Stock Analysis

Strong week for Sensys Gatso Group (STO:SGG) shareholders doesn't alleviate pain of five-year loss

Sensys Gatso Group AB (publ) (STO:SGG) shareholders should be happy to see the share price up 15% in the last quarter. But over the last half decade, the stock has not performed well. In fact, the share price is down 38%, which falls well short of the return you could get by buying an index fund.

On a more encouraging note the company has added kr110m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

View our latest analysis for Sensys Gatso Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Sensys Gatso Group became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

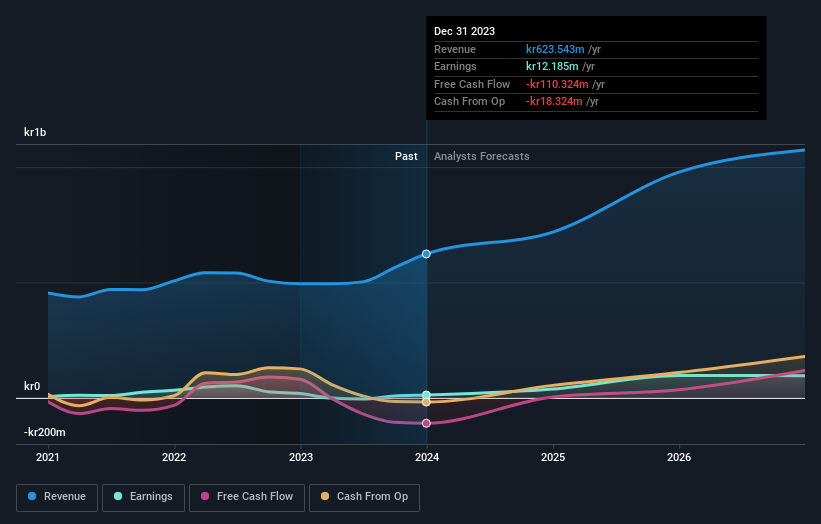

In contrast to the share price, revenue has actually increased by 8.3% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Sensys Gatso Group has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Sensys Gatso Group's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 22% in the last year, Sensys Gatso Group shareholders lost 2.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 7% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Sensys Gatso Group is showing 2 warning signs in our investment analysis , you should know about...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Sensys Gatso Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SGG

Sensys Gatso Group

Sensys Gatso Group AB (publ), together with its subsidiaries, designs, develops, owns, operates, markets, and sells traffic management and enforcement solutions to nations, cities, and fleet owners worldwide.

Excellent balance sheet with reasonable growth potential.