- Sweden

- /

- Medical Equipment

- /

- OM:VIMIAN

3 Swedish Growth Companies With Up To 37% Insider Ownership

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by hopes of a soft landing in the U.S. and resilient economic indicators in Europe, Sweden's stock market has shown promising stability. Against this backdrop, growth companies with high insider ownership are particularly compelling, as they often signal strong confidence from those closest to the business. In this article, we will explore three Swedish growth companies where insiders hold up to 37% ownership, highlighting how such significant stakes can be an indicator of potential long-term value and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.8% | 73.8% |

| Yubico (OM:YUBICO) | 37.5% | 43.7% |

| BioArctic (OM:BIOA B) | 34% | 102.8% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Calliditas Therapeutics (OM:CALTX) | 12.7% | 51.9% |

| InCoax Networks (OM:INCOAX) | 18.1% | 115.5% |

| edyoutec (NGM:EDYOU) | 13.4% | 63.1% |

Here we highlight a subset of our preferred stocks from the screener.

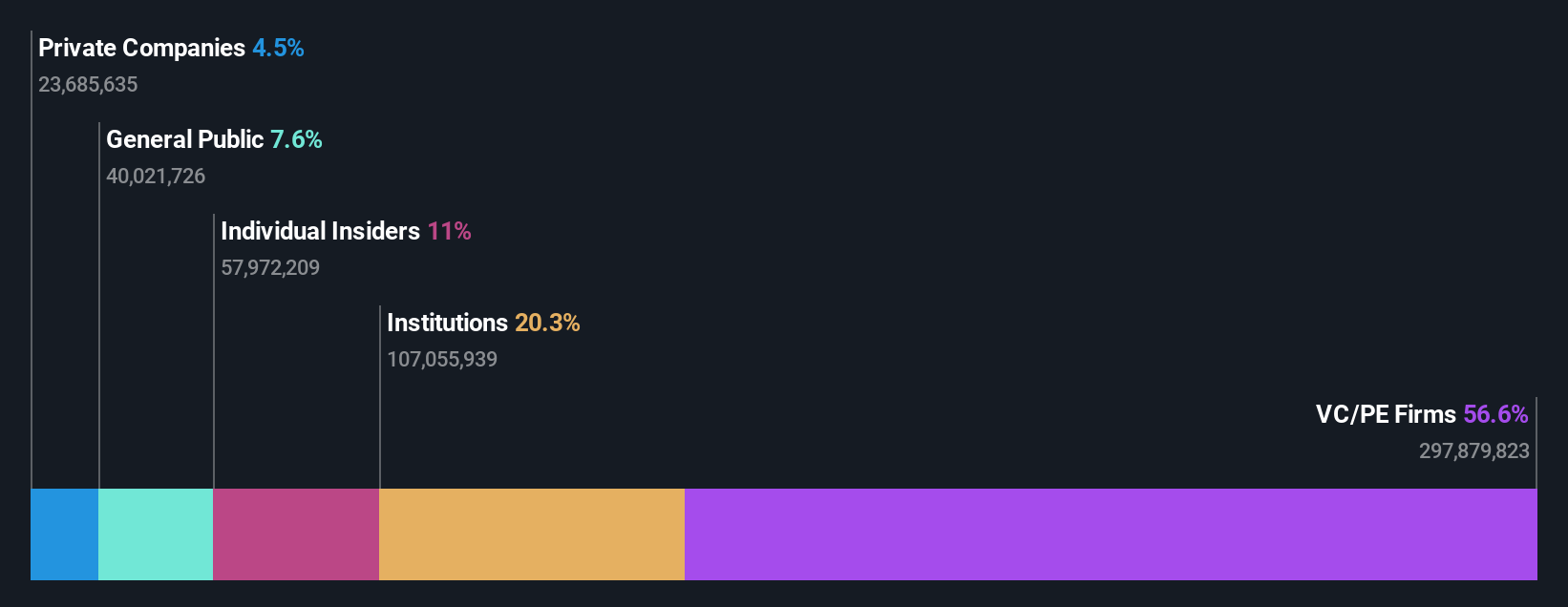

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of SEK398.83 billion.

Operations: The company's revenue segments include €37.20 million from Central, €878.70 million from Real Assets, and €1.28 billion from Private Capital.

Insider Ownership: 30.9%

EQT, a prominent growth company with high insider ownership in Sweden, is forecast to achieve significant annual earnings growth of 56.8%, outpacing the Swedish market's 16.1%. Despite recent substantial insider selling and no major insider purchases in the past three months, EQT's revenue is expected to grow at 17.9% annually. The company's recent activities include share repurchases and multiple M&A discussions, such as potential bids for Compass Education Pty Ltd and Aavas Financiers Limited.

- Get an in-depth perspective on EQT's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report EQT implies its share price may be too high.

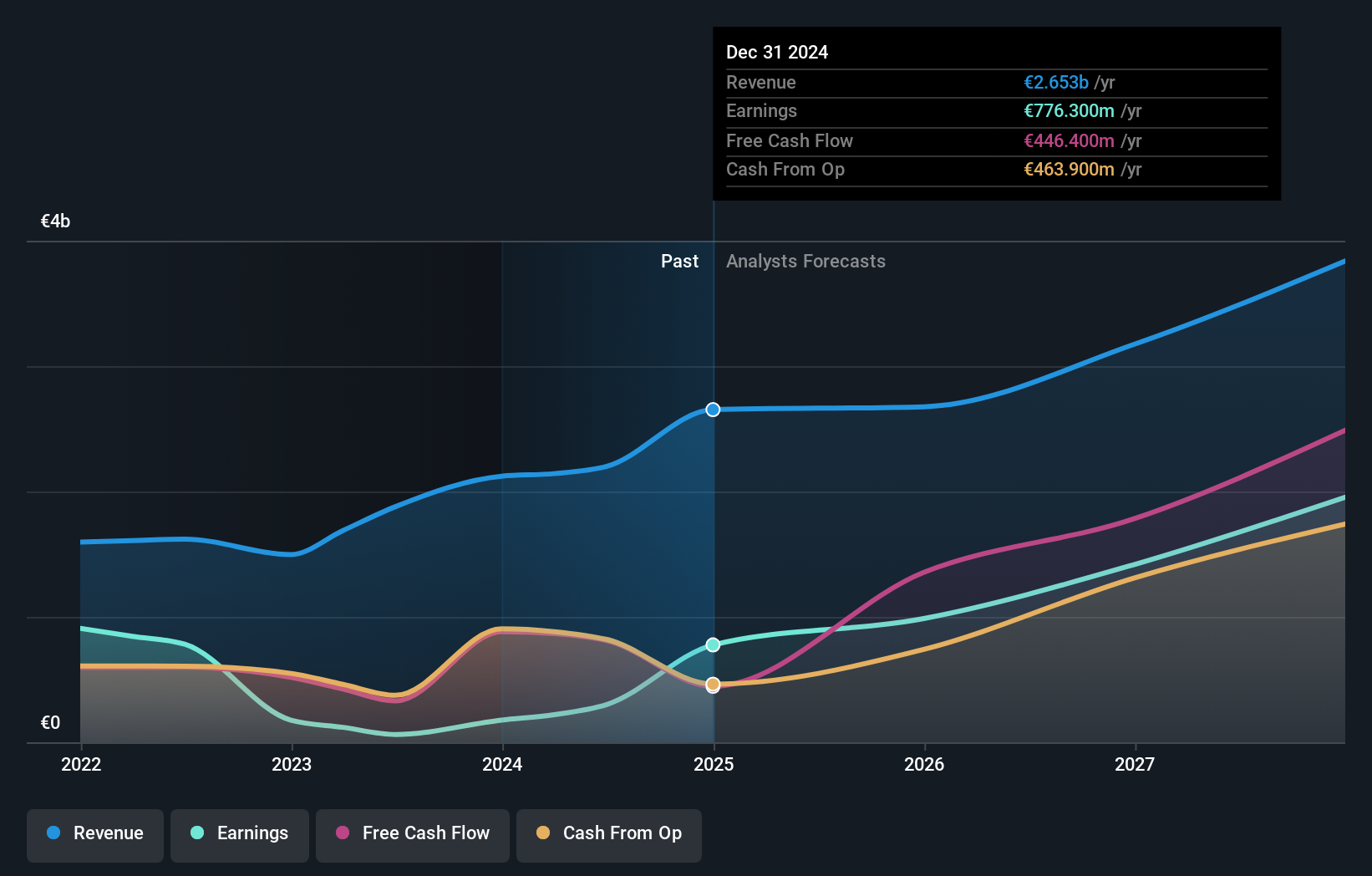

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB (publ) operates in the global animal health industry with a market cap of SEK20.45 billion.

Operations: The company generates revenue from four primary segments: Medtech (€111.91 million), Diagnostics (€20.63 million), Specialty Pharma (€158.39 million), and Veterinary Services (€53.95 million).

Insider Ownership: 11.1%

Vimian Group, a growth company with high insider ownership in Sweden, is forecast to see its earnings grow significantly at 62.9% per year, surpassing the Swedish market's 16.1%. Despite recent shareholder dilution and low future return on equity (7.5%), insiders have substantially bought shares in the past three months. Recent Q2 2024 results showed sales of €90.99M and net income of €4.87M, reflecting solid year-over-year growth from €81.31M and €2.99M respectively.

- Delve into the full analysis future growth report here for a deeper understanding of Vimian Group.

- Our valuation report here indicates Vimian Group may be undervalued.

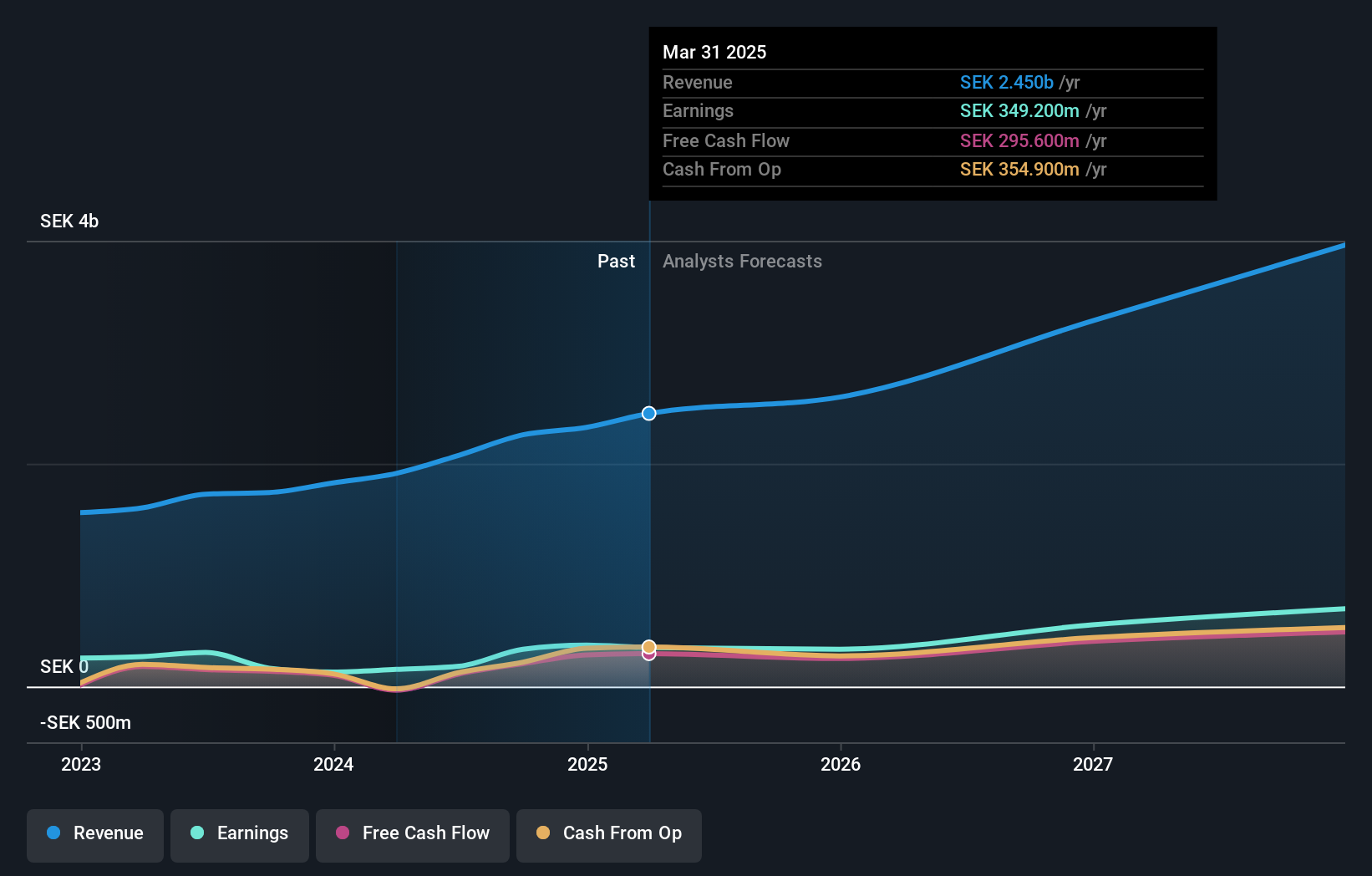

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB, with a market cap of SEK25.66 billion, offers authentication solutions for computers, networks, and online services.

Operations: Yubico's revenue from Security Software & Services is SEK2.09 billion.

Insider Ownership: 37.5%

Yubico, known for its high insider ownership, is forecast to grow revenue by 22.5% annually, outpacing the Swedish market's 1.1%. Despite recent shareholder dilution and a volatile share price, Yubico's earnings are expected to rise significantly at 43.7% per year. The company recently announced MilSecure Mobile with Straxis for secure web access in defense sectors and reported a 21.2% revenue increase over the past year, although profit margins have declined from last year's figures.

- Unlock comprehensive insights into our analysis of Yubico stock in this growth report.

- Upon reviewing our latest valuation report, Yubico's share price might be too optimistic.

Summing It All Up

- Click here to access our complete index of 93 Fast Growing Swedish Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIMIAN

Undervalued with reasonable growth potential.