- Sweden

- /

- Real Estate

- /

- OM:WALL B

3 Swedish Growth Stocks With Up To 35% Insider Ownership

Reviewed by Simply Wall St

As global markets react to the recent Federal Reserve rate cut, European stocks have shown mixed performance, with cautious optimism prevailing among investors. In this environment, identifying growth companies with substantial insider ownership can provide additional confidence for investors seeking stability and potential upside. In Sweden, three such growth stocks stand out due to their robust insider ownership of up to 35%, reflecting strong internal belief in their future prospects.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.5% |

| Biovica International (OM:BIOVIC B) | 17.6% | 78.5% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Below we spotlight a couple of our favorites from our exclusive screener.

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control components internationally, with a market cap of SEK102.66 billion.

Operations: NIBE Industrier AB (publ) generates revenue from three primary segments: Stoves (SEK5.33 billion), Element (SEK13.48 billion), and Climate Solutions (SEK35.22 billion).

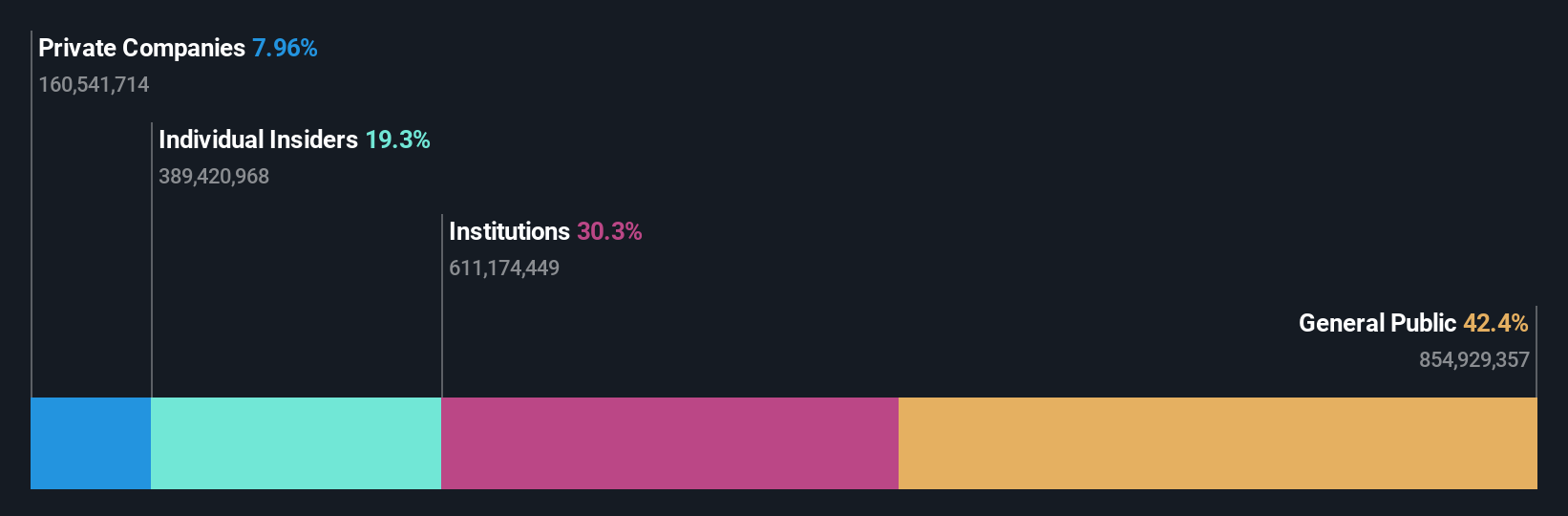

Insider Ownership: 20.2%

NIBE Industrier's revenue is forecast to grow at 6.8% per year, outpacing the Swedish market's 0.9%. However, profit margins have declined from 11.2% to 3.6% over the past year, and recent earnings reports show a significant drop in net income and sales compared to last year. Despite this, earnings are expected to grow significantly at 42.5% per year over the next three years, although interest payments are not well covered by earnings.

- Delve into the full analysis future growth report here for a deeper understanding of NIBE Industrier.

- The valuation report we've compiled suggests that NIBE Industrier's current price could be inflated.

AB Sagax (OM:SAGA A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company operating in Sweden, Finland, France, Benelux, Spain, Germany, and other European countries with a market cap of SEK97.74 billion.

Operations: The company generates revenue primarily through its Real Estate - Rental segment, which amounts to SEK4.63 billion.

Insider Ownership: 28.6%

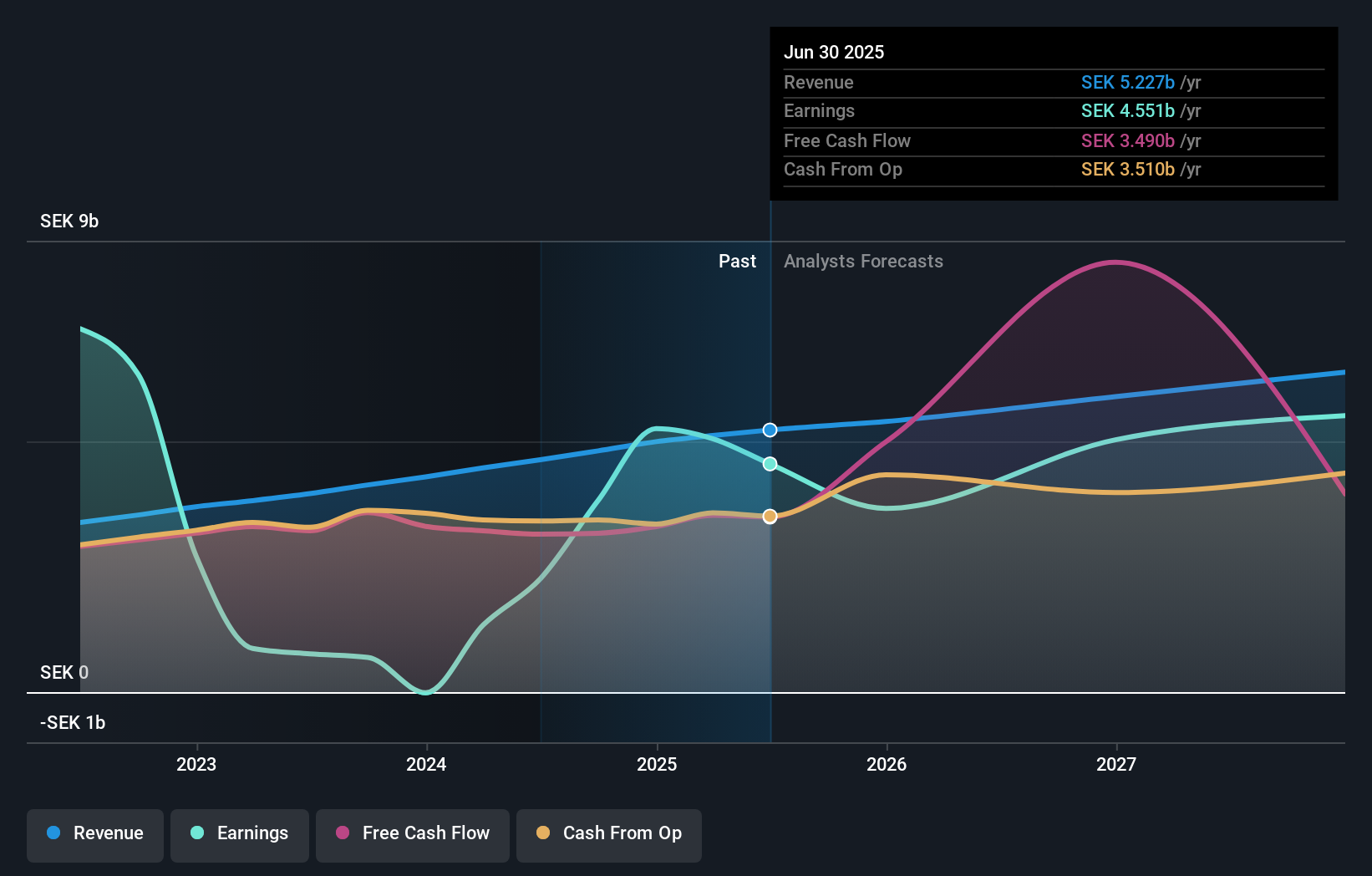

AB Sagax's revenue is forecast to grow at 9.3% per year, surpassing the Swedish market's 0.9%, with earnings expected to increase by 29.1% annually. The company reported strong financial performance for the second quarter of 2024, with sales of SEK 1.20 billion and net income of SEK 978 million, a substantial improvement from last year’s figures. However, shareholders experienced dilution over the past year and debt coverage by operating cash flow remains inadequate.

- Get an in-depth perspective on AB Sagax's performance by reading our analyst estimates report here.

- Our valuation report here indicates AB Sagax may be overvalued.

Wallenstam (OM:WALL B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wallenstam AB (publ) is a property company operating in Sweden with a market cap of SEK38.01 billion.

Operations: Wallenstam generates revenue from its property operations in Stockholm (SEK938 million) and Gothenburg (SEK1.94 billion).

Insider Ownership: 35%

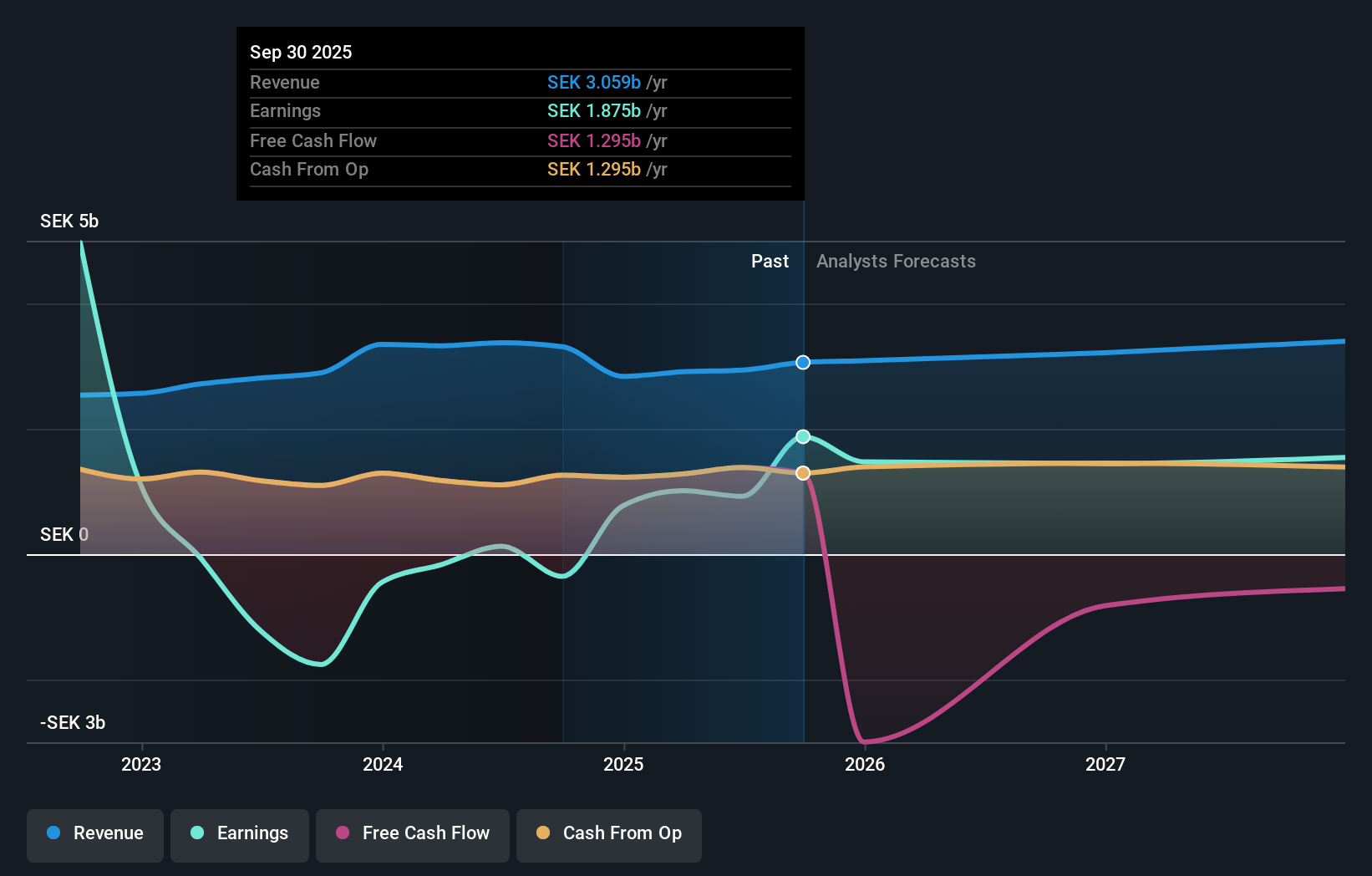

Wallenstam's revenue is forecast to grow at 3.2% per year, outpacing the Swedish market's 0.9%, while earnings are expected to increase significantly by 53.6% annually. The company recently reported improved financial results for the second quarter of 2024, with net income of SEK 74 million compared to a net loss last year. However, interest payments are not well covered by earnings and large one-off items have impacted financial results.

- Click to explore a detailed breakdown of our findings in Wallenstam's earnings growth report.

- Upon reviewing our latest valuation report, Wallenstam's share price might be too optimistic.

Key Takeaways

- Click through to start exploring the rest of the 88 Fast Growing Swedish Companies With High Insider Ownership now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wallenstam might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:WALL B

Reasonable growth potential unattractive dividend payer.