- Sweden

- /

- Real Estate

- /

- OM:HUFV A

The Bull Case For Hufvudstaden (OM:HUFV A) Could Change Following Dramatic Earnings Turnaround—Learn Why

Reviewed by Sasha Jovanovic

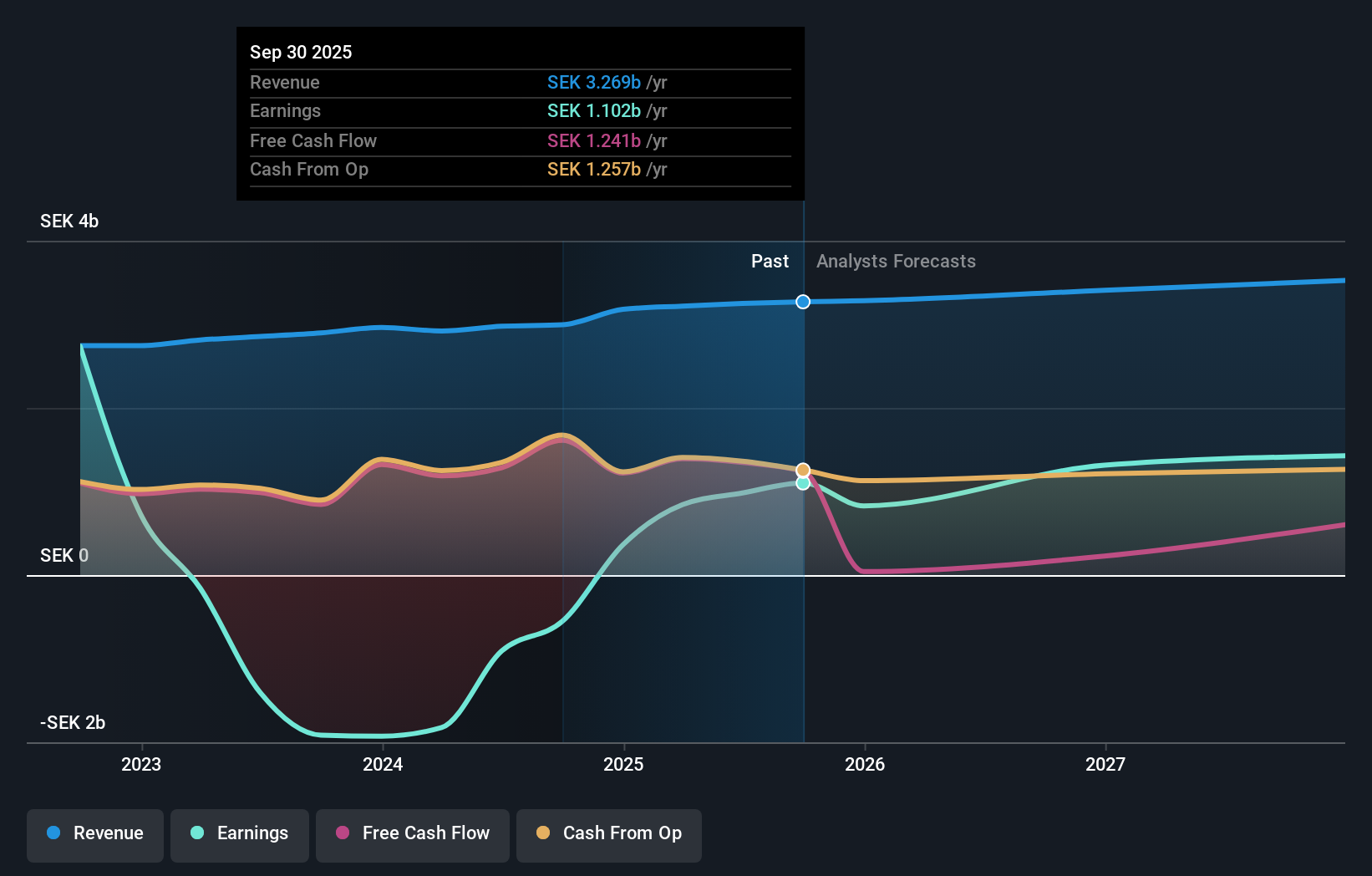

- Hufvudstaden AB (publ) recently reported its third-quarter and nine-month 2025 earnings, with sales reaching SEK801.6 million and SEK2.43 billion respectively, while net income for both periods rebounded sharply compared to last year.

- This substantial improvement contrasts with a net loss in the prior year, signaling a dramatic shift in the company's financial results over the past year.

- We'll explore how Hufvudstaden's strong return to profitability shapes the company's investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Hufvudstaden's Investment Narrative?

To believe in Hufvudstaden as a shareholder, you need to see value in its core assets, stable tenant roster, and ongoing expansion efforts, especially with prominent retail brands entering key locations. The recent Q3 earnings release marks a striking resurgence, with profits swinging decisively into positive territory after last year’s net loss. This recovery may lead some to view the company’s risk profile as improving, potentially easing earlier worries about profitability and revenue stability that shaped analyst projections. In the short term, increased earnings and continued dividend payments could help support the share price and underpin confidence, but it’s important to acknowledge that a large, non-recurring gain was part of this turnaround. As a result, any analysis from before the Q3 rebound may understate near-term momentum, though questions remain about the sustainability of the new profitability and the impact of a higher valuation relative to industry peers.

However, board independence remains a concern for investors watching corporate governance closely.

Hufvudstaden's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Hufvudstaden - why the stock might be worth just SEK126.20!

Build Your Own Hufvudstaden Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hufvudstaden research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hufvudstaden research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hufvudstaden's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hufvudstaden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUFV A

Hufvudstaden

Engages in the ownership, development, and management of commercial properties in Stockholm and Gothenburg, Sweden.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives