Akelius Residential Property AB (publ)'s (STO:AKEL D) investors are due to receive a payment of €0.025 per share on 11th of November. This makes the dividend yield 6.1%, which will augment investor returns quite nicely.

Check out our latest analysis for Akelius Residential Property

Akelius Residential Property Might Find It Hard To Continue The Dividend

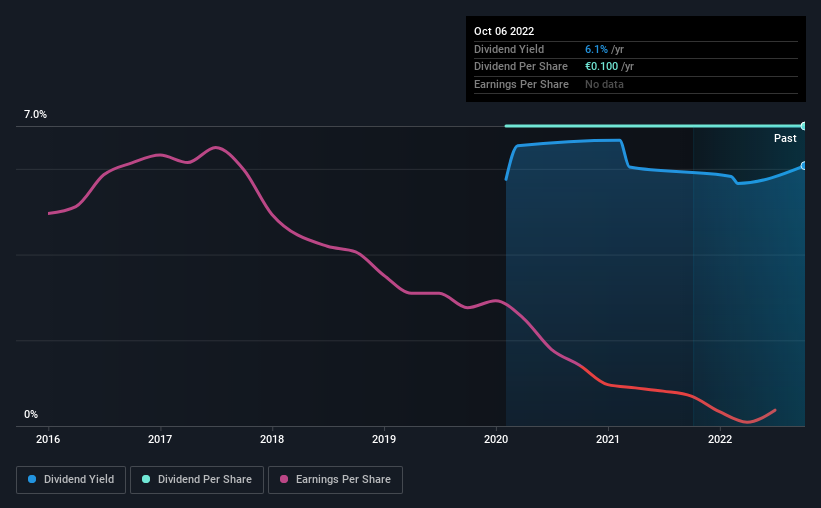

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Akelius Residential Property isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This makes us feel that the dividend will be hard to maintain.

Looking forward, earnings per share could 71.0% over the next year if the trend of the last few years can't be broken. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

Akelius Residential Property Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. The most recent annual payment of €0.10 is about the same as the annual payment 3 years ago. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, initial appearances might be deceiving. Over the past five years, it looks as though Akelius Residential Property's EPS has declined at around 71% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Akelius Residential Property's Dividend Doesn't Look Great

Overall, this isn't a great candidate as an income investment, even though the dividend was stable this year. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. The dividend doesn't inspire confidence that it will provide solid income in the future.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 3 warning signs for Akelius Residential Property that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AKEL D

Akelius Residential Property

Through its subsidiaries, owns, manages, rents, restores, and upgrades residential properties in the United States, Canada, and Europe.

Low unattractive dividend payer.