- Sweden

- /

- Life Sciences

- /

- OM:MCAP

Undiscovered Gems In Sweden October 2024

Reviewed by Simply Wall St

As the European markets experience a boost from consecutive interest rate cuts by the European Central Bank, investor sentiment in Sweden is also being influenced by these broader economic shifts. In this context, identifying promising small-cap stocks that can capitalize on these changing conditions becomes crucial for investors seeking opportunities in less explored segments of the Swedish market.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Investment AB Öresund | NA | 0.07% | 0.45% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

AQ Group (OM:AQ)

Simply Wall St Value Rating: ★★★★★★

Overview: AQ Group AB (publ) is a company that manufactures and sells components and systems for industrial customers across Sweden, other European countries, and internationally, with a market cap of approximately SEK12.17 billion.

Operations: AQ Group generates revenue primarily from its Component and System segments, with the Component segment contributing SEK7.81 billion and the System segment adding SEK1.59 billion. The company's financial structure is significantly influenced by these two segments, highlighting their importance in its overall revenue model.

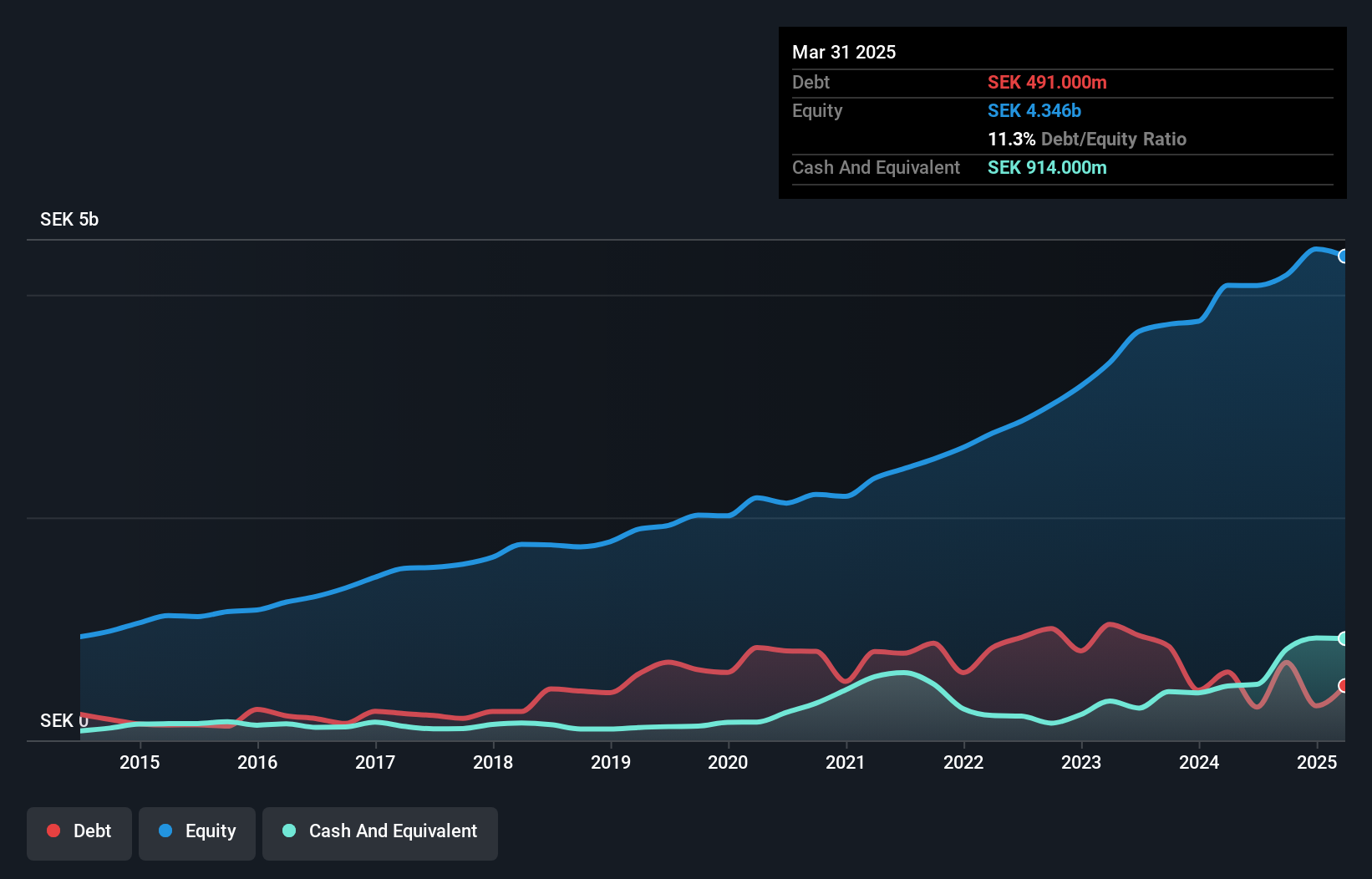

AQ Group, a notable player in the Swedish market, has seen its earnings grow by 1.7% over the past year, outpacing the Electrical industry average of 0.3%. The company trades at a significant discount to its estimated fair value, suggesting potential undervaluation. AQ boasts high-quality earnings and strong debt management; its debt-to-equity ratio has decreased from 31.4% to 16.8% over five years, and it holds more cash than total debt. Despite a slight dip in third-quarter sales to SEK 1,949 million from SEK 2,149 million last year, nine-month net income rose to SEK 510 million from SEK 499 million previously.

- Click here to discover the nuances of AQ Group with our detailed analytical health report.

Gain insights into AQ Group's past trends and performance with our Past report.

MedCap (OM:MCAP)

Simply Wall St Value Rating: ★★★★★★

Overview: MedCap AB (publ) is a private equity firm that focuses on investments in secondary direct, later stage, industry consolidation, and growth capital, with a market capitalization of approximately SEK7.97 billion.

Operations: MedCap generates revenue primarily from Specialist Drugs (SEK469.30 million) and Medicine - Technology (SEK579.30 million).

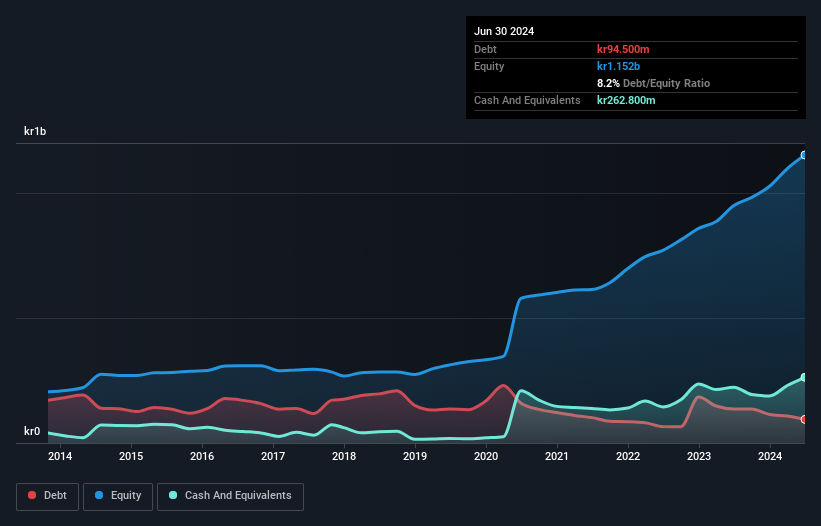

MedCap, a noteworthy player in the Swedish market, has seen its debt to equity ratio significantly decrease from 43.6% to 8.2% over five years, indicating improved financial health. The company boasts strong earnings growth of 43.7% in the past year, outpacing the Life Sciences sector's -13%. With earnings well covering interest payments at a multiple of 22.9 times EBIT and trading at nearly half its estimated fair value, MedCap appears undervalued. Recent inclusion in the S&P Global BMI Index and robust revenue growth further highlight its potential as an attractive investment opportunity within this niche market segment.

- Dive into the specifics of MedCap here with our thorough health report.

Assess MedCap's past performance with our detailed historical performance reports.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TF Bank AB (publ) is a digital bank that offers consumer banking services and e-commerce solutions via its proprietary IT platform, with a market cap of SEK6.75 billion.

Operations: TF Bank generates revenue primarily from three segments: Credit Cards (SEK 563.14 million), Consumer Lending (SEK 602.16 million), and Ecommerce Solutions excluding Credit Cards (SEK 380.14 million).

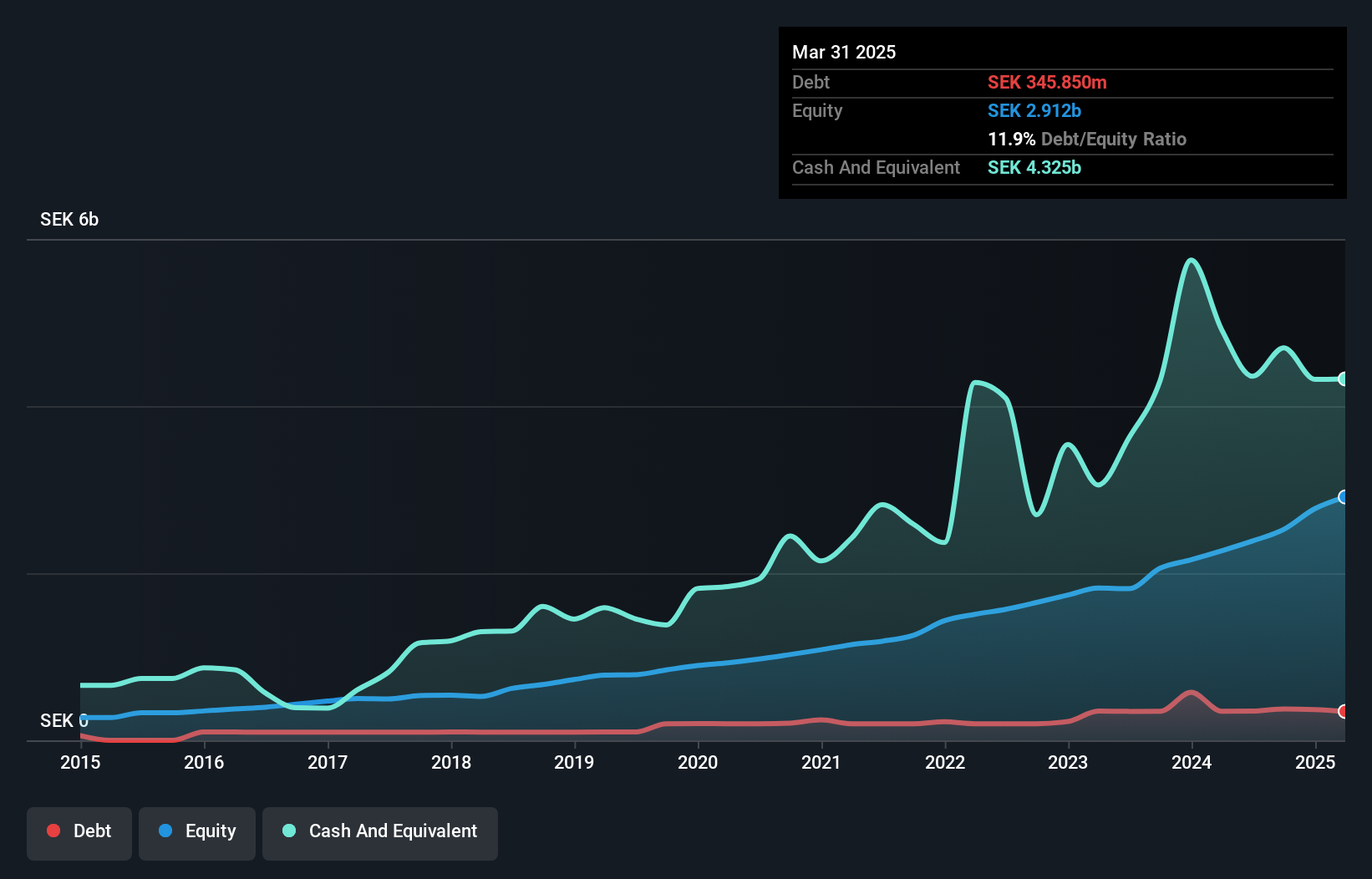

TF Bank, a dynamic player in Sweden's financial landscape, showcases robust growth with earnings up 28.1% over the past year, outpacing the industry average of 11.8%. The bank trades at an attractive 48.8% below its estimated fair value and holds total assets of SEK25.3 billion against equity of SEK2.5 billion. Despite a high bad loans ratio at 10.6%, TF Bank benefits from primarily low-risk funding sources, comprising 95% customer deposits, which are less risky than external borrowing. Recent strategic moves include establishing Rediem Capital AB to focus on non-performing exposures, aiming for specialized debt restructurer status by January 2025.

- Get an in-depth perspective on TF Bank's performance by reading our health report here.

Gain insights into TF Bank's historical performance by reviewing our past performance report.

Next Steps

- Discover the full array of 55 Swedish Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MCAP

MedCap

A private equity firm specializing in investments in secondary direct, later stage, industry consolidation, add-on acquisitions, growth capital, middle market, mature, turnarounds, buyout.

Flawless balance sheet with solid track record.