- Sweden

- /

- Professional Services

- /

- OM:AFRY

Afry And 2 Other Swedish Dividend Stocks To Consider

Reviewed by Simply Wall St

As European markets experience a boost from the European Central Bank's recent rate cuts, Swedish dividend stocks present an interesting opportunity for investors seeking stability amid shifting economic conditions. A good dividend stock in such a climate typically combines consistent payout histories with strong fundamentals, making companies like Afry and others worth considering for those looking to balance growth with income potential.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.63% | ★★★★★★ |

| Zinzino (OM:ZZ B) | 3.30% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.82% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.07% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.48% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.97% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 5.02% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.95% | ★★★★☆☆ |

| Afry (OM:AFRY) | 3.07% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.76% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

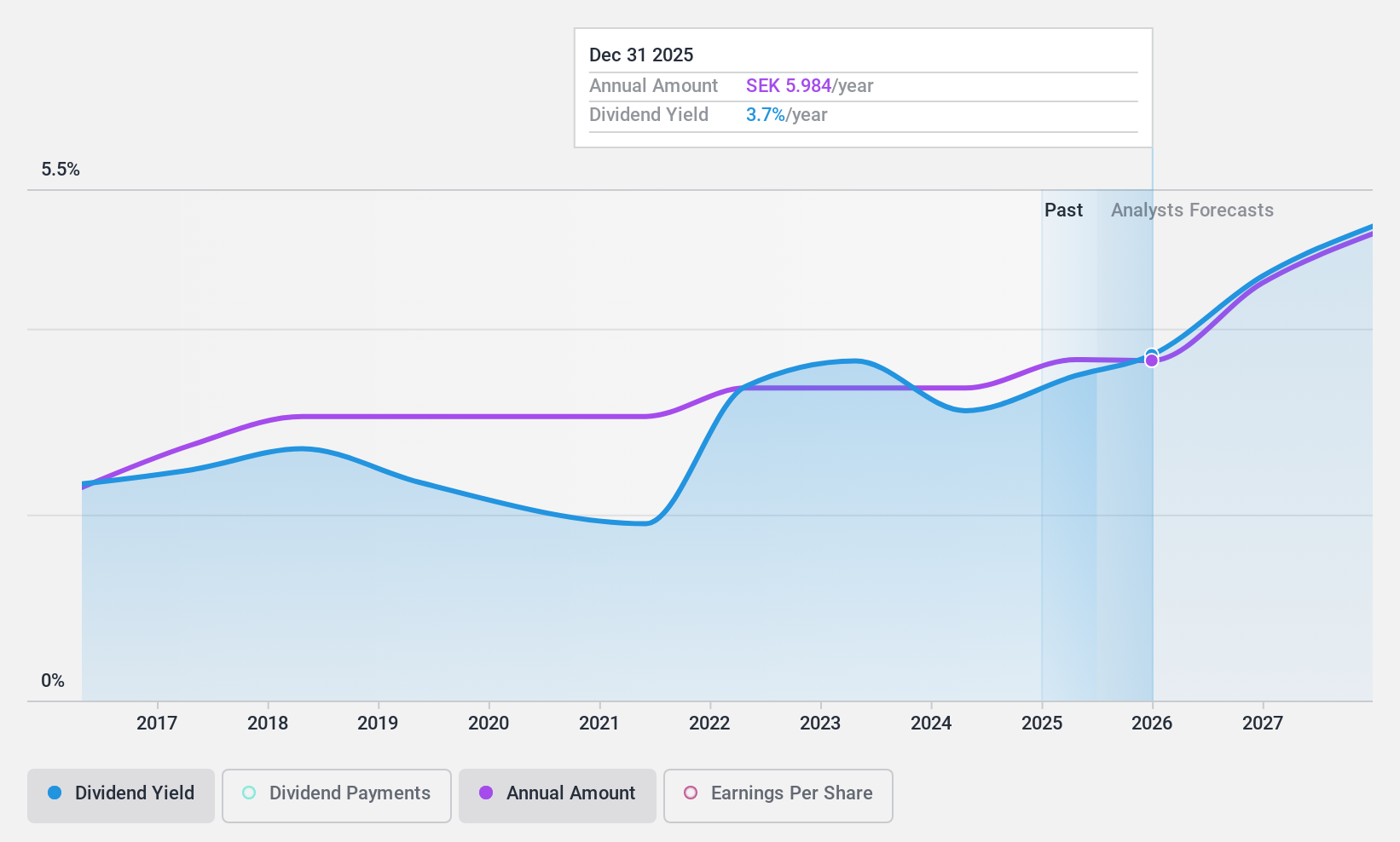

Afry (OM:AFRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Afry AB offers engineering, design, and advisory services across the infrastructure, industry, energy, and digitalization sectors in North and South America, Finland, and Central Europe with a market cap of SEK20.27 billion.

Operations: Afry AB's revenue segments include Energy (SEK3.69 billion), Infrastructure (SEK10.43 billion), Process Industries (SEK5.47 billion), Management Consulting (SEK1.69 billion), and Industrial & Digital Solutions (SEK6.83 billion).

Dividend Yield: 3.1%

AFRY's dividend payments have increased over the past decade but have been volatile, with drops exceeding 20% annually. Despite this instability, dividends are well-covered by earnings and cash flows, with payout ratios of 52.1% and 38.8%, respectively. However, its dividend yield of 3.07% is below the top quartile in Sweden's market. Recent executive changes include CEO Jonas Gustavsson's departure announcement, potentially impacting future strategic direction and dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Afry.

- The valuation report we've compiled suggests that Afry's current price could be quite moderate.

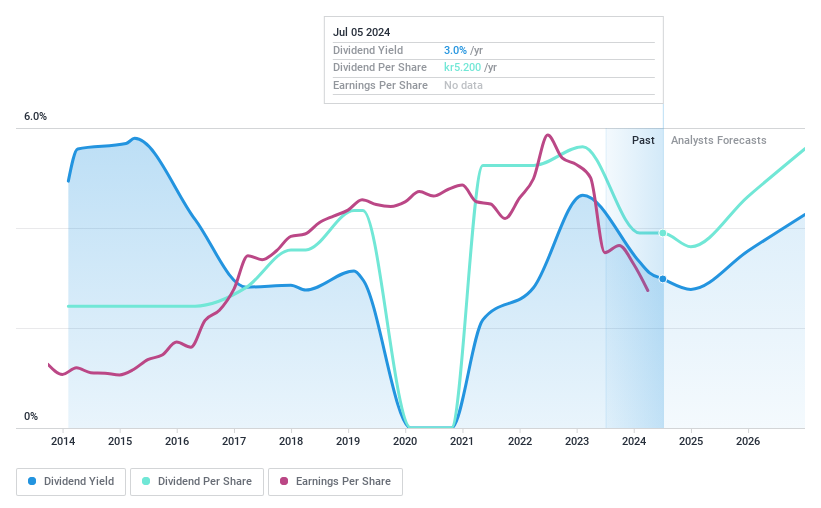

Knowit (OM:KNOW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Knowit AB (publ) is a consultancy company focused on developing digital solutions, with a market cap of SEK4.21 billion.

Operations: Knowit AB's revenue is primarily derived from its Solutions segment at SEK3.90 billion, followed by the Experience segment at SEK1.44 billion, Connectivity at SEK1.02 billion, and Insight at SEK898.95 million.

Dividend Yield: 3.4%

Knowit's dividend payments have grown over the past decade but remain volatile, with annual drops exceeding 20%, making them unreliable. Despite this, dividends are well-supported by earnings and cash flows, with payout ratios of 77.3% and 41.6%, respectively. Its dividend yield of 3.38% is lower than the top quartile in Sweden's market. Recent changes in its Nomination Committee could influence future governance and strategic decisions impacting dividends.

- Take a closer look at Knowit's potential here in our dividend report.

- Upon reviewing our latest valuation report, Knowit's share price might be too pessimistic.

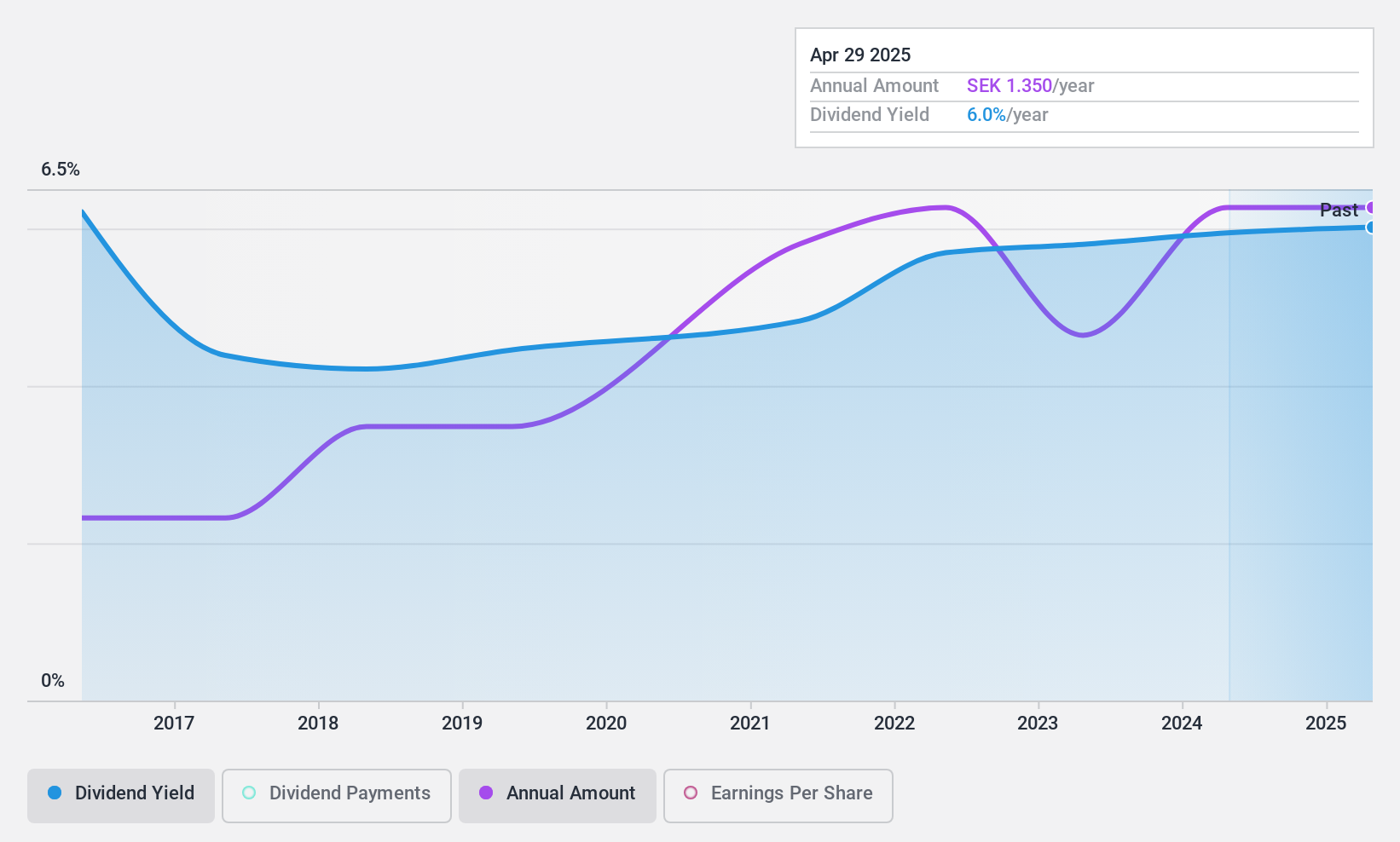

Softronic (OM:SOF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softronic AB (publ) offers IT and management services mainly in Sweden, with a market cap of SEK1.21 billion.

Operations: Softronic AB (publ) generates revenue primarily from its Computer Services segment, amounting to SEK838.92 million.

Dividend Yield: 5.9%

Softronic offers a dividend yield of 5.87%, placing it in the top quartile of Swedish dividend payers, yet its payments have been volatile over the past decade. Although dividends are covered by earnings with an 85.5% payout ratio, they are not well-supported by free cash flow due to a high cash payout ratio of 94.5%. The company's price-to-earnings ratio of 14.6x is attractive compared to the broader Swedish market average.

- Navigate through the intricacies of Softronic with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Softronic is priced higher than what may be justified by its financials.

Summing It All Up

- Dive into all 22 of the Top Swedish Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AFRY

Afry

Provides engineering, design, and advisory services for the infrastructure, industry, energy, and digitalization sectors in North and South America, Finland, and Central Europe.

Very undervalued with excellent balance sheet and pays a dividend.