Stock Analysis

- Sweden

- /

- Medical Equipment

- /

- OM:BRAIN

BrainCool (STO:BRAIN) pulls back 13% this week, but still delivers shareholders notable 75% return over 1 year

The last three months have been tough on BrainCool AB (publ) (STO:BRAIN) shareholders, who have seen the share price decline a rather worrying 34%. But looking back over the last year, the returns have actually been rather pleasing! To wit, it had solidly beat the market, up 75%.

Although BrainCool has shed kr86m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for BrainCool

Because BrainCool made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

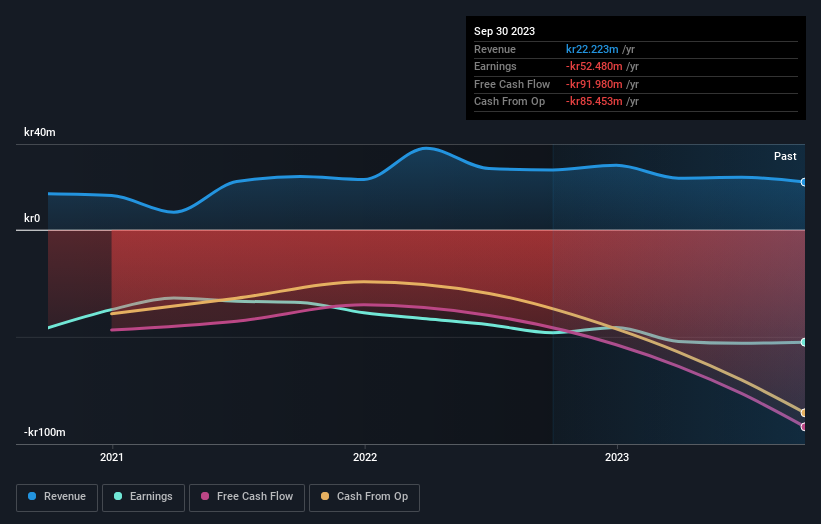

BrainCool actually shrunk its revenue over the last year, with a reduction of 20%. Despite the lack of revenue growth, the stock has returned a solid 75% the last twelve months. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on BrainCool's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that BrainCool shareholders have received a total shareholder return of 75% over one year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand BrainCool better, we need to consider many other factors. Take risks, for example - BrainCool has 5 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether BrainCool is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BRAIN

BrainCool

BrainCool AB (publ), a medical device company, together with its subsidiaries, engages in the development, marketing, and sale of medical cooling systems for the healthcare sector in Sweden.

Flawless balance sheet and overvalued.