Stock Analysis

High Growth Swedish Tech Stocks To Watch In September 2024

Reviewed by Simply Wall St

As global markets grapple with economic slowdowns and investor sentiment shifts, the Swedish tech sector continues to show resilience and potential for high growth. In this article, we will explore three promising Swedish tech stocks to watch in September 2024, focusing on companies that demonstrate strong fundamentals and innovative capabilities amidst challenging market conditions.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.32% | 21.61% | ★★★★★★ |

| Fortnox | 20.18% | 22.60% | ★★★★★★ |

| Xbrane Biopharma | 53.90% | 118.02% | ★★★★★★ |

| Bonesupport Holding | 33.76% | 31.20% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Yubico | 20.52% | 42.35% | ★★★★★★ |

| Hemnet Group | 20.13% | 25.41% | ★★★★★★ |

| Skolon | 31.76% | 121.72% | ★★★★★★ |

| BioArctic | 42.38% | 98.40% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sectra AB (publ) provides solutions for medical IT and cybersecurity sectors in Sweden, the United Kingdom, the Netherlands, and rest of Europe with a market cap of SEK50.63 billion.

Operations: Sectra generates revenue primarily from its Imaging IT Solutions and Secure Communications segments, with SEK2.67 billion and SEK388.55 million respectively. The company operates in Sweden, the United Kingdom, the Netherlands, and other parts of Europe.

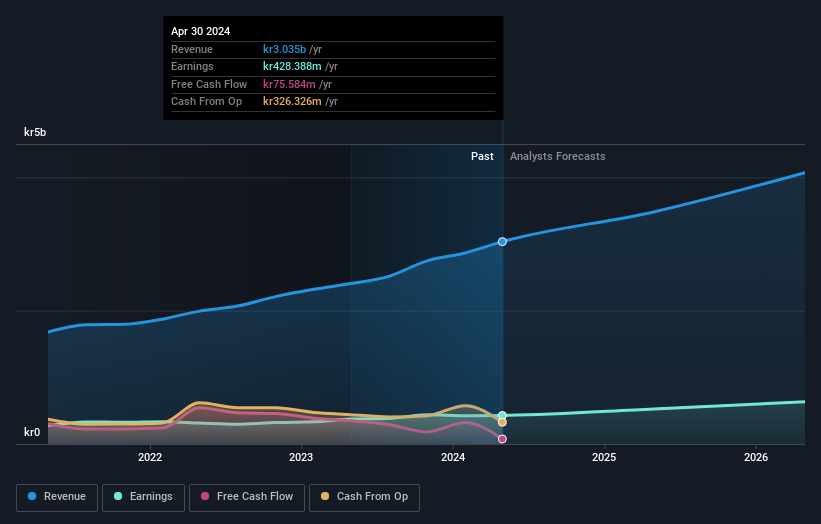

Sectra's recent earnings report highlights a robust performance with sales reaching SEK 736.75 million, up from SEK 601.71 million year-on-year, and net income rising to SEK 80.4 million from SEK 61.56 million. The company's R&D expenses underscore its commitment to innovation, with significant investments driving future growth; Sectra's revenue is projected to grow at 14.2% annually while earnings are expected to increase by 21.2% per year, outpacing the Swedish market average of 15.4%. Additionally, the successful implementation of Sectra One Cloud in Belgian hospitals showcases its expanding footprint in healthcare IT solutions and underscores the potential for recurring revenue through SaaS models.

Swedish Orphan Biovitrum (OM:SOBI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedish Orphan Biovitrum AB (publ) is an integrated biotechnology company that researches, develops, manufactures, and sells pharmaceuticals in haematology, immunology, and specialty care across Europe, North America, the Middle East, Asia, and Australia with a market cap of SEK109.13 billion.

Operations: SOBI generates revenue primarily from its haematology segment (SEK15.07 billion), followed by immunology (SEK7.49 billion) and specialty care (SEK1.15 billion). The company focuses on developing and selling pharmaceuticals in these therapeutic areas across multiple regions globally.

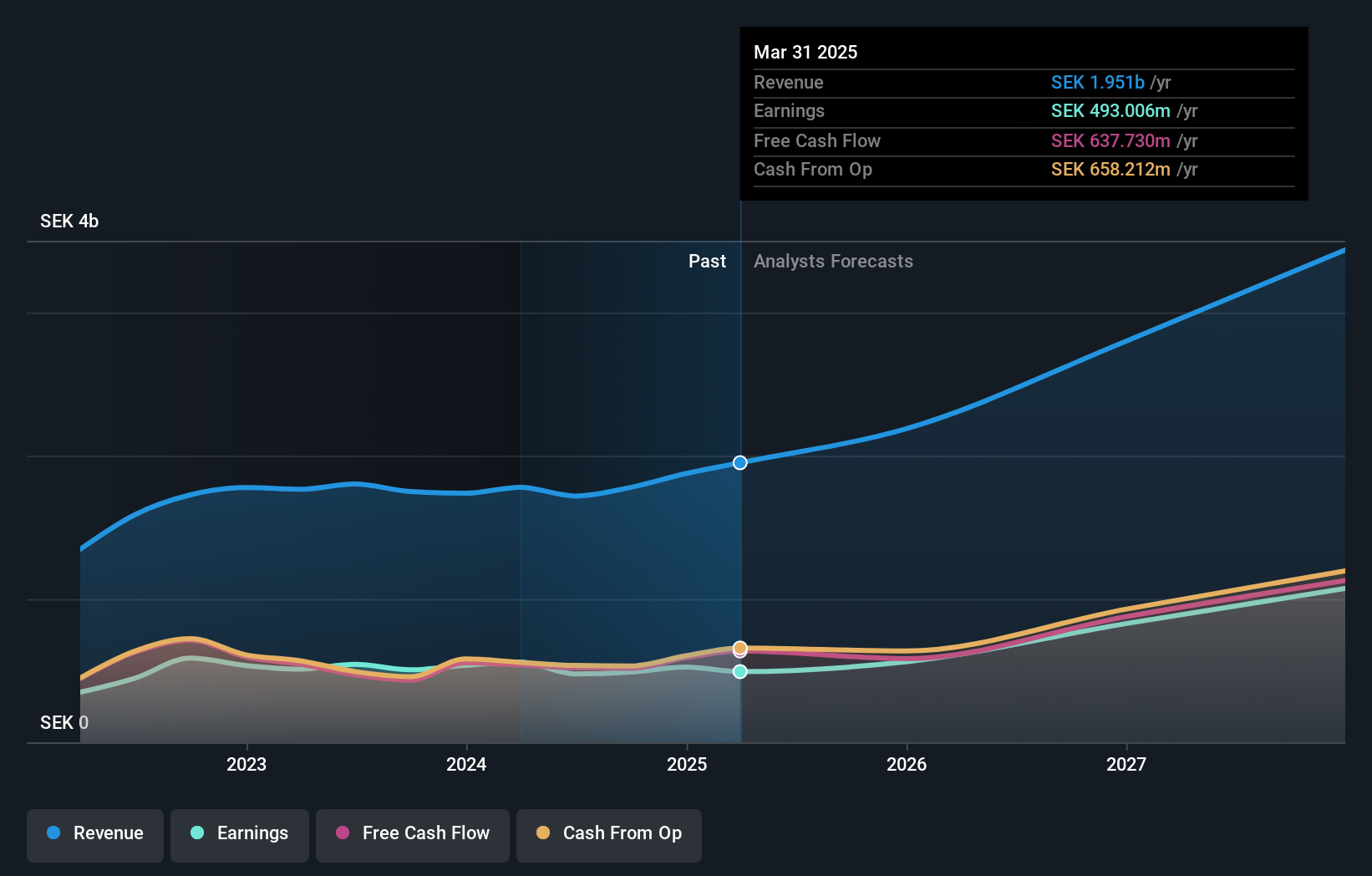

Swedish Orphan Biovitrum (SOBI) forecasts revenue growth of 9.4% annually, outpacing the Swedish market's 1%. Despite a high debt level, earnings are projected to rise by 25.8% per year over the next three years. Recent Phase 3 study results for pegcetacoplan showed a significant proteinuria reduction of 68%, highlighting SOBI’s innovative edge in rare disease treatments. R&D expenses reflect their commitment to innovation, with SEK 1 billion invested last year alone.

- Click here to discover the nuances of Swedish Orphan Biovitrum with our detailed analytical health report.

Evaluate Swedish Orphan Biovitrum's historical performance by accessing our past performance report.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of SEK12.70 billion.

Operations: Truecaller AB (publ) generates revenue primarily through its communications software segment, which reported SEK1.72 billion. The company focuses on mobile caller ID applications for both individual and business users across various regions globally.

Truecaller reported a 12.2% decline in earnings over the past year, yet its revenue is expected to grow by 20.3% annually, significantly outpacing the Swedish market's average of 1%. The company's R&D expenses reflect a strong commitment to innovation, with SEK 457.87 million invested last year alone. Truecaller's new Fraud Insurance product for premium subscribers in India showcases its efforts to diversify and enhance user protection, potentially boosting future growth prospects with an expanded service offering.

- Get an in-depth perspective on Truecaller's performance by reading our health report here.

Gain insights into Truecaller's past trends and performance with our Past report.

Make It Happen

- Dive into all 81 of the Swedish High Growth Tech and AI Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SOBI

Swedish Orphan Biovitrum

An integrated biotechnology company, researches, develops, manufactures, and sells pharmaceuticals in the therapeutic areas of haematology, immunology, and specialty care in Europe, North America, the Middle East, Asia, and Australia.