- Sweden

- /

- Tech Hardware

- /

- OM:DYVOX

High Growth Tech Stocks To Watch For Potential Expansion

Reviewed by Simply Wall St

As global markets navigate rising inflation and potential shifts in trade policies, U.S. stock indexes are climbing toward record highs with growth stocks outperforming value shares. In this environment, identifying high-growth tech stocks requires a focus on companies that demonstrate resilience and adaptability to evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.85% | 25.26% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 25.35% | 25.09% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1208 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Dynavox Group (OM:DYVOX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dynavox Group AB (publ) develops and sells assistive technology products for communication both in Sweden and internationally, with a market cap of SEK7.34 billion.

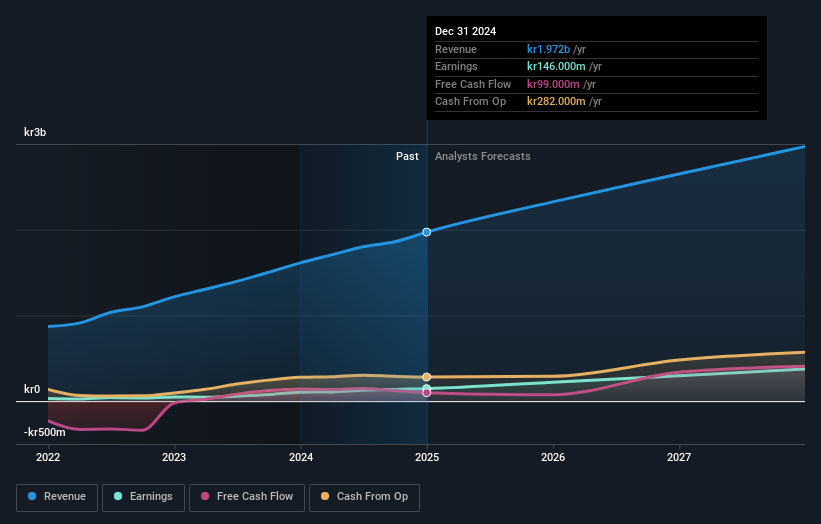

Operations: The company generates revenue primarily from its computer hardware segment, contributing SEK1.97 billion. The focus on assistive technology products for communication indicates a specialized niche in the tech industry.

Dynavox Group's recent earnings report showcases robust growth, with a notable increase in sales to SEK 1.97 billion and net income rising to SEK 146 million for the fiscal year. This performance is underpinned by a substantial annual revenue growth rate of 13.5% and an impressive earnings expansion of 29.2% per year, outpacing the Swedish market's average. The company's strategic focus on innovation is evident from its R&D investments, aligning with industry trends towards enhanced technological solutions. With a forecasted Return on Equity of 32%, Dynavox not only demonstrates financial acumen but also positions itself as a strong contender in tech, potentially shaping future industry standards through its high-quality earnings and commitment to growth amidst competitive pressures.

Primeton Information Technologies (SHSE:688118)

Simply Wall St Growth Rating: ★★★★★☆

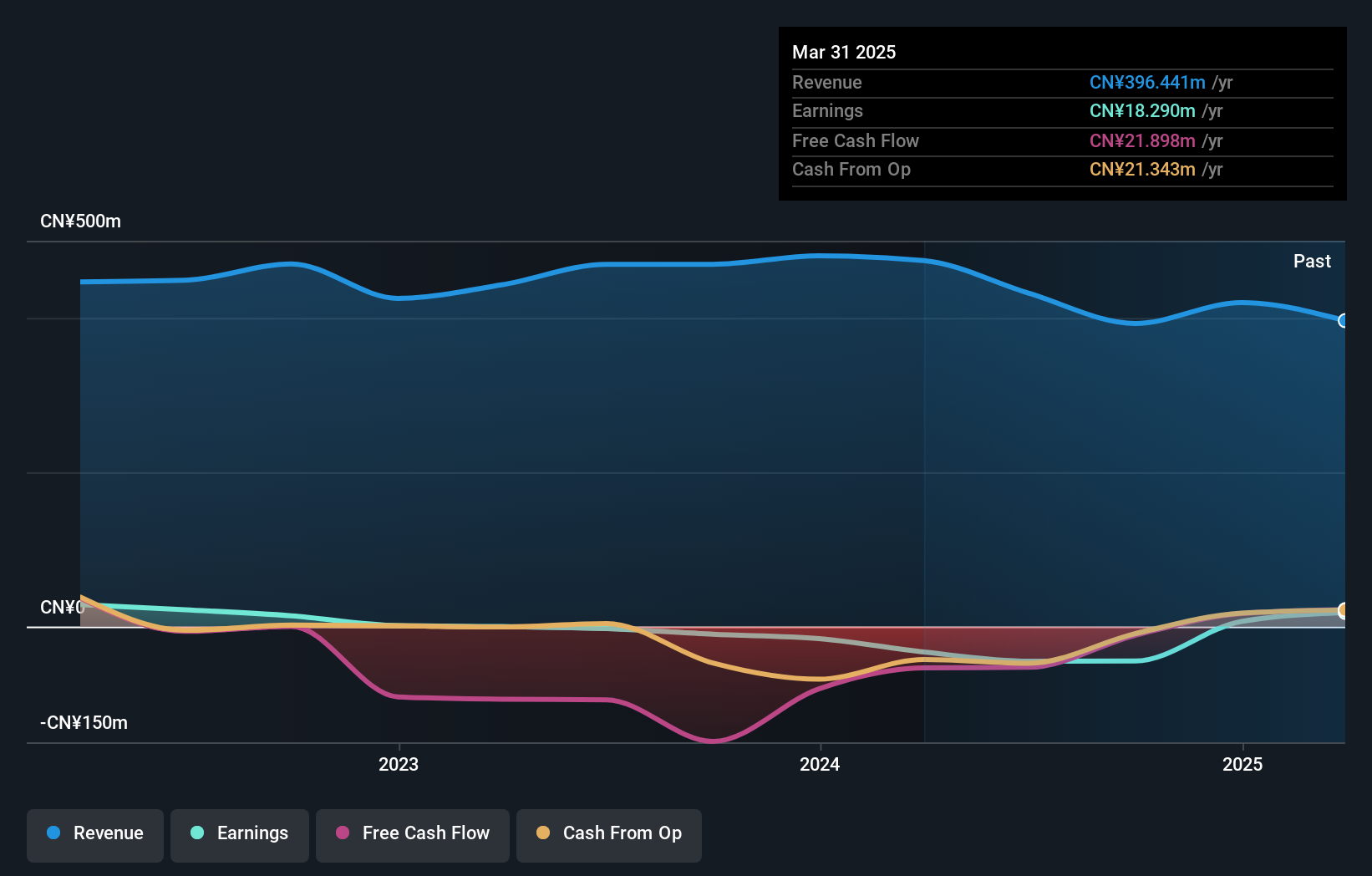

Overview: Primeton Information Technologies, Inc. offers professional software foundation platforms and technical services in China with a market capitalization of approximately CN¥2.37 billion.

Operations: Primeton Information Technologies generates revenue primarily from computer services, amounting to CN¥392.80 million.

Primeton Information Technologies is navigating a challenging landscape with its unprofitable status, yet it shows promise with an expected annual earnings growth of 112.17% and projected revenue increases at 24.5% per year, outpacing the CN market's 13.3%. Despite a volatile share price, the company's focus on becoming profitable within three years and its strategic positioning in the competitive tech sector could signal a turnaround. This potential is underscored by their recent special shareholders meeting aimed at addressing key strategic initiatives, reflecting proactive governance amidst financial uncertainty.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

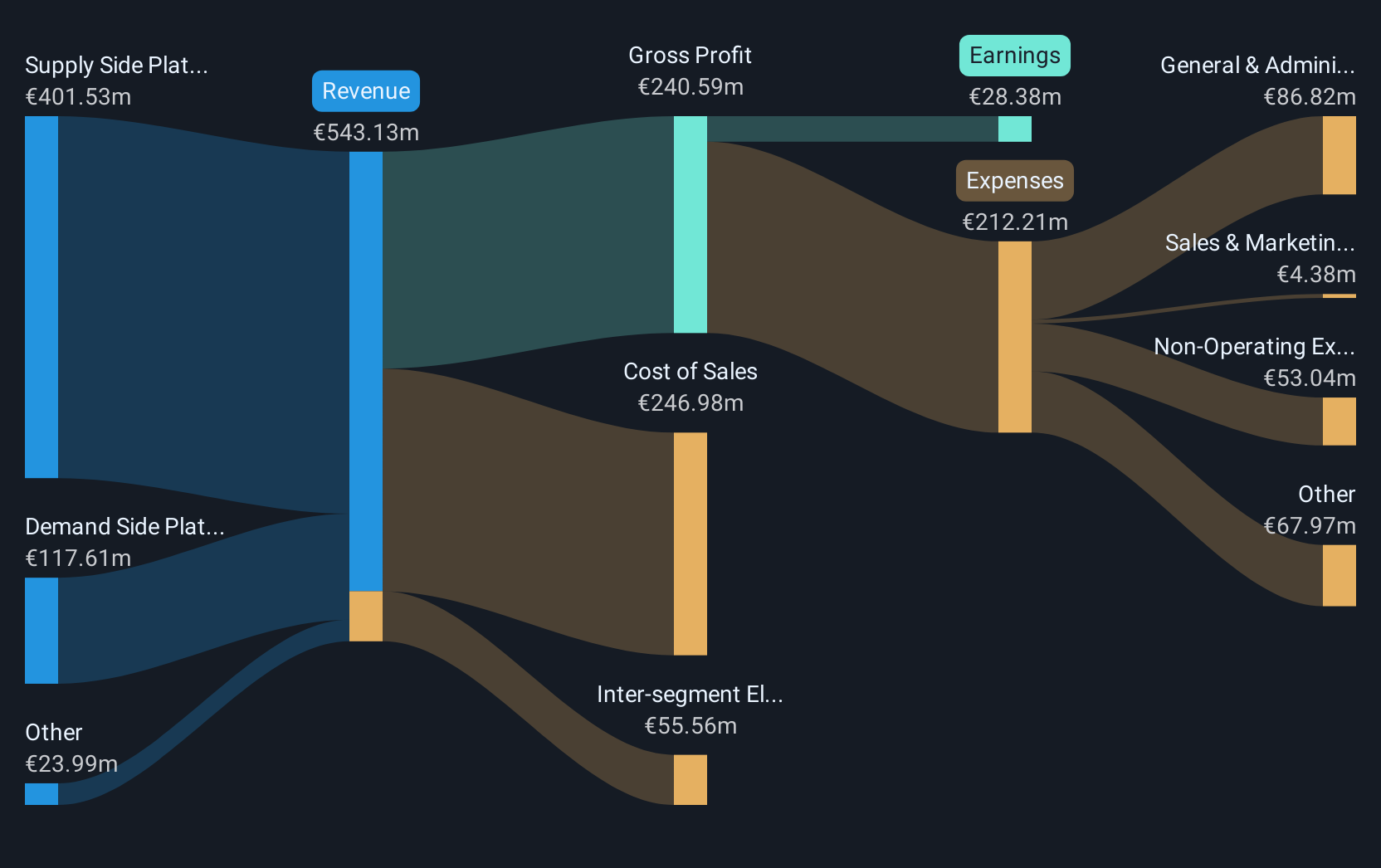

Overview: Verve Group SE operates a software platform facilitating the automated buying and selling of digital advertising space in North America and Europe, with a market cap of approximately €651.34 million.

Operations: Verve Group SE generates revenue primarily through its Supply Side Platforms (SSP) at €367.48 million and Demand Side Platforms (DSP) contributing €73.36 million, after accounting for a segment adjustment of -€49.35 million.

Verve Group SE has demonstrated robust financial performance with a 52.2% earnings growth over the past year, outpacing its industry average of 17.1%. This growth trajectory is supported by an aggressive R&D investment strategy, aligning with industry shifts towards more integrated ad-tech solutions. Recent executive changes signal strategic realignment, as incoming CFO Christian Duus brings extensive sector experience aiming to enhance operational efficiencies and financial discipline. The company's recent presentations at significant investor events further underscore its commitment to transparency and strategic communication with stakeholders, positioning it well for sustained growth in a competitive market.

- Navigate through the intricacies of Verve Group with our comprehensive health report here.

Evaluate Verve Group's historical performance by accessing our past performance report.

Seize The Opportunity

- Click this link to deep-dive into the 1208 companies within our High Growth Tech and AI Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DYVOX

Dynavox Group

Through its subsidiaries, engages in the development and sale of assistive technology products for customers with impaired communication skills.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives