- Sweden

- /

- Real Estate

- /

- OM:STEF B

Top European Undervalued Small Caps With Insider Action For July 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of new U.S. tariffs, the pan-European STOXX Europe 600 Index has shown resilience, ending slightly higher amid optimism for potential trade deals. Despite these challenges, small-cap stocks in Europe continue to attract attention, particularly those that demonstrate strong fundamentals and strategic insider activity, positioning them as intriguing opportunities in today's market landscape.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Kitwave Group | 13.5x | 0.3x | 43.61% | ★★★★★☆ |

| Stelrad Group | 13.0x | 0.7x | 38.28% | ★★★★★☆ |

| Foxtons Group | 13.6x | 1.2x | 37.05% | ★★★★★☆ |

| A.G. BARR | 19.1x | 1.8x | 47.18% | ★★★★☆☆ |

| Yubico | 32.9x | 4.7x | 10.82% | ★★★★☆☆ |

| Hoist Finance | 8.7x | 1.8x | 19.17% | ★★★★☆☆ |

| Renold | 10.6x | 0.7x | 2.92% | ★★★★☆☆ |

| CVS Group | 45.0x | 1.3x | 39.17% | ★★★★☆☆ |

| Seeing Machines | NA | 2.9x | 45.12% | ★★★★☆☆ |

| NSI | 207.7x | 5.6x | 49.67% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

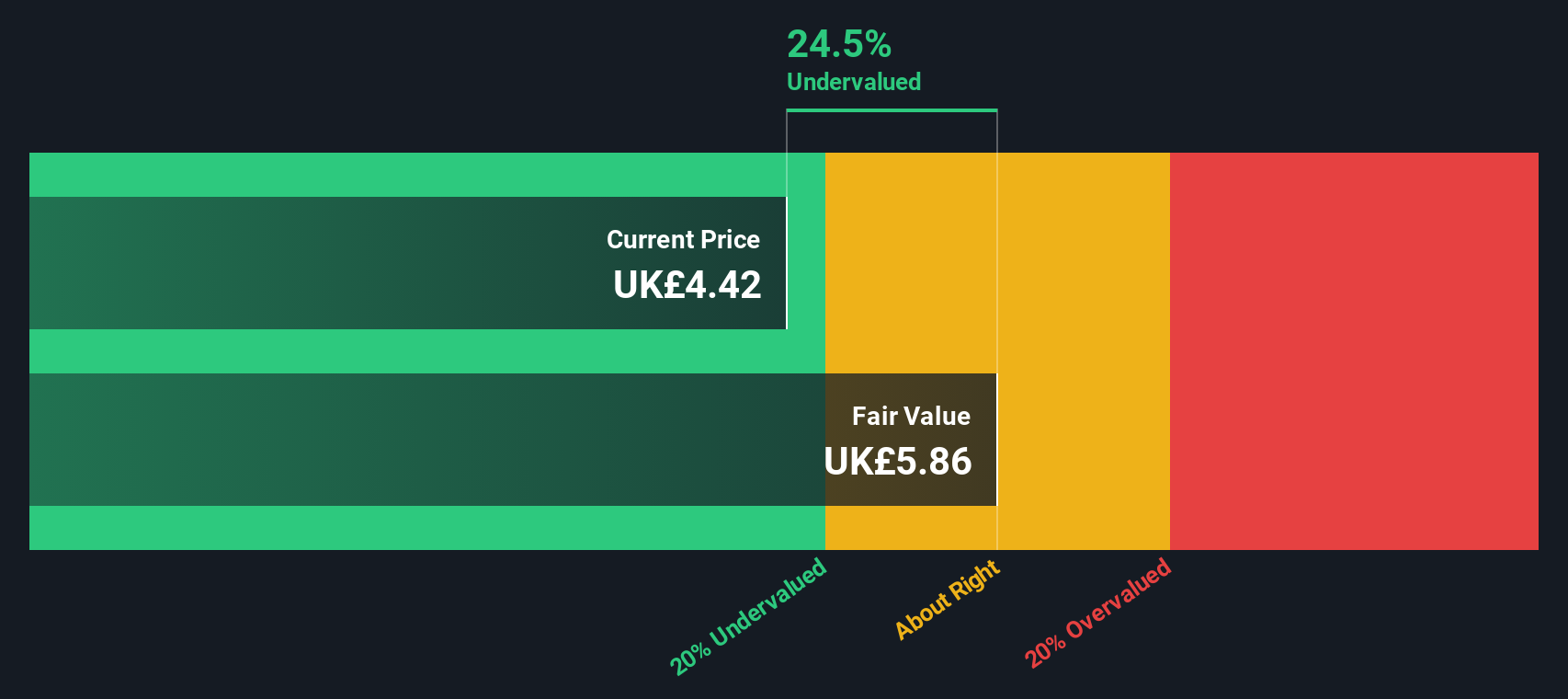

Polar Capital Holdings (AIM:POLR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Polar Capital Holdings is an investment management company specializing in actively managed funds, with a market capitalization of approximately £0.53 billion.

Operations: Polar Capital Holdings generates revenue primarily from its investment management business, which reported £226.11 million in the latest period. The company has seen a gross profit margin of 87.72% as of the most recent data point, while its net income margin stands at 15.62%. Operating expenses are a significant component of costs, reaching £146.48 million in the same period.

PE: 13.0x

Polar Capital Holdings, a small European investment firm, has shown insider confidence with Gavin Rochussen purchasing 36,905 shares for £144,132 in recent months. Despite a dip in net income to £35.31 million from £40.79 million the previous year, revenue increased to £226.11 million from £197.59 million. The company maintains its dividend at 46 pence per share annually and anticipates earnings growth of 9% per year amid higher-risk external funding sources. Leadership changes are underway as Iain Evans prepares to take over as CEO following Rochussen's retirement announcement after eight years at the helm.

Georgia Capital (LSE:CGEO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Georgia Capital is an investment company focused on acquiring and developing businesses in Georgia, with a market capitalization of approximately £0.46 billion.

Operations: Georgia Capital generates revenue primarily through its diversified investment portfolio, which has shown fluctuations in net income margins over time. Notably, the gross profit margin reached 1.0% in several periods, indicating a significant control over cost of goods sold relative to revenue. Operating expenses have been consistently low, with general and administrative expenses often being a key component.

PE: 6.2x

Georgia Capital, a European investment firm, is gaining attention among smaller companies due to its strategic moves. Recently, the company increased its equity buyback plan by $18 million to a total of $68 million and extended it until October 2025. From January to May 2025, they repurchased over 2.3 million shares for £31.87 million, showing strong insider confidence in their stock's potential value. However, reliance on external borrowing highlights some risk in their funding strategy.

- Unlock comprehensive insights into our analysis of Georgia Capital stock in this valuation report.

Examine Georgia Capital's past performance report to understand how it has performed in the past.

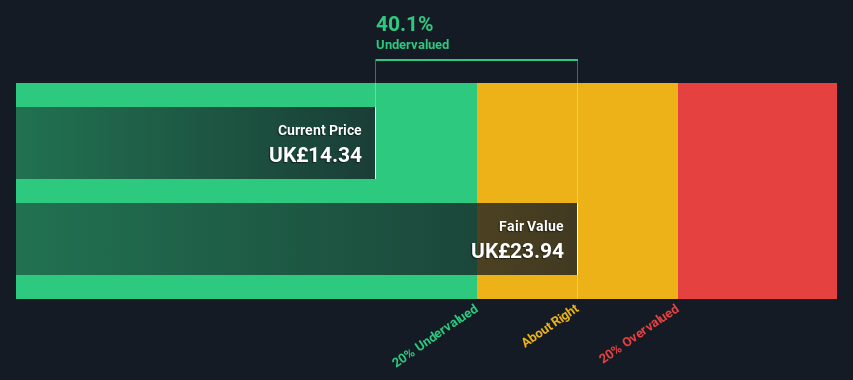

Stendörren Fastigheter (OM:STEF B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Stendörren Fastigheter is a Swedish real estate company focused on the acquisition, development, and management of industrial and commercial properties, with a market capitalization of approximately SEK 3.45 billion.

Operations: The company's primary revenue stream is derived from real estate, with recent quarterly revenue reaching SEK 927 million. Cost of goods sold (COGS) was SEK 187 million, resulting in a gross profit of SEK 740 million. Operating expenses were reported at SEK 89 million, while non-operating expenses amounted to SEK 327 million. The gross profit margin stands at an impressive 79.83%.

PE: 19.7x

Stendörren Fastigheter, a European property company, recently expanded its portfolio by acquiring properties in Finland and Sweden for SEK 70 million and SEK 56 million respectively. These acquisitions are fully leased, promising steady rental income. The firm also secured new leases worth SEK 11 million annually. Despite using riskier external borrowing for funding, the company's earnings have shown significant growth with Q1 net income rising to SEK 107 million from SEK 57 million last year. Insider confidence is evident as insiders have been purchasing shares since early this year, indicating belief in future prospects.

- Take a closer look at Stendörren Fastigheter's potential here in our valuation report.

Understand Stendörren Fastigheter's track record by examining our Past report.

Key Takeaways

- Take a closer look at our Undervalued European Small Caps With Insider Buying list of 54 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STEF B

Stendörren Fastigheter

A real estate company, engages in managing, developing, and acquiring properties and building rights in logistics, warehouse, and light industry primarily located in Greater Stockholm, Västerås, and Mälardalen.

Reasonable growth potential with very low risk.

Market Insights

Community Narratives