Exploring High Growth Tech Stocks In Europe Featuring Three Key Players

Reviewed by Simply Wall St

Amidst escalating trade tensions and fluctuating consumer sentiment, the European market has experienced a turbulent period, with the pan-European STOXX Europe 600 Index ending 1.92% lower before rebounding slightly following a delay in U.S. tariff impositions. In this environment of heightened uncertainty and economic vigilance by central banks, identifying high-growth tech stocks requires focusing on companies that demonstrate resilience through innovation and adaptability to shifting global dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.54% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Skolon | 29.76% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Eurobio Scientific Société anonyme (ENXTPA:ALERS)

Simply Wall St Growth Rating: ★★★★☆☆

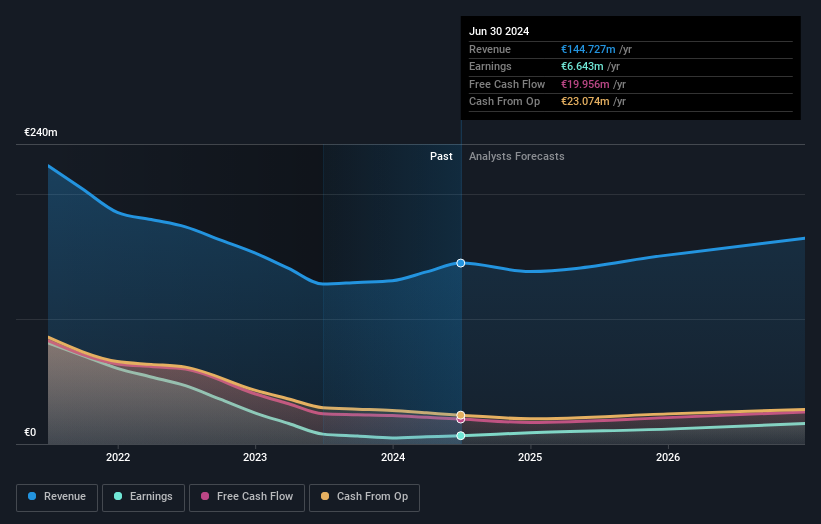

Overview: Eurobio Scientific Société anonyme focuses on designing, developing, and commercializing in vitro diagnostics products across various medical fields including transplantation, immunology, infectious diseases, life sciences, and cancer with a market cap of €243.61 million.

Operations: Eurobio Scientific Société anonyme generates revenue primarily from its Diagnostics and Therapeutics segment, which amounts to €144.73 million.

Eurobio Scientific Société anonyme, a notable entity in Europe's biotech sector, demonstrates a promising trajectory with its earnings forecast to surge by 34.3% annually. This growth rate notably outpaces the broader French market's expected 12.5% increase, highlighting its robust position despite a challenging year where it saw a 16% contraction in earnings. The firm also projects revenue growth at 6.2% annually, slightly above the French market average of 5.6%. These financial dynamics are set against an industry backdrop where innovation and R&D are critical—although specific R&D spending figures aren't provided, the sector typically invests heavily in these areas to fuel advancements and maintain competitive edges. As Eurobio navigates through these waters, its ability to outperform market expectations could be pivotal for its standing in the high-growth tech landscape of Europe.

Karnov Group (OM:KAR)

Simply Wall St Growth Rating: ★★★★☆☆

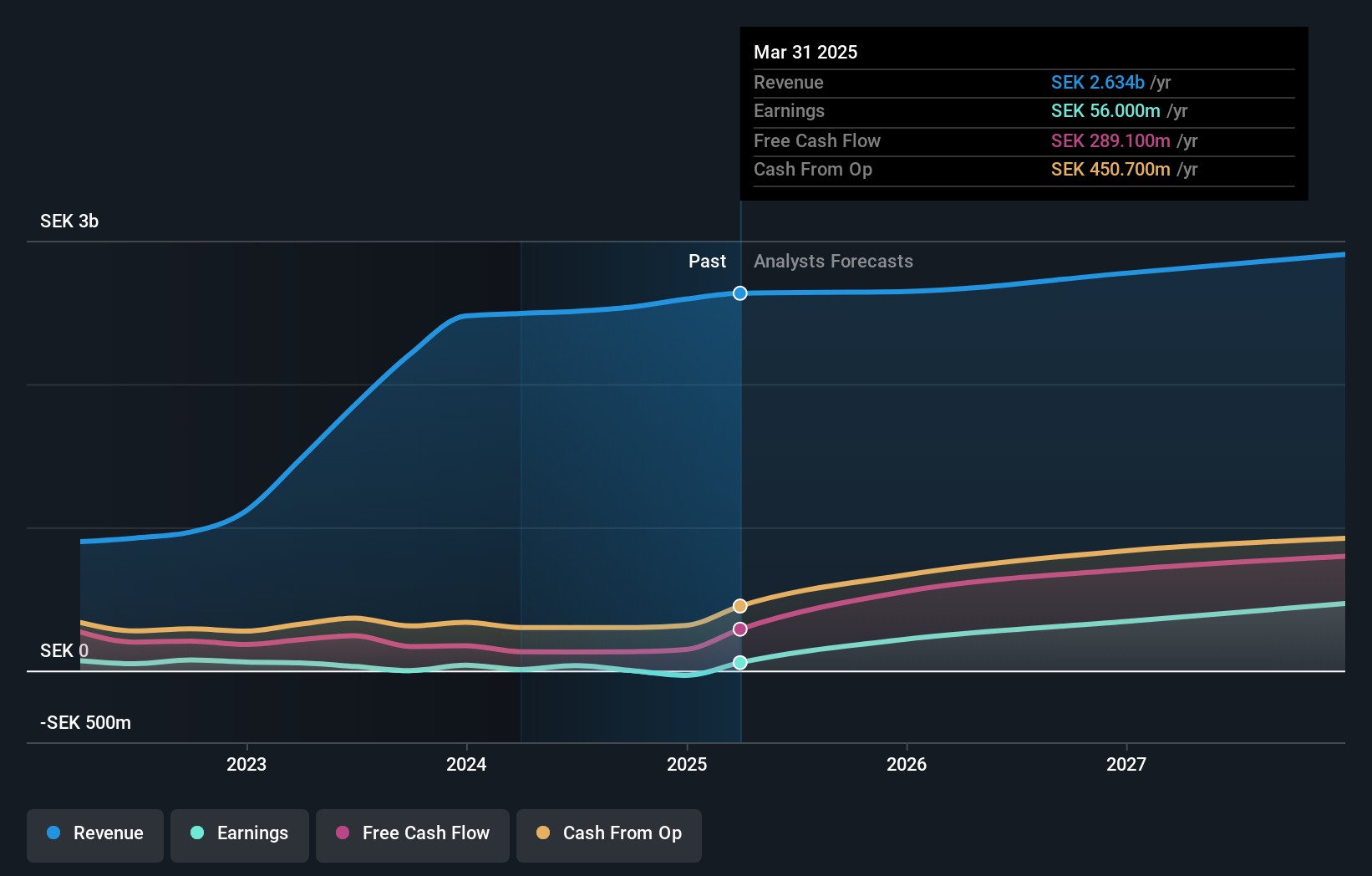

Overview: Karnov Group AB (publ) offers information products and services for legal, tax and accounting, environmental, and health and safety professionals across Denmark, Norway, France, Sweden, Portugal, and Spain with a market cap of approximately SEK9.71 billion.

Operations: The company generates revenue through its online and offline information products and services, with SEK1.21 billion coming from Region North and SEK1.38 billion from Region South.

Karnov Group's recent engagement of Steve Obenski as Senior AI Advisor signals a strategic pivot towards maximizing AI-driven opportunities, reflecting its commitment to integrating cutting-edge technologies in its operations. Despite facing a net loss of SEK 9.8 million in Q4 2024, the company reported an annual revenue growth of 4.2%, outpacing the Swedish market average of 2.8%. This positions Karnov to potentially leverage its enhanced AI capabilities for future profitability, especially given forecasts suggesting earnings could grow by approximately 49.77% annually over the next three years. The firm's proactive approach in adapting to technological shifts and potential for significant earnings growth underscores its evolving presence in Europe’s tech landscape.

Lagercrantz Group (OM:LAGR B)

Simply Wall St Growth Rating: ★★★★☆☆

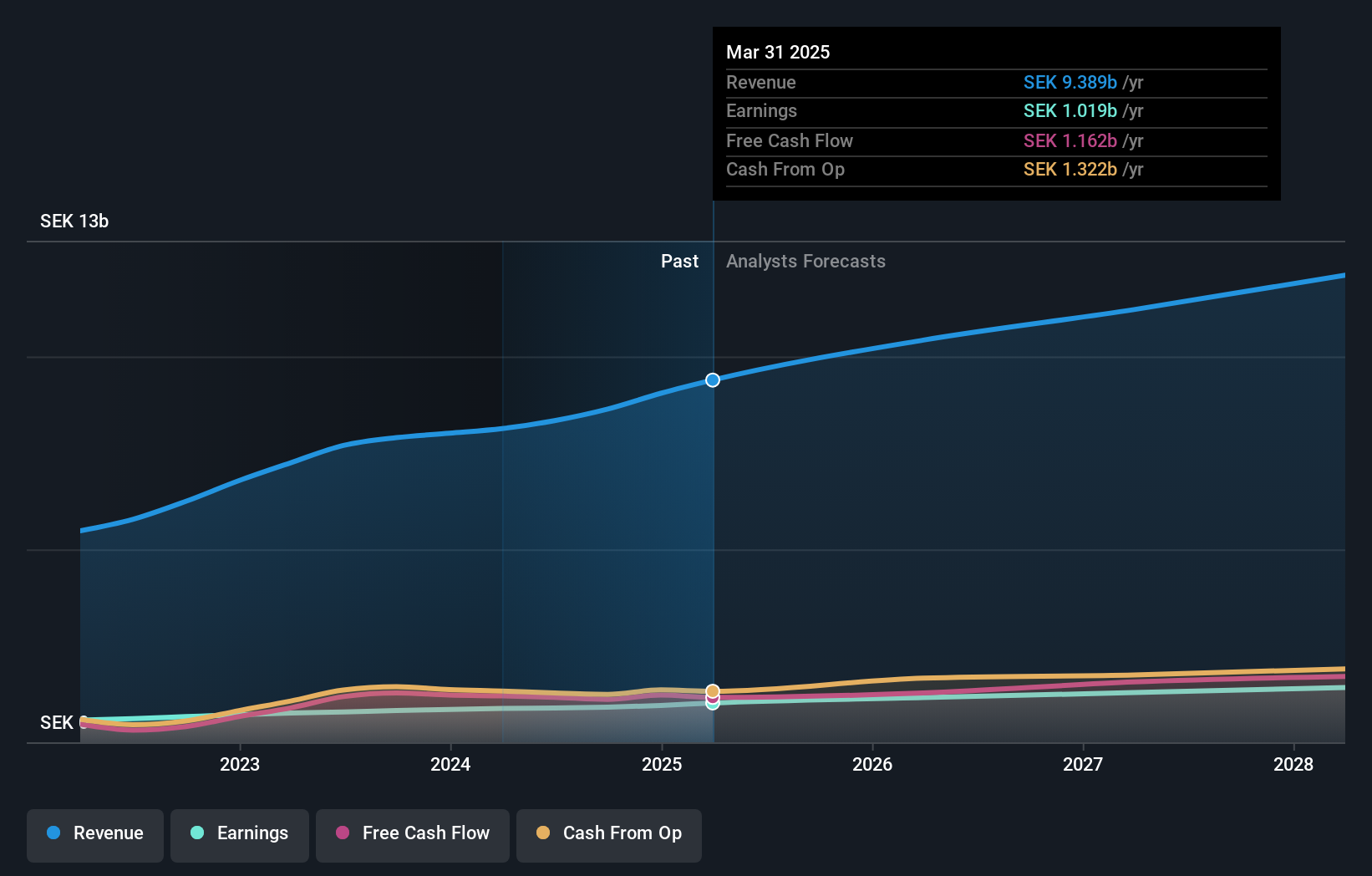

Overview: Lagercrantz Group AB (publ) is a technology company that operates through its subsidiaries across various regions including Europe, North America, and Asia, with a market cap of approximately SEK42.95 billion.

Operations: Lagercrantz Group AB operates through several revenue segments, including Tecsec (SEK2.14 billion), Control (SEK898 million), Electrify (SEK2.17 billion), International (SEK1.58 billion), and Niche Products (SEK2.30 billion). The company's diverse operations span multiple regions, contributing to its substantial market presence in the technology sector.

Lagercrantz Group's recent financial performance underscores its resilience and potential within the European tech sector. With a robust 11.9% annual revenue growth, the company outstrips the Swedish market average of 2.8%, showcasing its capacity to expand effectively amidst competitive pressures. Notably, its earnings have also seen an encouraging uptick, with a forecasted growth rate of 14.6% per year, surpassing broader market expectations of 13.4%. At a recent conference presentation in Stockholm, Lagercrantz demonstrated strategic initiatives aimed at sustaining this momentum, which could further solidify its position in high-tech markets across Europe. The firm's commitment to innovation is evident from its R&D investments and recent earnings call revelations; however, it faces challenges due to a high level of debt that could impact future operations. Despite these concerns, Lagercrantz continues to perform well with significant improvements in net income and sales as reported in their latest quarterly results—sales surged from SEK 2 billion last year to SEK 2.46 billion this quarter while net income increased from SEK 225 million to SEK 267 million year-over-year—highlighting strong operational execution and financial health that may well attract continued investor interest in the evolving landscape of European technology sectors.

- Dive into the specifics of Lagercrantz Group here with our thorough health report.

Understand Lagercrantz Group's track record by examining our Past report.

Summing It All Up

- Get an in-depth perspective on all 229 European High Growth Tech and AI Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karnov Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:KAR

Karnov Group

Provides online and offline information products and services for professionals in the areas of legal, tax and accounting, environmental, and health and safety in Denmark, Norway, France, Sweden, Portugal, and Spain.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives