- Sweden

- /

- Healthcare Services

- /

- OM:MCOV B

Medicover (OM:MCOV B) Is Down 9.5% After Swinging Back to Profit in Q3—What's Changed

Reviewed by Sasha Jovanovic

- Medicover AB (publ) recently reported its third quarter and nine-month earnings for the period ended September 30, 2025, with quarterly sales rising to €591.6 million and a net income of €19.5 million, reversing a net loss from the prior year.

- This marks a meaningful recovery in profitability and earnings per share, underscoring a significant improvement in Medicover's financial performance over the past year.

- We'll now explore how the move from net loss to net profit for the quarter reshapes Medicover's investment narrative and future outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Medicover Investment Narrative Recap

To own Medicover as a shareholder, you need to believe in its ability to capture rising healthcare demand across Central and Eastern Europe while managing risks from local regulatory changes, capital-intensive growth and cost pressures. The recent swing to profitability is an encouraging signal and may offer some reassurance about execution, but does not materially change the main short-term catalyst, continued volume growth and successful ramp-up of new facilities, nor does it eliminate exposure to local reimbursement and regulatory shifts, especially in Poland and Germany.

Among recent announcements, the latest data from the DART clinical study (presented in October 2025) stands out. These findings underscore Medicover’s push into advanced diagnostics, which is closely tied to its strategy for margin expansion and higher-value service offerings, a key catalyst that could influence its ability to sustain earnings growth in the face of potential cost or regulatory pressures.

However, investors should be aware that despite recent earnings improvements, risks remain for those focused on …

Read the full narrative on Medicover (it's free!)

Medicover's projections indicate €3.2 billion in revenue and €146.5 million in earnings by 2028. This outlook is based on an anticipated 11.8% yearly revenue growth and an increase in earnings of €103.1 million from the current €43.4 million.

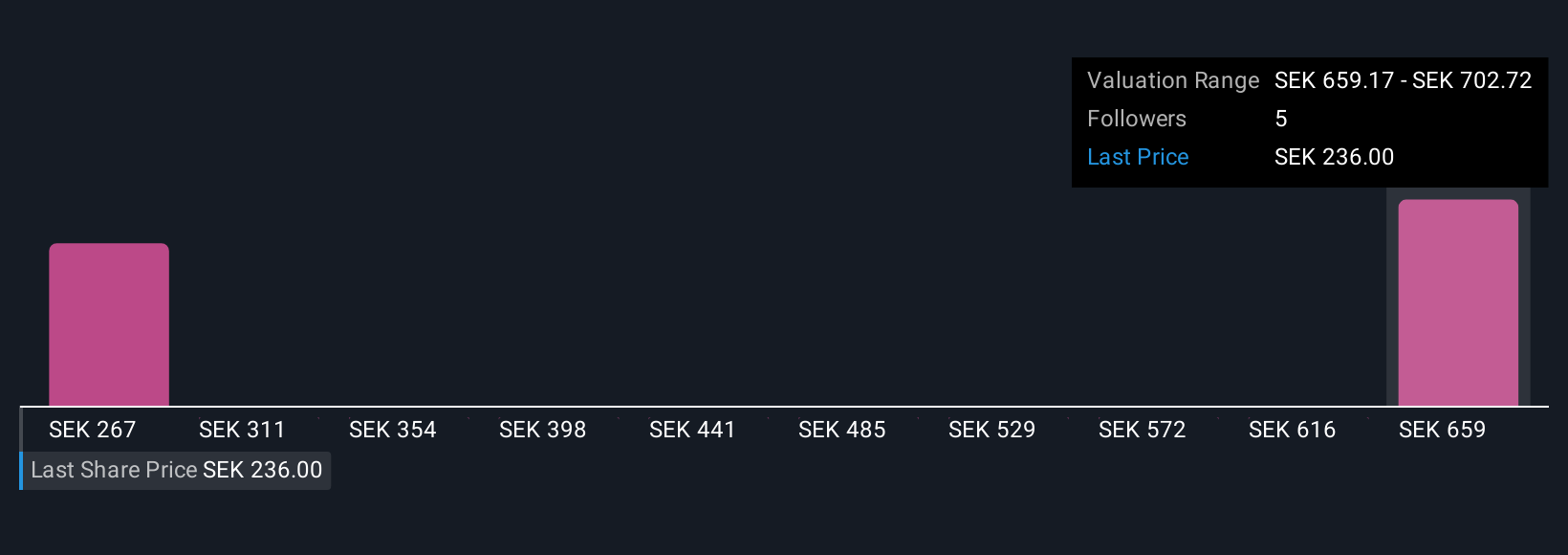

Uncover how Medicover's forecasts yield a SEK267.22 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer two fair value estimates for Medicover, ranging widely from SEK267.22 to SEK700.41. While many see upside potential, the continued reliance on Poland and Germany in the business model points to regulatory risks that could affect future returns; you may want to compare different viewpoints.

Explore 2 other fair value estimates on Medicover - why the stock might be worth over 2x more than the current price!

Build Your Own Medicover Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Medicover research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Medicover research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Medicover's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MCOV B

Medicover

Provides healthcare and diagnostic services in Poland, Sweden, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives