- Sweden

- /

- Life Sciences

- /

- OM:BIOT

Exploring 3 Undiscovered Swedish Gems with Strong Fundamentals

Reviewed by Simply Wall St

As global markets continue to show mixed performances, with small-cap and value shares outpacing large-cap growth stocks, investors are increasingly looking towards under-the-radar opportunities. In this context, the Swedish market offers some compelling options with strong fundamentals that may be overlooked by the broader investment community.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 9.47% | 15.07% | ★★★★★★ |

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 15.31% | 29.94% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Rederiaktiebolaget Gotland | NA | -14.29% | 18.06% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Karnell Group | 44.29% | 22.04% | 39.45% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Betsson (OM:BETS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Betsson AB (publ) operates an online gaming business through its subsidiaries across the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally with a market cap of SEK17.62 billion.

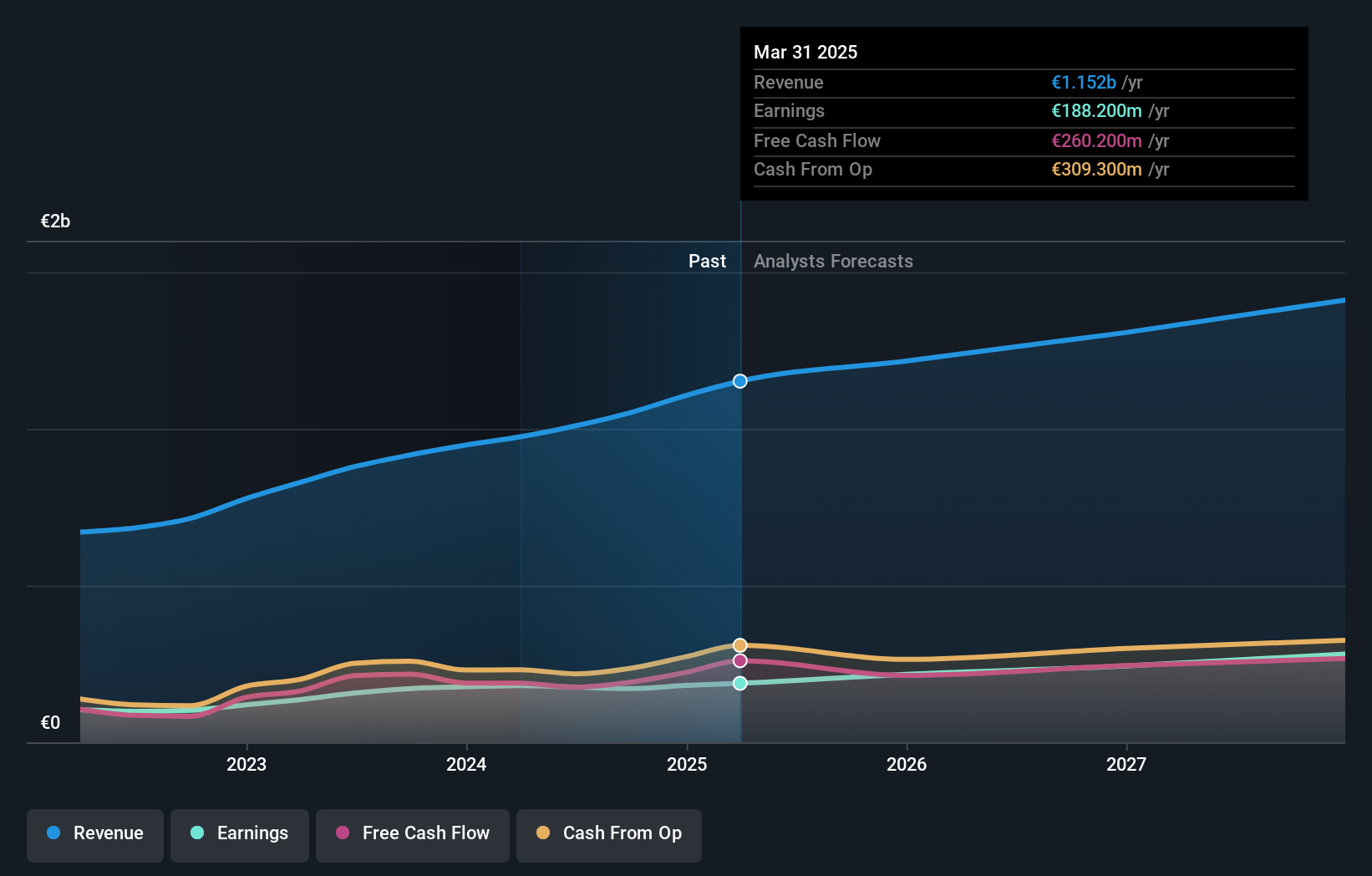

Operations: Betsson AB (publ) generates revenue primarily from its Casinos & Resorts segment, which reported €1009.20 million. The company's net profit margin stands at 12.5%.

Betsson, a notable player in Sweden's market, has demonstrated impressive financial health. The company’s earnings growth of 12.2% over the past year outpaced the Hospitality industry’s -12.7%. Betsson trades at 71.6% below its estimated fair value and boasts high-quality earnings with EBIT covering interest payments 16.5 times over. Despite a slight dip in net income to EUR 45.5 million for Q2 2024 from EUR 50.2 million last year, it remains profitable and expanding into new markets like Peru and Argentina.

- Click to explore a detailed breakdown of our findings in Betsson's health report.

Review our historical performance report to gain insights into Betsson's's past performance.

Biotage (OM:BIOT)

Simply Wall St Value Rating: ★★★★★★

Overview: Biotage AB (publ) offers solutions and products for drug discovery and development, analytical testing, and water and environmental testing, with a market cap of SEK16.07 billion.

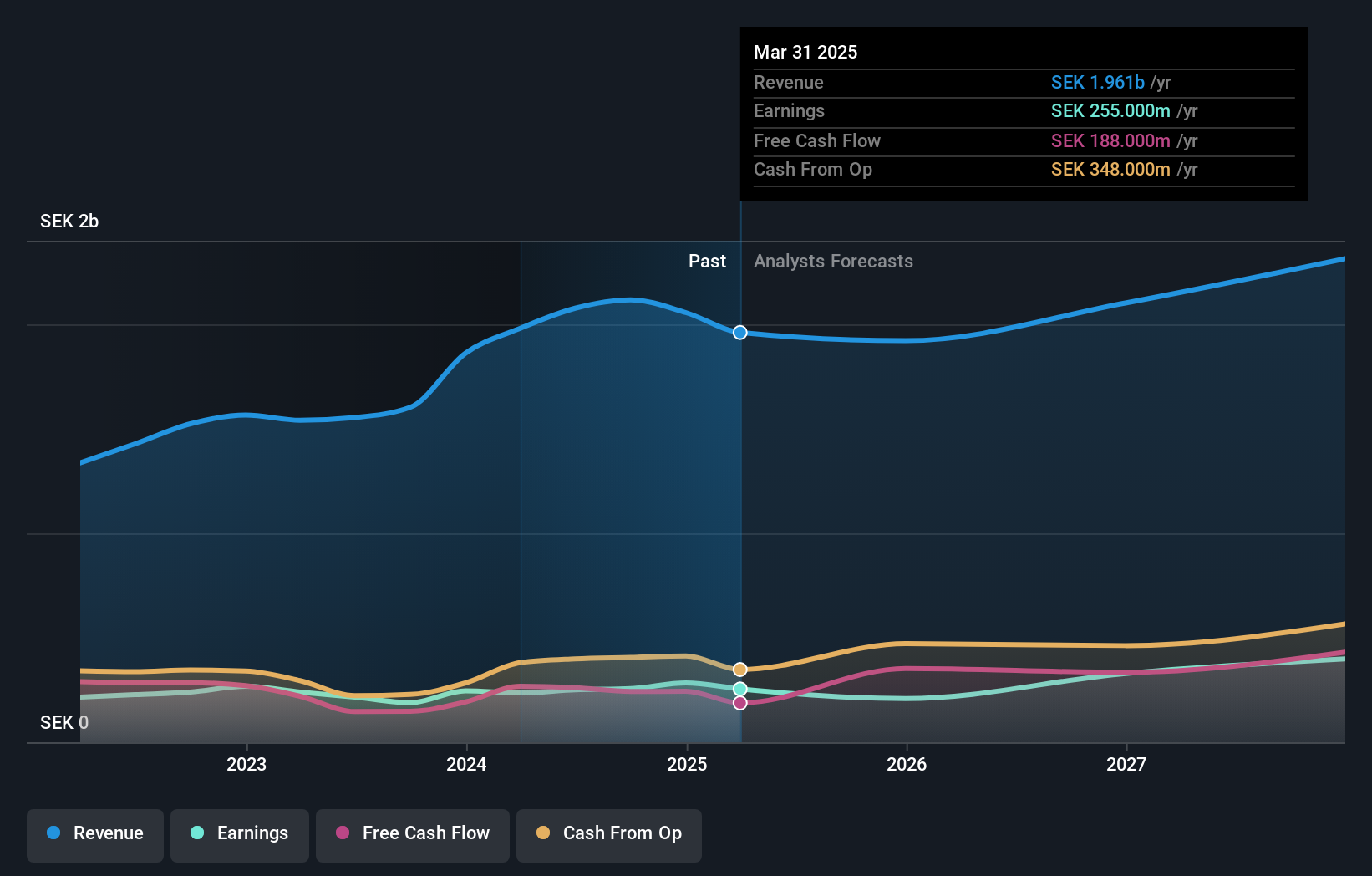

Operations: Biotage generates revenue primarily from its Healthcare Software segment, which amounted to SEK 2.08 billion. The company has a market cap of SEK 16.07 billion.

Biotage, a Swedish life sciences company, has seen its earnings grow by 16.2% over the past year, outpacing the industry average of -13%. Trading at 37.4% below its estimated fair value, Biotage appears undervalued. The firm has more cash than total debt and reduced its debt-to-equity ratio from 19.2% to 4% over five years. Recent earnings reports show sales of SEK 504 million for Q2 and net income of SEK 48 million, up from SEK 34 million last year.

- Get an in-depth perspective on Biotage's performance by reading our health report here.

Gain insights into Biotage's past trends and performance with our Past report.

MedCap (OM:MCAP)

Simply Wall St Value Rating: ★★★★★★

Overview: MedCap AB (publ) is a private equity firm focusing on secondary direct, later stage investments, industry consolidation, add-on acquisitions, growth capital, middle market segments, mature businesses, turnarounds and buyouts with a market cap of SEK8.90 billion.

Operations: MedCap AB (publ) generates revenue primarily through its Specialist Drugs segment (SEK469.30 million) and Medicine - Technology segment (SEK579.30 million), with a total market cap of SEK8.90 billion. Segment Adjustments account for SEK692.10 million in the financials, impacting overall revenue calculations.

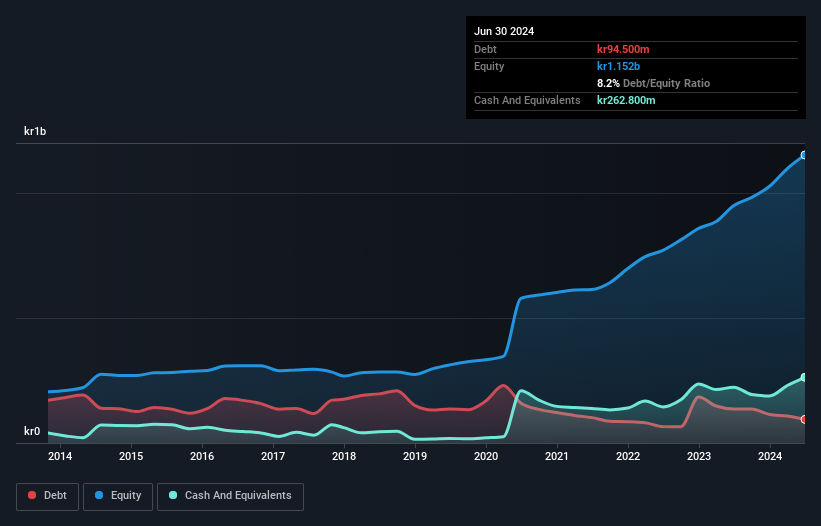

MedCap, a promising player in Sweden's life sciences sector, has seen its earnings grow by 43.7% over the past year, outpacing the industry average of -13%. Its debt to equity ratio improved significantly from 43.6% to 8.2% over five years, highlighting robust financial health. Recent earnings reports show net income for Q2 2024 at SEK 56.8 million compared to SEK 46.8 million last year, with basic EPS rising from SEK 3.2 to SEK 3.8 per share

- Take a closer look at MedCap's potential here in our health report.

Assess MedCap's past performance with our detailed historical performance reports.

Next Steps

- Gain an insight into the universe of 52 Swedish Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biotage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOT

Biotage

Provides solutions and products in the areas of drug discovery and development, analytical testing, and water and environmental testing.

Flawless balance sheet with proven track record.