Why Sinch (OM:SINCH) Is Down 19.9% After Dramatically Narrowing Its Net Loss in Q3

Reviewed by Sasha Jovanovic

- Sinch AB (publ) recently released its third quarter 2025 results, reporting sales of SEK6.77 billion and a net loss of SEK10 million, narrowing substantially from the very large SEK6.09 billion loss in the previous year.

- This dramatic improvement in net loss occurred despite slightly lower sales, highlighting considerable cost or operational efficiencies achieved by the company over the period.

- We'll explore how Sinch's sharp reduction in net loss this quarter could influence its future investment outlook and analyst expectations.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Sinch Investment Narrative Recap

To be a shareholder in Sinch right now, you need confidence that the company can deliver sustained margin improvements and eventually restore steady sales growth, even as the broader communications software market experiences pressures from competition and channel shifts. The sharp reduction in net loss for the third quarter signals material operational progress but does not resolve the most pressing short term issue: sluggish topline growth and the risk of further revenue stagnation. Despite the clear improvement in efficiency, the news leaves this central risk largely unchanged.

Among Sinch’s recent corporate announcements, the rollout of RCS for Business in August stands out, given it aligns directly with one of the company’s primary revenue growth catalysts. RCS represents an important push into next-generation messaging, but the recent results underscore that most RCS activity is still cannibalizing SMS volumes, rather than bringing new revenue. Until these new channels deliver outsized sales or margin gains, near-term investor optimism will likely remain in check.

In contrast, it’s important for investors to consider persistent headwinds around organic net sales growth and what happens if customer pipeline conversion remains slow…

Read the full narrative on Sinch (it's free!)

Sinch's outlook anticipates SEK30.1 billion in revenue and SEK1.1 billion in earnings by 2028. This is based on analysts' assumptions of 1.3% annual revenue growth and an SEK7.5 billion increase in earnings from the current SEK -6.4 billion.

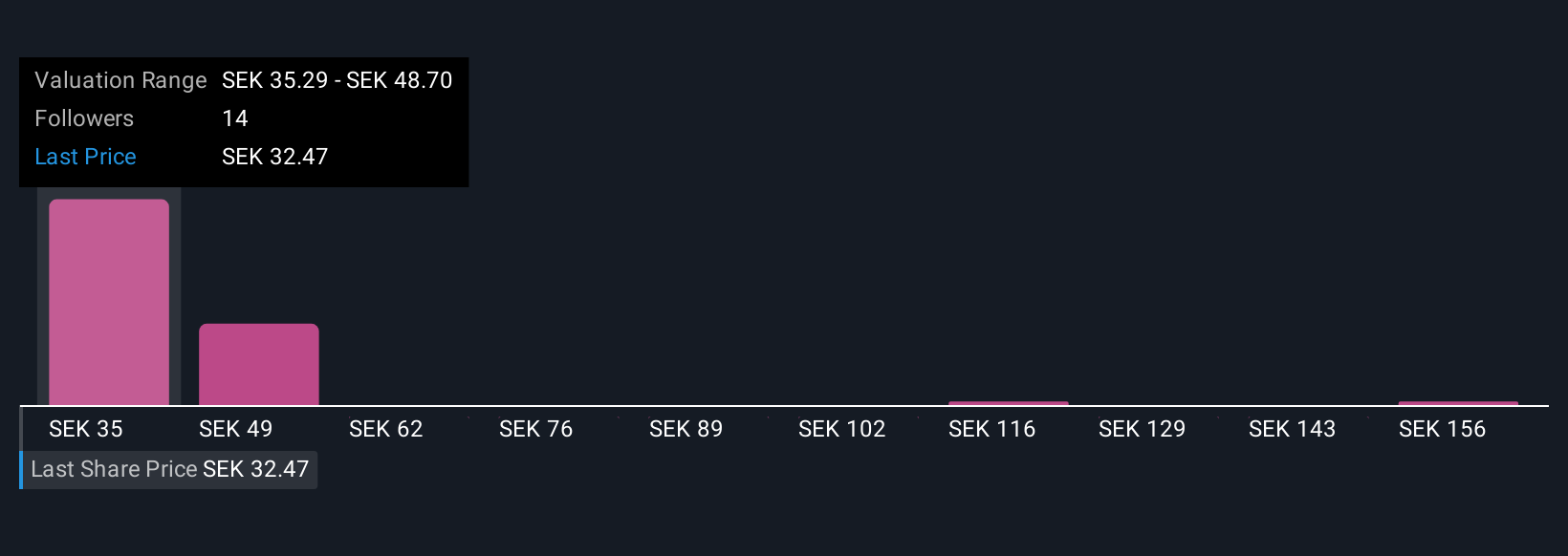

Uncover how Sinch's forecasts yield a SEK35.57 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community set fair value estimates for Sinch between SEK35.57 and SEK169.38. While community optimism runs high for new AI and messaging services fueling growth, ongoing sales headwinds may continue to test investor patience.

Explore 5 other fair value estimates on Sinch - why the stock might be worth just SEK35.57!

Build Your Own Sinch Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sinch research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Sinch research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sinch's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SINCH

Sinch

Provides cloud communications services and solutions for enterprises and mobile operators.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives