- Sweden

- /

- Healthcare Services

- /

- OM:AMBEA

Did Ambea’s (OM:AMBEA) Strong Q3 Results Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Ambea AB recently released its third quarter and nine-month results for the period ended September 30, 2025, reporting sales of SEK 4,114 million and net income of SEK 322 million for the quarter, both higher than the previous year.

- In addition to showing year-on-year revenue and earnings growth, the company reported improved basic and diluted earnings per share from continuing operations over both the quarter and nine-month period.

- We'll explore how Ambea's sustained growth in quarterly sales and earnings impacts the company's investment narrative and future outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ambea Investment Narrative Recap

Ambea’s investment narrative centers on benefiting from strong demand for care services, organic growth from new units, and market share gains through acquisitions, particularly in the Nordics. The company’s latest quarter of rising sales and earnings supports the ongoing growth story but does not materially alter the most urgent short-term catalyst, successfully integrating recent acquisitions, nor does it resolve ongoing risks related to high financial leverage and public sector dependency.

Among recent announcements, Ambea’s continued emphasis on bolt-on acquisitions in Finland and further integration of Validia remains most relevant, directly tied to its consolidation strategy and the near-term push for scale and efficiency gains. These efforts anchor both the company’s growth and its exposure to integration challenges given higher net debt, making execution quality a focal point after another quarter of expansion.

Yet, in contrast to the headline results, investors need to be aware that integration costs and risks tied to recent acquisitions remain...

Read the full narrative on Ambea (it's free!)

Ambea's outlook suggests SEK18.3 billion in revenue and SEK1.0 billion in earnings by 2028. This is based on a 6.7% annual revenue growth rate and an increase in earnings of SEK374 million from the current SEK626 million.

Uncover how Ambea's forecasts yield a SEK147.50 fair value, a 16% upside to its current price.

Exploring Other Perspectives

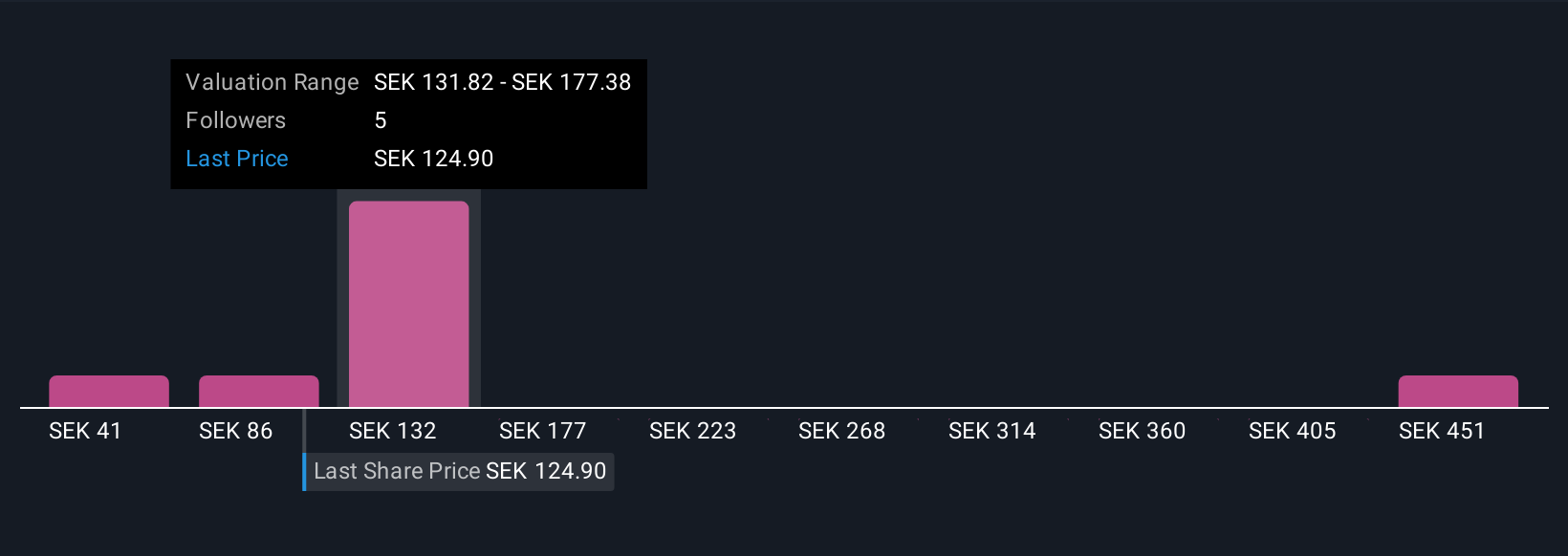

Simply Wall St Community members have published four fair value estimates for Ambea stock, ranging from SEK40.71 to SEK439.97. While some see upside from expected operating synergies, this underscores how views may sharply diverge around acquisition risks; consider each outlook carefully.

Explore 4 other fair value estimates on Ambea - why the stock might be worth less than half the current price!

Build Your Own Ambea Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ambea research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ambea research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ambea's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:AMBEA

Ambea

Provides elderly care, disability care, and psychosocial support for the elderly and people with disabilities in Sweden, Norway, and Denmark.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives