- Sweden

- /

- Real Estate

- /

- OM:SAGA A

Swedish Exchange Growth Companies With Insider Ownership At Least 28%

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets and specific regional economic challenges, the Swedish stock market presents a unique landscape for investors interested in growth companies with high insider ownership. Such stocks often signal strong confidence from those closest to the company, potentially aligning well with current market conditions where discerning investment choices are paramount.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| Biovica International (OM:BIOVIC B) | 18.5% | 73.8% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Sileon (OM:SILEON) | 14.1% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| Yubico (OM:YUBICO) | 37.5% | 43.8% |

| InCoax Networks (OM:INCOAX) | 18.1% | 104.9% |

| BioArctic (OM:BIOA B) | 34% | 50.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.7% | 52.9% |

| SaveLend Group (OM:YIELD) | 23.3% | 103.4% |

Let's take a closer look at a couple of our picks from the screened companies.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company that operates across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market capitalization of approximately SEK 102.32 billion.

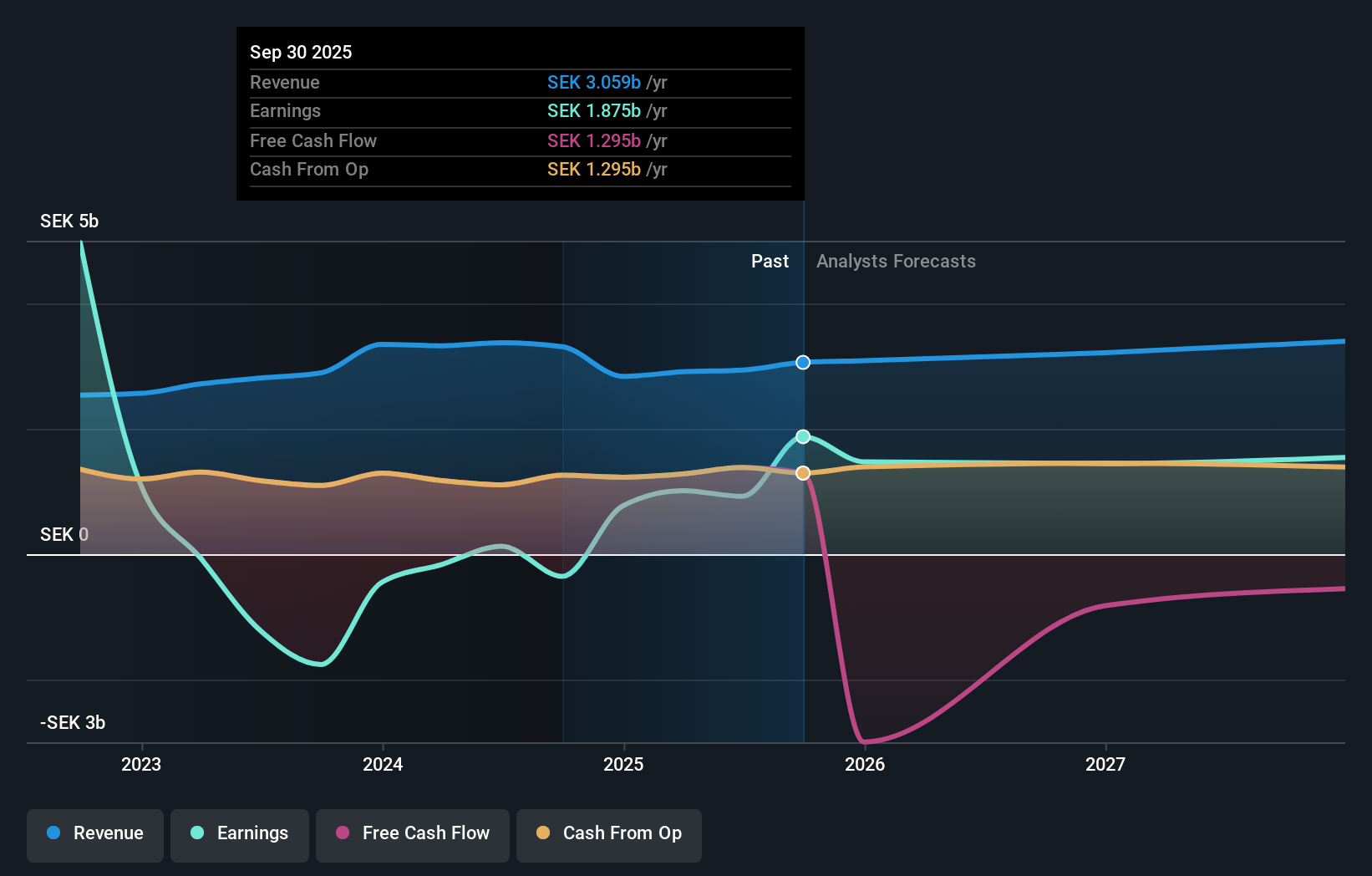

Operations: The company generates its revenue primarily from real estate rentals, amounting to SEK 4.47 billion.

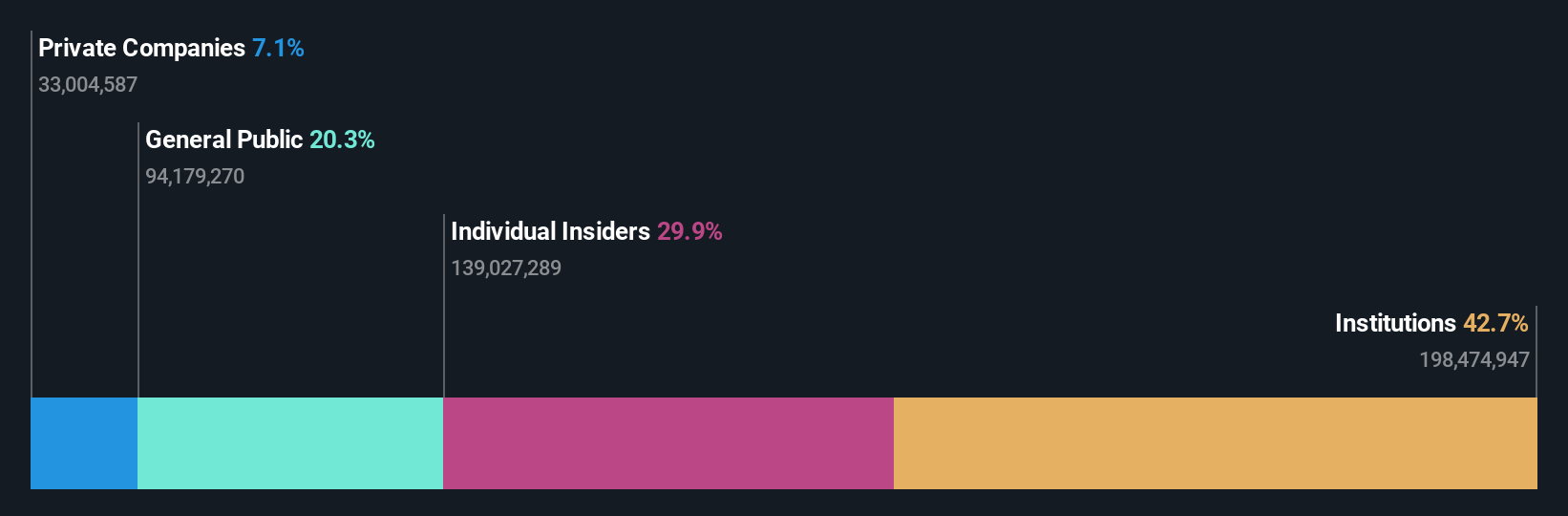

Insider Ownership: 28.3%

AB Sagax, a Swedish real estate company, has recently focused on sustainable financing, evidenced by its multiple green bond issuances totaling nearly €1.5 billion in May 2024. These bonds support general corporate purposes under its Green Finance Framework. Despite high insider ownership signaling strong confidence from management, the company's revenue growth forecast at 9.3% per year lags behind more aggressive growth benchmarks but surpasses the Swedish market average of 1.8%. However, earnings are expected to significantly outpace the market with an anticipated annual increase of 33.5%. Meanwhile, shareholder dilution over the past year and insufficient coverage of debt by operating cash flow pose concerns about financial leverage and capital structure integrity.

- Click to explore a detailed breakdown of our findings in AB Sagax's earnings growth report.

- Our comprehensive valuation report raises the possibility that AB Sagax is priced higher than what may be justified by its financials.

Wallenstam (OM:WALL B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a Swedish property company with a market capitalization of approximately SEK 36.66 billion.

Operations: The firm operates in the Swedish real estate sector.

Insider Ownership: 35%

Wallenstam AB, a Swedish property developer, has recently shifted to profitability with a strong earnings report for the first half of 2024, showing significant improvements in net income and revenue compared to the previous year. The company's revenue growth is modestly above the market average, and earnings are expected to grow robustly. Despite this positive outlook, challenges include low forecasted return on equity and substantial one-off items affecting financial results. Insider transactions have been balanced with more purchases than sales but not in significant volumes.

- Navigate through the intricacies of Wallenstam with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Wallenstam implies its share price may be too high.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB specializes in providing authentication solutions for computers, networks, and online services, with a market capitalization of SEK 20.84 billion.

Operations: The company generates SEK 1.93 billion in revenue from its Security Software & Services segment.

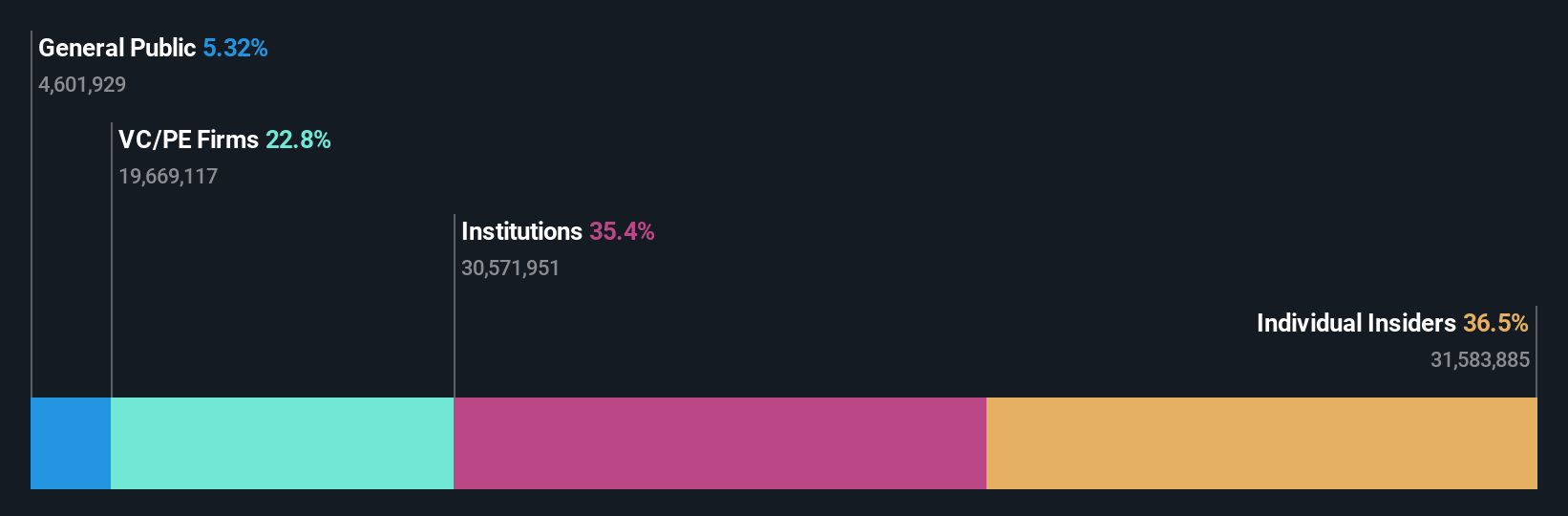

Insider Ownership: 37.5%

Yubico AB, a Swedish growth company with substantial insider ownership, is poised for robust expansion with its earnings forecasted to grow by 43.81% annually. Despite trading at 18% below its fair value and showing strong revenue growth of 22.9% per year, challenges include significant insider selling and shareholder dilution over the past year. Additionally, profit margins have decreased from the previous year's figures. Recent developments include the election of Jaya Baloo as a new director and promising first-quarter financial results for 2024.

- Get an in-depth perspective on Yubico's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Yubico's current price could be inflated.

Where To Now?

- Navigate through the entire inventory of 86 Fast Growing Swedish Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAGA A

AB Sagax

Operates as a property company in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries.

Proven track record average dividend payer.