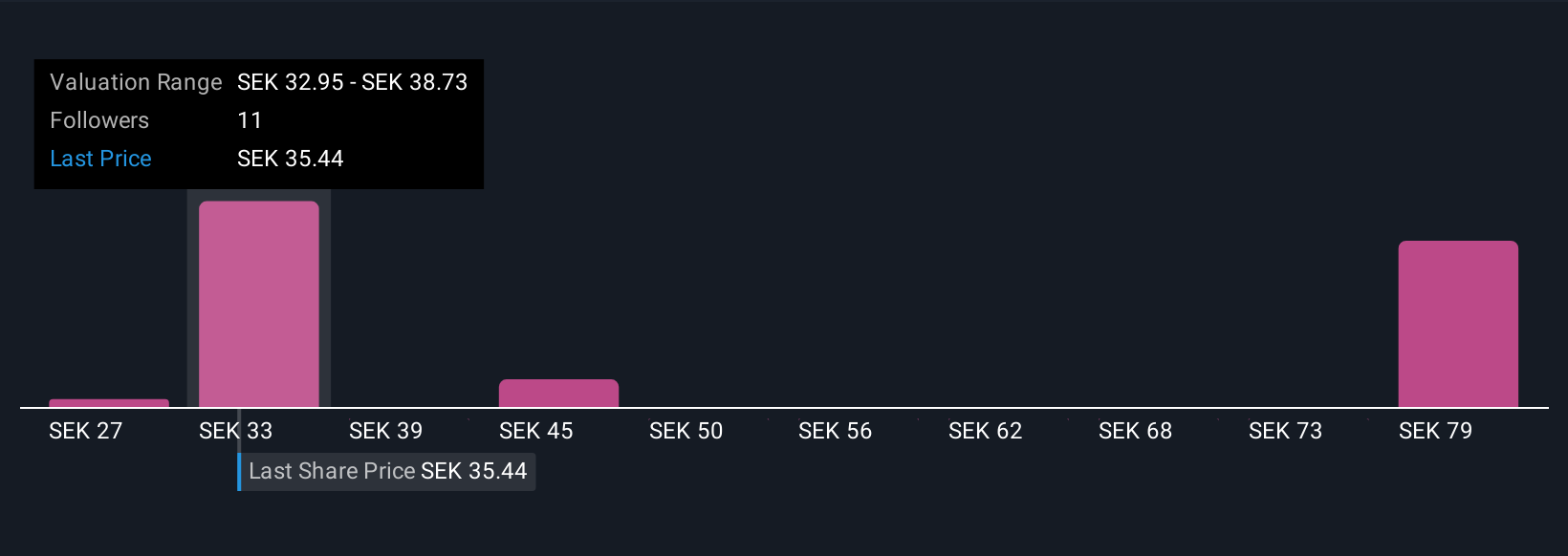

Five members of the Simply Wall St Community valued Telia’s shares at levels ranging from SEK27.17 to SEK65.83. While some see major upside, current analyst outlooks caution that heavy infrastructure spending and limited subscriber growth could weigh on returns, explore a spectrum of perspectives here.

Explore 5 other fair value estimates on Telia Company - why the stock might be worth as much as 74% more than the current price!

Build Your Own Telia Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Telia Company research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Telia Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Telia Company's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telia Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TELIA

Telia Company

Provides communication services to businesses, individuals, families, and communities in Sweden, Finland, Norway, Denmark, Lithuania, Estonia, and Latvia.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives