- France

- /

- Electrical

- /

- ENXTPA:ALOKW

Discover Groupe OKwind Société Anonyme And 2 Other Promising European Penny Stocks

Reviewed by Simply Wall St

Amid recent global trade concerns and economic uncertainty, European markets have experienced significant declines, with the STOXX Europe 600 Index seeing its largest drop in five years. Despite these challenges, certain investment opportunities remain appealing, particularly among penny stocks. These smaller or newer companies can offer unique growth potential when backed by strong financials, making them intriguing options for investors looking to explore under-the-radar opportunities with solid balance sheets and long-term prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.95 | SEK1.87B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.53 | SEK229.09M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.59 | SEK269.2M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.72 | SEK226.32M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.28 | PLN111.17M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.44 | €51.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.95 | €31.81M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.20 | €24.32M | ✅ 3 ⚠️ 3 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.84 | €18.09M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.06 | €284.41M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 433 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Groupe OKwind Société anonyme (ENXTPA:ALOKW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Groupe OKwind Société anonyme designs, manufactures, sells, and installs green energy solutions in France with a market cap of €17.31 million.

Operations: The company generates revenue through two main segments: B to B, which accounts for €69.37 million, and B to C, contributing €6.96 million.

Market Cap: €17.31M

Groupe OKwind Société anonyme, with a market cap of €17.31 million, is actively expanding its industrial capabilities, as evidenced by the construction of a new production site in Etrelles. This initiative aligns with their strategy to enhance energy autonomy and self-consumption solutions. Despite recent negative earnings growth and high share price volatility, the company remains financially stable with satisfactory debt levels and sufficient asset coverage for liabilities. While trading at a good relative value compared to peers, Groupe OKwind's profit margins have declined from last year, yet it continues to offer high-quality earnings supported by seasoned management.

- Click to explore a detailed breakdown of our findings in Groupe OKwind Société anonyme's financial health report.

- Explore Groupe OKwind Société anonyme's analyst forecasts in our growth report.

Transiro Holding (NGM:TIRO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Transiro Holding AB (publ) develops systems for the trade and transport industry in Sweden, with a market cap of SEK31.97 million.

Operations: Transiro Holding does not report any specific revenue segments.

Market Cap: SEK31.97M

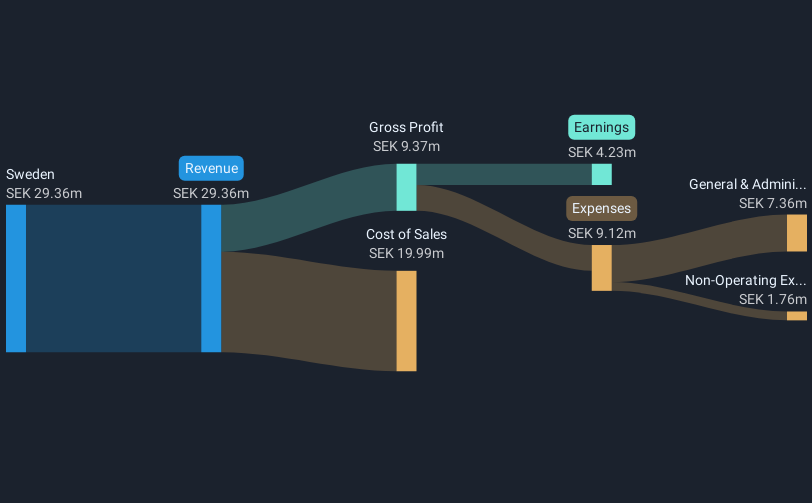

Transiro Holding AB, with a market cap of SEK31.97 million, has recently turned profitable, reporting a net income of SEK 7.73 million for Q1 2025 compared to SEK 1.07 million the previous year. Despite its small size and high share price volatility, Transiro's financial health is underscored by being debt-free and having no long-term liabilities. The company's return on equity stands at an outstanding 43.7%, although its sales have slightly decreased year-over-year to SEK 31.25 million in 2024 from SEK33.55 million in 2023, indicating potential challenges in revenue growth amidst improving profitability metrics.

- Unlock comprehensive insights into our analysis of Transiro Holding stock in this financial health report.

- Review our historical performance report to gain insights into Transiro Holding's track record.

Nordic LEVEL Group AB (publ.) (OM:LEVEL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nordic LEVEL Group AB (publ.) offers safety and security solutions mainly in Sweden, with a market cap of SEK116.76 million.

Operations: The company generates its revenue from various segments, including Advisory (SEK19.28 million), Group-wide (SEK13.22 million), and Technology (SEK355.06 million).

Market Cap: SEK116.76M

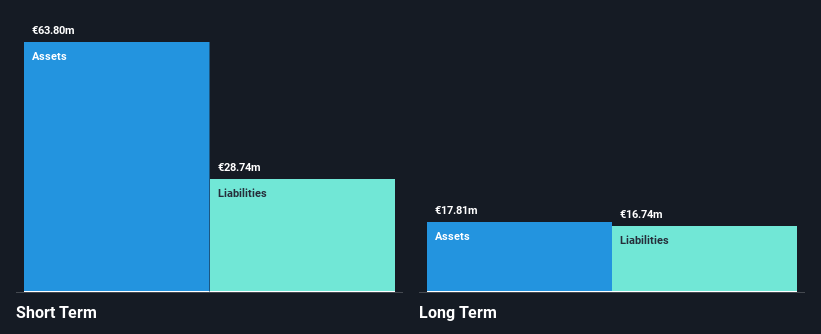

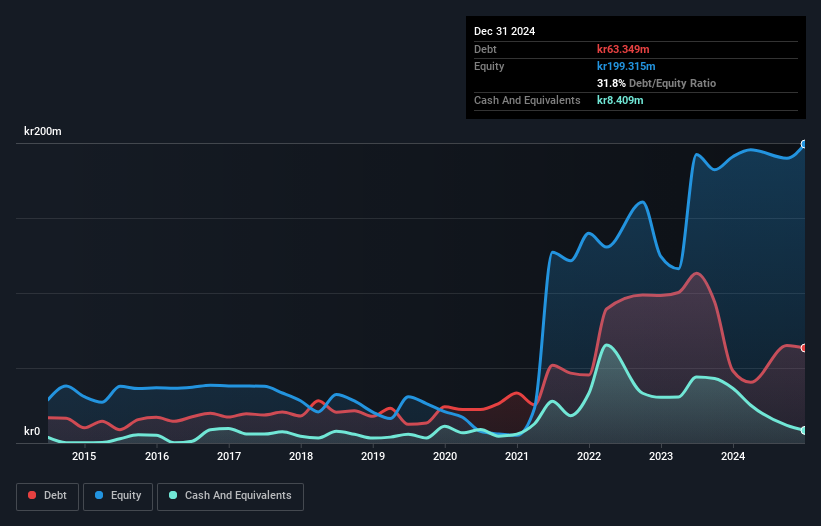

Nordic LEVEL Group AB (publ.) has a market cap of SEK116.76 million and operates primarily in Sweden's safety and security sector. The company reported annual revenue of SEK375.76 million for 2024, with a net loss of SEK6.03 million, highlighting ongoing profitability challenges despite reducing losses over five years by 23.7% annually. Its debt to equity ratio improved significantly from 115.3% to 31.8% over five years, reflecting better financial management, although short-term liabilities exceed assets slightly at SEK146.6 million versus SEK140.3 million in assets. While unprofitable, the company maintains a cash runway exceeding three years due to positive free cash flow trends.

- Get an in-depth perspective on Nordic LEVEL Group AB (publ.)'s performance by reading our balance sheet health report here.

- Understand Nordic LEVEL Group AB (publ.)'s earnings outlook by examining our growth report.

Next Steps

- Investigate our full lineup of 433 European Penny Stocks right here.

- Searching for a Fresh Perspective? Trump has pledged to "unleash" American oil and gas and these 20 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALOKW

Groupe OKwind Société anonyme

Designs, manufactures, sells, and installs green energy solutions in France.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives