Did a New SLX Order in Asia Just Shift Mycronic's (OM:MYCR) Investment Narrative?

Reviewed by Sasha Jovanovic

- Mycronic AB recently announced that it has received an order for its SLX mask writer from a new customer in Asia, with an order value between US$5 million and US$7 million and revenue to be recognized this quarter.

- This highlights Mycronic’s ability to attract new business in the growing Asian semiconductor market and showcases the importance of its SLX technology in photomask production.

- We'll examine how this new SLX order in Asia could influence Mycronic’s future growth expectations and industry positioning.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Mycronic Investment Narrative Recap

To own shares of Mycronic, investors need to believe in the company’s ability to capitalize on persistent demand for photomask equipment, especially in Asia, while navigating cyclical swings and external headwinds. The recent SLX order from a new Asian customer is a positive sign for growth in Pattern Generators, but with limited short-term impact on the company’s most pressing risks, such as ongoing weakness and volatility in the High Flex division.

Among recent announcements, the sizeable order for three mask writers (one Prexision 8 Evo and two Prexision Lite 8 Evos) in late September stands out, further validating demand for Mycronic’s high-end display solutions. This, combined with the latest SLX order, highlights how customer appetite for new generation mask writers remains a crucial catalyst supporting Mycronic’s sales outlook.

However, in contrast to strong order flow in Pattern Generators, investors should be aware of emerging challenges in...

Read the full narrative on Mycronic (it's free!)

Mycronic's outlook forecasts SEK8.4 billion in revenue and SEK1.8 billion in earnings by 2028. This is based on a 1.3% annual revenue growth rate and a decrease in earnings of SEK0.2 billion from the current SEK2.0 billion.

Uncover how Mycronic's forecasts yield a SEK217.33 fair value, in line with its current price.

Exploring Other Perspectives

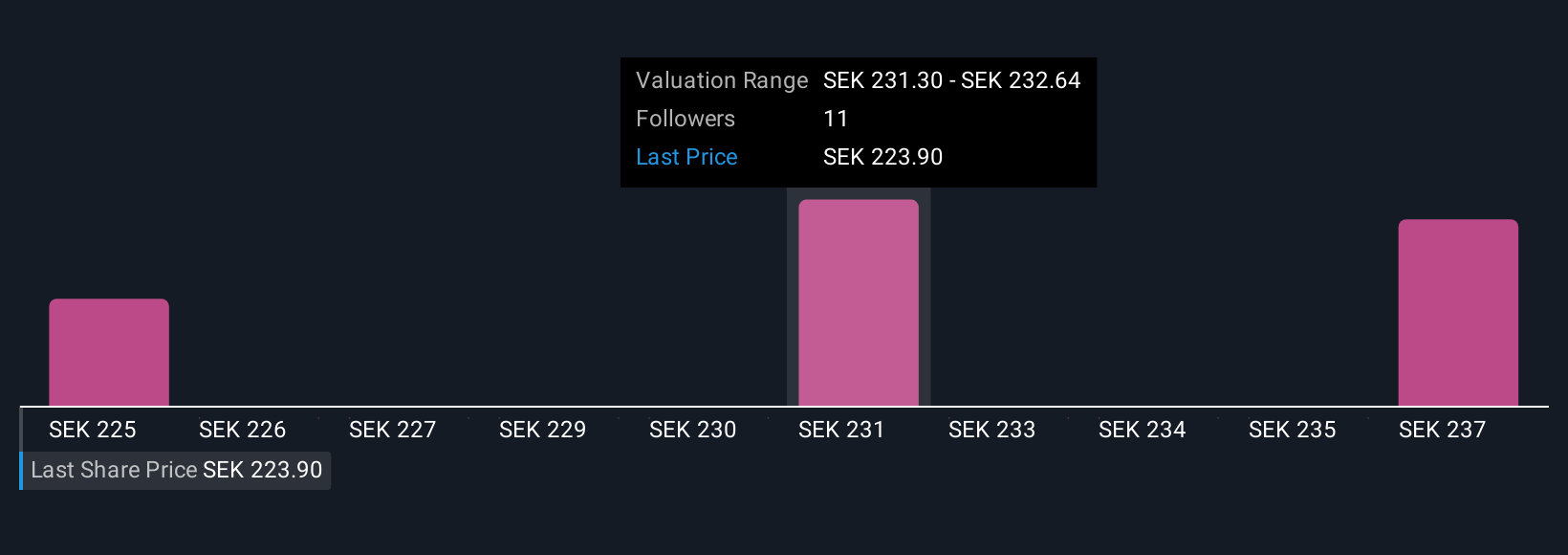

Fair value estimates for Mycronic from three Simply Wall St Community perspectives range from SEK216.73 to SEK232.58, showing meaningful variation in expectations. While several analyses factor in potential order growth, ongoing weakness in the High Flex division reminds us that near-term revenue stability remains a concern worth considering among these differing viewpoints.

Explore 3 other fair value estimates on Mycronic - why the stock might be worth just SEK216.73!

Build Your Own Mycronic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mycronic research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Mycronic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mycronic's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MYCR

Mycronic

Develops, manufactures, and sells production equipment for electronics industry in Sweden, rest of Europe, the United States, other Americas, China, South Korea, rest of Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives