- Sweden

- /

- Paper and Forestry Products

- /

- OM:HOLM B

Holmen (OM:HOLM B): Is the Current Valuation an Opportunity for Long-Term Investors?

Reviewed by Simply Wall St

Most Popular Narrative: 8% Undervalued

According to the most widely followed narrative, Holmen's shares are currently trading below their estimated fair value. This suggests upside potential for investors who believe in the company's long-term prospects.

Expanding regulatory support and incentives for sustainable forestry and land use across Europe position Holmen as a leading certified timber provider. This helps to reduce compliance risks and enhance net income margins as environmental standards become more stringent.

Curious why analysts believe Holmen could be poised for a rebound? Their fair value relies on ambitious changes in how fast the business can grow its bottom line, improve efficiency, and achieve a premium valuation multiple in the years ahead. Interested in the projections that drive this target? The numbers behind this assessment might surprise you.

Result: Fair Value of SEK398.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak demand in key markets or rising input costs could challenge Holmen's future growth and pressure its profitability outlook.

Find out about the key risks to this Holmen narrative.Another View

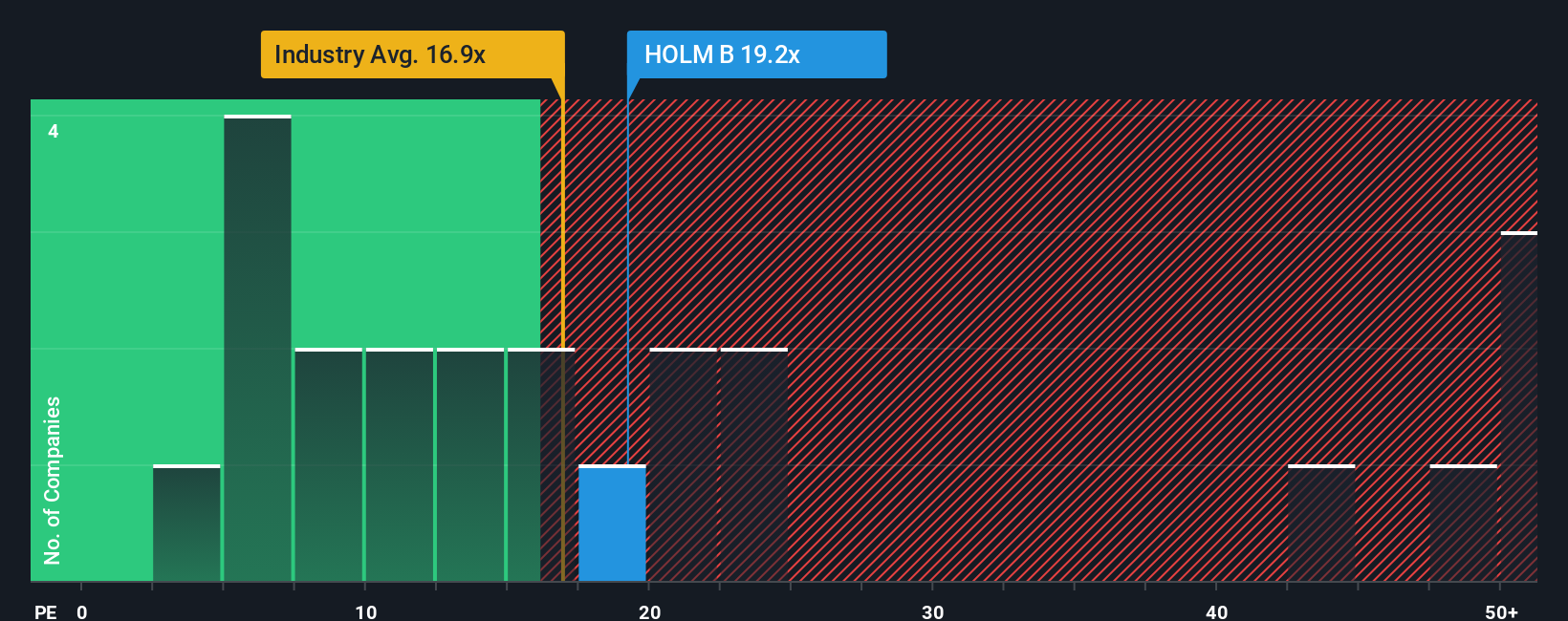

From another angle, looking at typical earnings valuations across the industry, Holmen appears more expensive compared to its sector peers. This challenges the first approach and raises the question: which perspective does the market trust?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Holmen to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Holmen Narrative

If the current viewpoints do not fully resonate with you, or you want to dig into the details on your own terms, you can build a personal narrative in just a few minutes. Do it your way

A great starting point for your Holmen research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not let potential winners slip through your fingers. Take action with the Simply Wall Street Screener to seize hand-picked opportunities before they run away.

- Boost your portfolio’s growth by checking out promising early-stage companies via our list of penny stocks with strong financials, emerging with solid financial health.

- Capture tomorrow’s breakthroughs by following AI penny stocks, companies that are setting the pace in artificial intelligence and reshaping the tech landscape.

- Maximize your yield with selections of dividend stocks with yields > 3% for reliable income backed by robust dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Holmen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OM:HOLM B

Holmen

Engages in the forest, paperboard, paper, wood products, and renewable energy businesses in Sweden and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives