Stock Analysis

- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A078600

Exploring High Growth Tech Stocks In November 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by record highs in U.S. indexes and a strong labor market, the focus on high-growth tech stocks becomes increasingly relevant for investors seeking opportunities amidst broad-based gains and geopolitical uncertainties. In such an environment, identifying promising tech stocks involves assessing factors like innovation potential, market demand, and adaptability to economic shifts, which are crucial for capitalizing on the sector's dynamic growth trajectory.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1295 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Daejoo Electronic Materials (KOSDAQ:A078600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Daejoo Electronic Materials Co., Ltd. is engaged in the development and sale of electronic materials across various international markets, including South Korea, China, Taiwan, the United States, Europe, and Southeast Asia; it has a market cap of ₩1.36 trillion.

Operations: Daejoo Electronic Materials specializes in producing electronic materials for a diverse range of global markets. The company's operations span multiple regions, contributing to its significant market presence and financial valuation.

Daejoo Electronic Materials has demonstrated robust growth, with a notable 37% annual increase in revenue and an impressive forecast of 34% yearly earnings growth. This performance is significantly above the Korean market's average, positioning Daejoo well within the high-growth tech sector. The company's recent quarterly results underscore this trajectory, reporting a substantial rise in net income to KRW 4.59 billion from just KRW 102.6 million year-over-year, alongside sales climbing to KRW 55.77 billion. These figures reflect Daejoo’s effective strategy and operational efficiency in a competitive electronics market, further evidenced by their proactive engagement at key industry events such as the KIS Global Investors Conference.

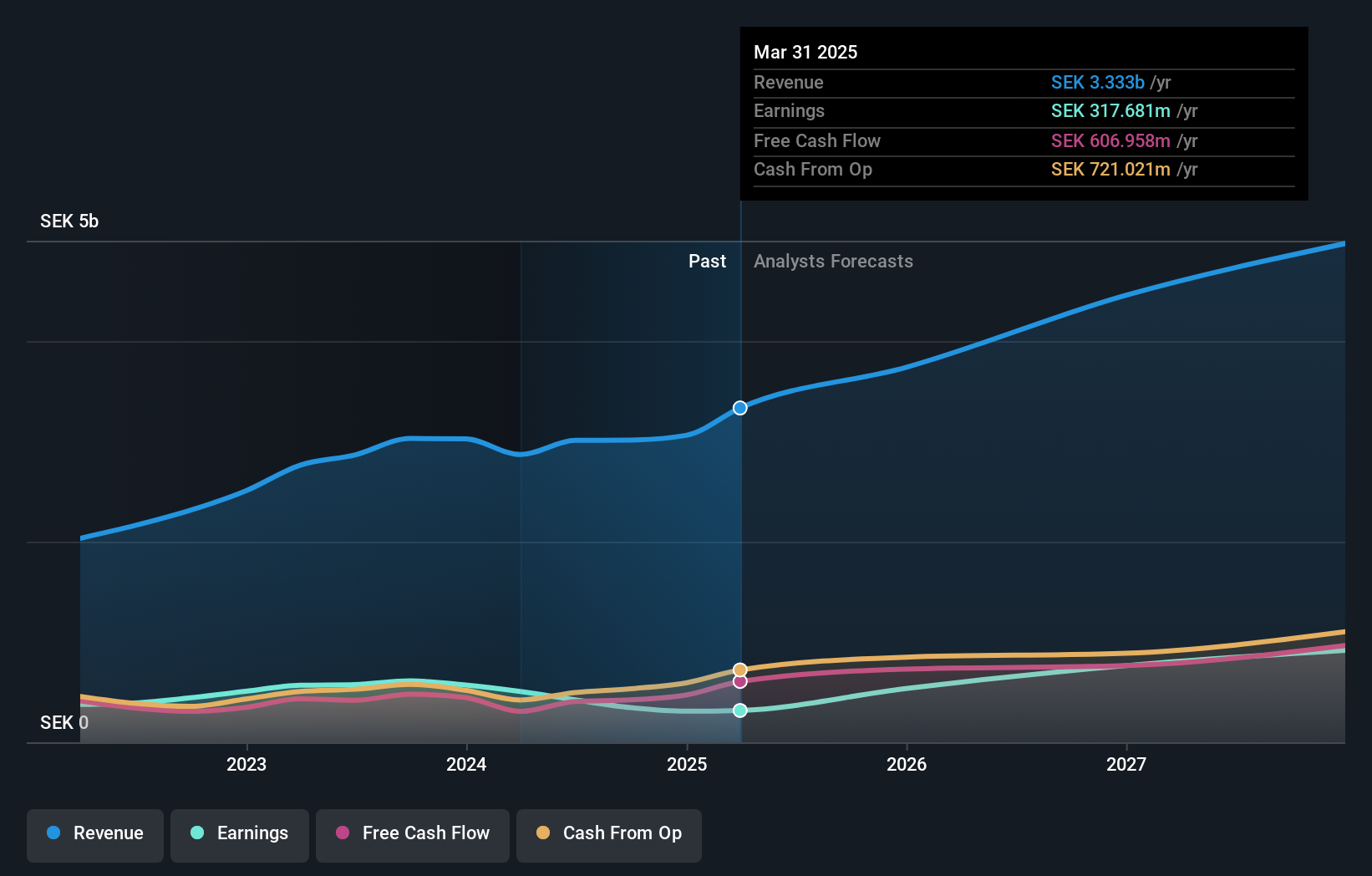

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) focuses on providing products that facilitate communication and information sharing among industrial equipment globally, with a market capitalization of SEK19.22 billion.

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, amounting to SEK3.01 billion. This segment involves products that enable seamless communication among industrial equipment on a global scale.

HMS Networks has strategically reorganized into three divisions, aiming to enhance technological synergies and customer focus, a move set to take full effect by January 2025. This restructuring is anticipated to save SEK 40 million annually, starting from the new fiscal year while incurring a one-time cost of SEK 25 million. Despite recent challenges reflected in a net income drop to SEK 95 million from SEK 172 million in the latest quarter, HMS's forward-looking measures and an impressive forecasted earnings growth rate of 42.5% per annum suggest robust potential. These initiatives underscore HMS's commitment to adapting its business structure in response to dynamic market demands and maintaining competitiveness within the tech sector.

- Get an in-depth perspective on HMS Networks' performance by reading our health report here.

Gain insights into HMS Networks' past trends and performance with our Past report.

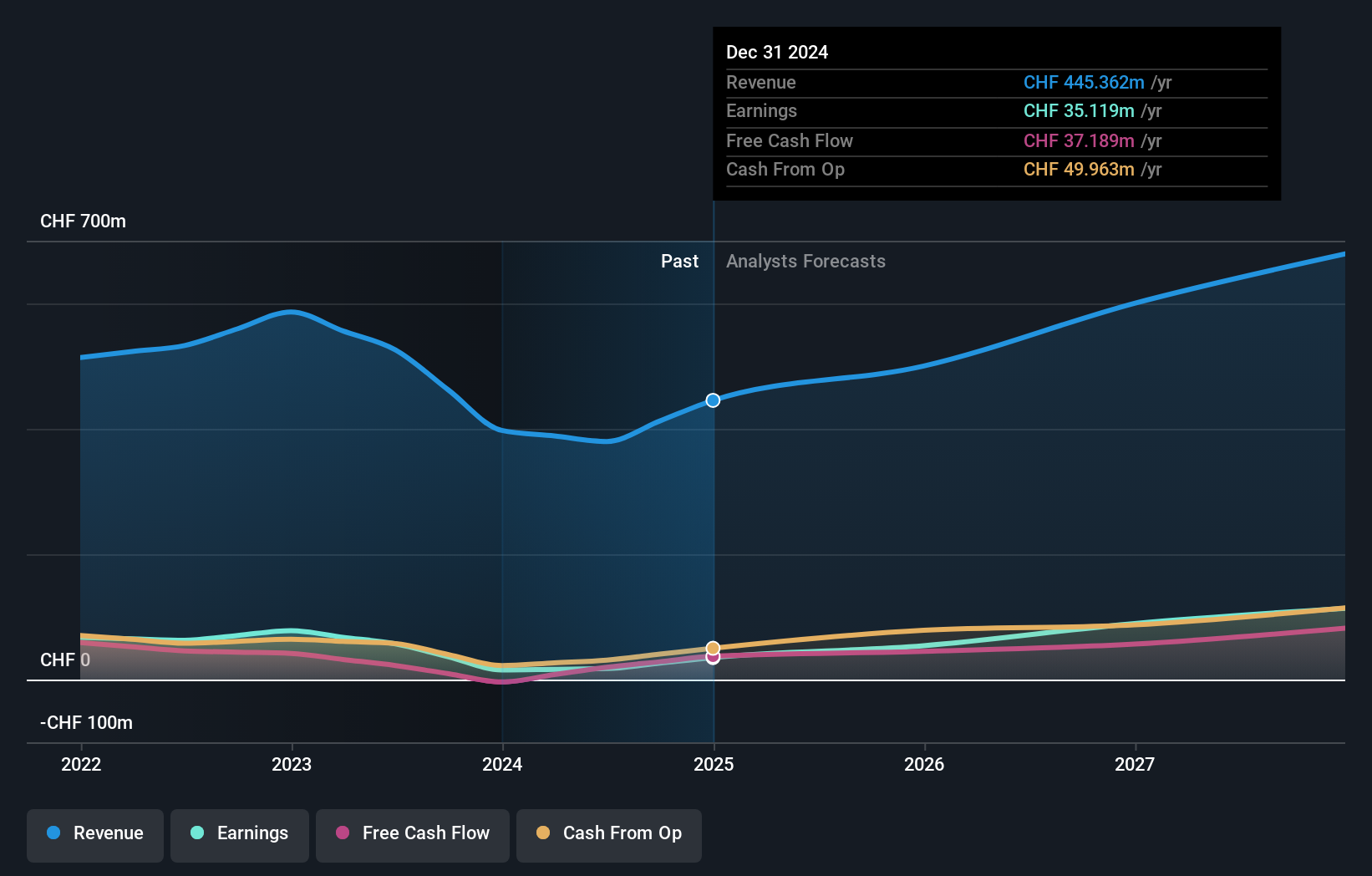

Comet Holding (SWX:COTN)

Simply Wall St Growth Rating: ★★★★★★

Overview: Comet Holding AG, with a market cap of CHF2.20 billion, operates globally through its subsidiaries to deliver X-ray and radio frequency power technology solutions across Europe, North America, Asia, and other international markets.

Operations: Comet Holding AG generates revenue primarily from its Plasma Control Technologies (CHF180.62 million), X-Ray Systems (CHF115.34 million), and Industrial X-Ray Modules (CHF95.90 million) segments. The company focuses on providing advanced technology solutions in the fields of X-ray and RF power, serving diverse international markets.

Comet Holding is navigating a challenging landscape with its earnings having dipped by 69.2% over the past year, yet it remains poised for substantial growth with an expected annual earnings increase of 48.6%. This growth outlook surpasses the broader Swiss market's forecast of 11.4%. Despite a decrease in profit margins from 10.8% to 4.6%, Comet's revenue is projected to rise by 20.4% annually, outpacing the Swiss market prediction of 4.2%. The firm has also committed significant resources to innovation, evidenced by its R&D expenses which stand at a robust CHF {rd_expense_string}. These investments are critical as they underpin future technological advancements and product development essential for staying competitive in the high-tech industry.

- Delve into the full analysis health report here for a deeper understanding of Comet Holding.

Understand Comet Holding's track record by examining our Past report.

Make It Happen

- Dive into all 1295 of the High Growth Tech and AI Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A078600

Daejoo Electronic Materials

Develops and sells electronic materials in South Korea, China, Taiwan, the United States, Europe, and Southeast Asia.