- Sweden

- /

- Communications

- /

- OM:ERIC B

A Closer Look at Ericsson (OM:ERIC B) Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

Telefonaktiebolaget LM Ericsson (OM:ERIC B) stock has caught the attention of investors lately, coming off a recent stretch of strong gains. Over the past month, the company’s shares have climbed nearly 19%, which has outpaced many peers in the tech sector.

See our latest analysis for Telefonaktiebolaget LM Ericsson.

After a sharp climb this past month, Ericsson's momentum is starting to draw in more eyes. The company has delivered a 10.9% total shareholder return over the past year, and its share price has surged nearly 30% over the last quarter. This has signaled renewed optimism around the stock's growth potential.

If you’re curious to see what other tech names could be poised for similar moves, discover See the full list for free.

However, with such a sharp rally, some investors are now asking whether Ericsson's recent gains reflect an undervalued opportunity or if the market has already priced in all the growth ahead. Could there still be room to buy in?

Most Popular Narrative: 7.9% Overvalued

Compared to its recent close at SEK94.08, the most widely followed narrative suggests Ericsson’s fair value sits lower at SEK87.22. This puts the stock about 7.9% above the narrative’s calculated estimate and raises questions about whether the rally has gotten ahead of realistic expectations.

Enhanced operational efficiency and technology leadership are improving profitability, enabling long-term market share gains and diversified revenue streams.

Think the current price captures all of Ericsson’s potential? You might be surprised at the bold projections underlying this valuation, especially when it comes to profitability and future market share. The most important drivers are not what you’d expect. Find out what’s really fueling this outlook by diving into the complete narrative.

Result: Fair Value of $87.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny and prolonged weakness in key emerging markets could quickly challenge the optimism behind Ericsson’s current valuation.

Find out about the key risks to this Telefonaktiebolaget LM Ericsson narrative.

Another View: Multiples Suggest Ericsson is Cheap

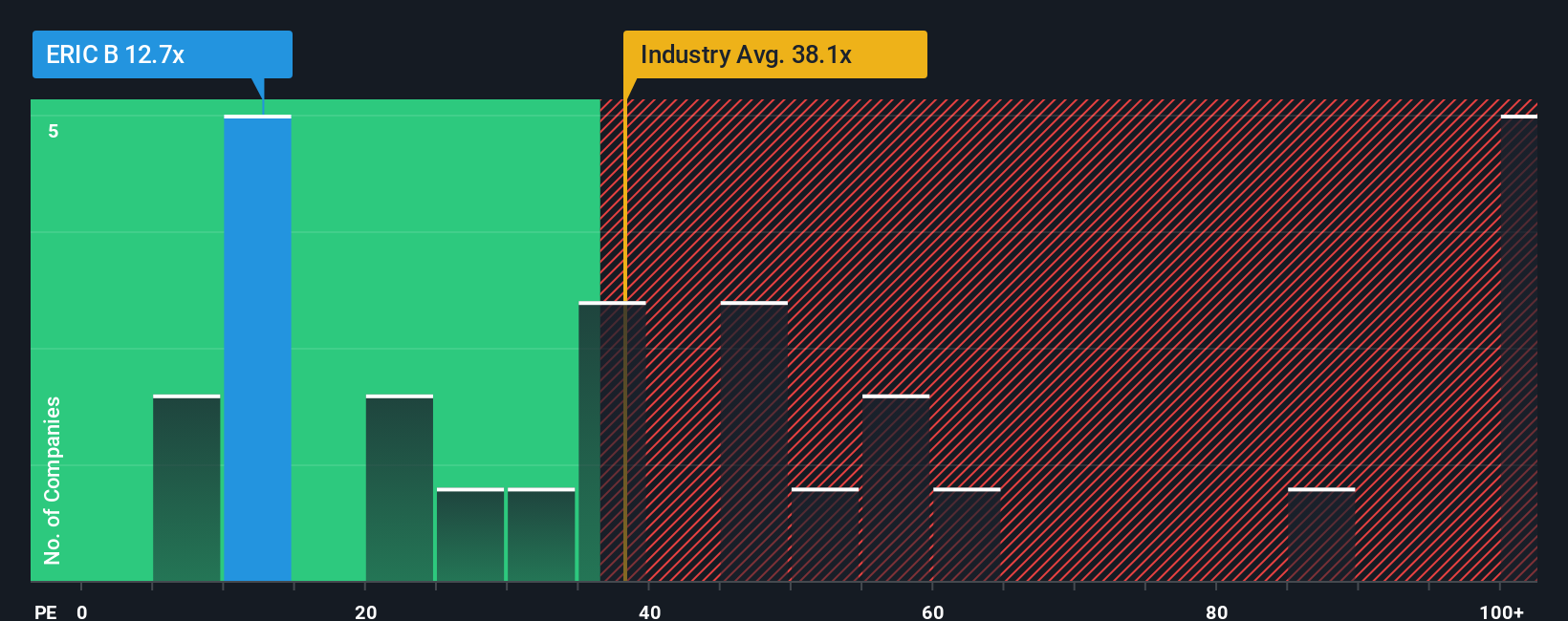

While consensus forecasts see Ericsson as slightly overvalued, our market-based approach using the price-to-earnings ratio tells a different story. At 12.7x earnings, it is far below the industry average of 38.1x, the peer average of 44.3x, and the fair ratio of 24.3x. This wide gap could signal real opportunity if the market re-rates Ericsson closer to these benchmarks. But does this discount reflect risk, or is the market missing something?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Telefonaktiebolaget LM Ericsson Narrative

If you see the numbers differently or want to dig into the details on your own, you can shape your own view in just minutes. Do it your way

A great starting point for your Telefonaktiebolaget LM Ericsson research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one opportunity when the market offers so much more. Use the Simply Wall Street Screener to uncover fresh investment themes that could shape your portfolio this year.

- Tap into the next generation of healthcare by checking out these 32 healthcare AI stocks, which is delivering breakthroughs in AI-powered medicine and diagnosis.

- Pounce on the momentum in digital assets and track rapid growth with these 82 cryptocurrency and blockchain stocks as the blockchain revolution accelerates globally.

- Boost your income streams and get ahead of market shifts with these 17 dividend stocks with yields > 3%, which offers yields above 3% and resilient fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telefonaktiebolaget LM Ericsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ERIC B

Telefonaktiebolaget LM Ericsson

Provides mobile connectivity solutions to communications service providers, enterprises, and the public sector.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives