Stock Analysis

As global markets grapple with geopolitical tensions and economic uncertainties, the Swedish tech sector continues to capture attention, buoyed by its innovative edge and resilience in a challenging landscape. In this context, identifying promising high-growth tech stocks involves assessing factors such as adaptability to market shifts, technological advancements, and robust financial health.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.32% | 21.61% | ★★★★★★ |

| Fortnox | 20.04% | 22.24% | ★★★★★★ |

| Xbrane Biopharma | 53.90% | 118.02% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| Hemnet Group | 20.12% | 25.41% | ★★★★★★ |

| Skolon | 32.63% | 122.14% | ★★★★★★ |

| BioArctic | 42.38% | 98.40% | ★★★★★★ |

| Yubico | 20.52% | 42.35% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

We'll examine a selection from our screener results.

Bonesupport Holding (OM:BONEX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bonesupport Holding AB (publ) is an orthobiologics company that develops and commercializes injectable bio-ceramic bone graft substitutes across Europe, North America, and internationally, with a market cap of SEK21.12 billion.

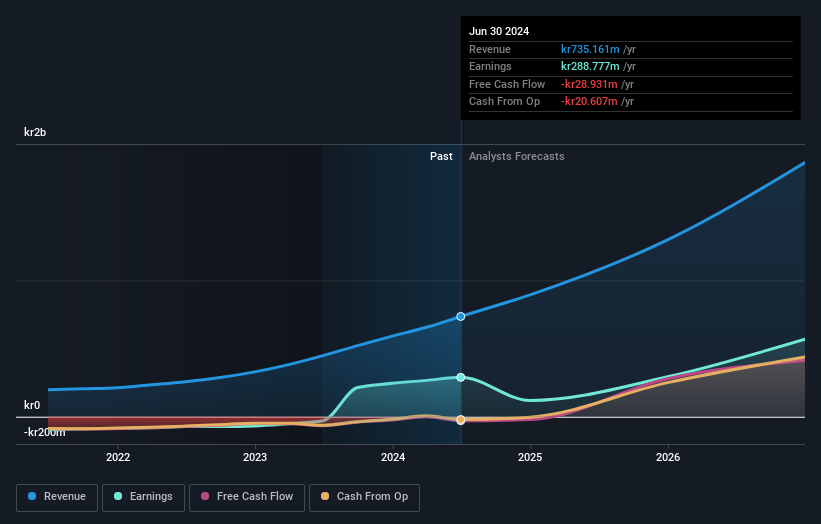

Operations: Bonesupport generates revenue primarily from its pharmaceuticals segment, amounting to SEK735.16 million. The company focuses on developing and commercializing injectable bio-ceramic bone graft substitutes.

Bonesupport Holding, a Swedish high-growth tech firm, has demonstrated robust financial and operational progress. The company's revenue is projected to increase by 33.8% annually, significantly outpacing the Swedish market's growth of 1.4%. This surge is supported by innovative practices in orthopedic treatments, as evidenced by the promising results of the SOLARIO study which could revolutionize antibiotic protocols in surgical settings. Moreover, Bonesupport's earnings are expected to climb by 31.2% each year, reflecting both market confidence and effective strategic initiatives. These figures underscore not only its current health but also its potential trajectory in the biotech sphere.

- Click here and access our complete health analysis report to understand the dynamics of Bonesupport Holding.

Gain insights into Bonesupport Holding's past trends and performance with our Past report.

Embracer Group (OM:EMBRAC B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Embracer Group AB (publ) is a global developer and publisher of PC, console, mobile, VR, and board games with a market cap of approximately SEK38.93 billion.

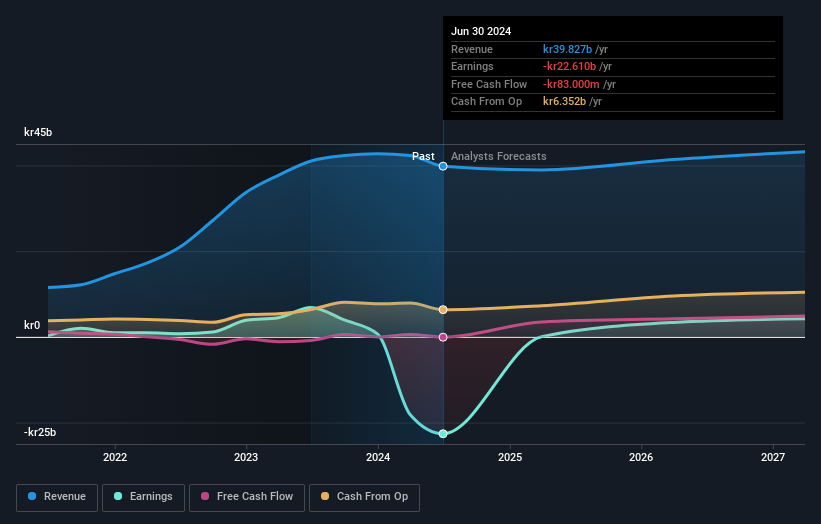

Operations: Embracer Group generates revenue primarily from PC/console games, tabletop games, mobile games, and entertainment & services. The largest revenue segment is tabletop games at SEK14.65 billion, followed by PC/console games at SEK13.10 billion.

Embracer Group, amidst a challenging financial period marked by a significant revenue drop to SEK 8.05 billion from SEK 10.54 billion year-over-year and transitioning into a net loss of SEK 2.18 billion, remains focused on strategic growth through R&D and market expansion. Despite these setbacks, the company's commitment to innovation is evident with an increase in R&D spending aimed at revitalizing its product offerings and enhancing competitive edge in the gaming sector. This approach is critical as it aligns with industry trends where continuous innovation shapes market dynamics. The recent securing of a EUR 600 million credit facility underscores Embracer's proactive steps to stabilize its financial base, providing the liquidity needed to support its ambitious R&D endeavors and potentially pivot towards profitability forecasted to surge by an impressive 103.8% annually over the next three years.

- Unlock comprehensive insights into our analysis of Embracer Group stock in this health report.

Explore historical data to track Embracer Group's performance over time in our Past section.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) is a company that offers solutions in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of SEK54.52 billion.

Operations: Sectra AB's primary revenue stream is from its Imaging IT Solutions segment, generating SEK2.67 billion, followed by Secure Communications at SEK388.55 million. The company operates in the medical IT and cybersecurity sectors across various European countries.

Sectra, a standout in the Swedish tech landscape, has shown robust performance with revenue projected to grow by 14.2% annually, outpacing the broader Swedish market's growth of 1.4%. This surge is complemented by an impressive anticipated annual earnings increase of 21.2%, significantly higher than the national average of 15.2%. The company's recent quarterly results underscore its upward trajectory, with revenues climbing to SEK 739.48 million from SEK 603.03 million year-over-year and net income rising to SEK 80.4 million from SEK 61.56 million, reflecting a solid execution strategy and operational efficiency in harnessing high-quality earnings predominantly derived from non-cash sources—a testament to its innovative edge within healthcare technology.

- Click to explore a detailed breakdown of our findings in Sectra's health report.

Understand Sectra's track record by examining our Past report.

Taking Advantage

- Unlock more gems! Our Swedish High Growth Tech and AI Stocks screener has unearthed 77 more companies for you to explore.Click here to unveil our expertly curated list of 80 Swedish High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bonesupport Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BONEX

Bonesupport Holding

An orthobiologics company, develops and commercializes injectable bio-ceramic bone graft substitutes in Europe, North America, and internationally.