- Sweden

- /

- Hospitality

- /

- OM:BETS B

Exploring Betsson And Two Other Hidden Swedish Stock Gems

Reviewed by Simply Wall St

As global markets exhibit mixed signals with small-cap stocks showing resilience, Sweden's market landscape presents intriguing opportunities for investors seeking potential growth. Recent trends indicate a dynamic shift where smaller companies could be poised to benefit from broader economic activities and investor sentiment. In this context, identifying stocks like Betsson that may not dominate headlines but offer unique value propositions becomes particularly compelling.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 9.47% | 15.07% | ★★★★★★ |

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 15.31% | 29.94% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Rederiaktiebolaget Gotland | NA | -14.29% | 18.06% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Karnell Group | 44.29% | 22.04% | 39.45% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Betsson (OM:BETS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Betsson AB (publ) is a company that operates and manages online gaming businesses, focusing on regions including the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, and Central Asia with a market capitalization of SEK 17.42 billion.

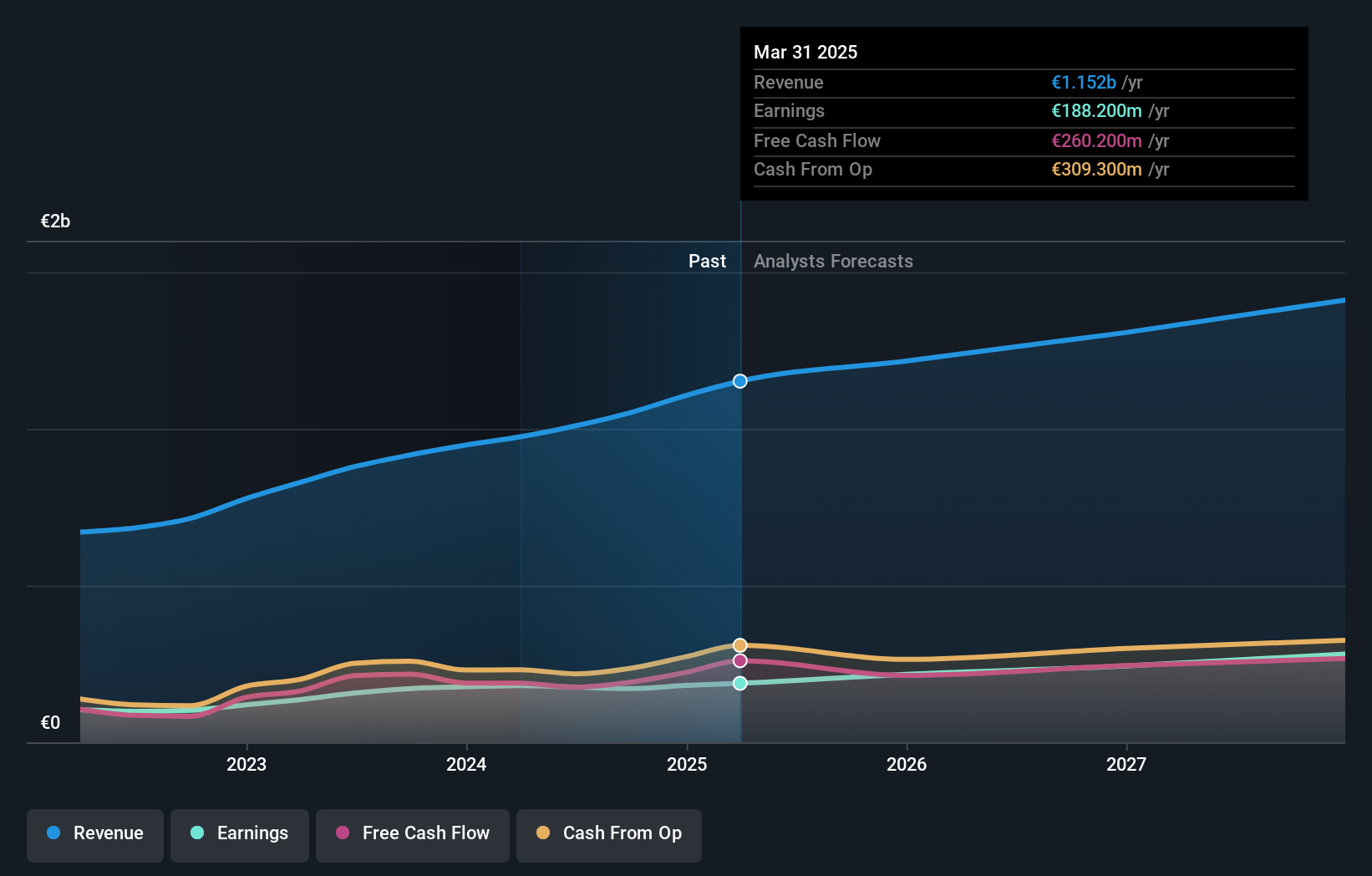

Operations: The company generates revenue primarily through its Casinos & Resorts segment, totaling €1009.2 million. It maintains a notable gross profit margin of approximately 79.95%, reflecting efficient management of operating costs and effective control over expenses related to sales, marketing, and administration.

Betsson, a lesser-known gem in Sweden's stock market, has shown robust financial health and growth potential. In the past year, earnings surged by 12.2%, surpassing the hospitality industry's contraction of 12.7%. The company is trading at a significant 72.3% below its estimated fair value, indicating an attractive investment opportunity. Betsson's debt-to-equity ratio improved from 25.9% to 21.7% over five years, underscoring prudent financial management alongside more cash than total debt on its books—a testament to its solid balance sheet strength and strategic positioning for future growth.

- Click to explore a detailed breakdown of our findings in Betsson's health report.

Explore historical data to track Betsson's performance over time in our Past section.

Biotage (OM:BIOT)

Simply Wall St Value Rating: ★★★★★★

Overview: Biotage AB (publ) specializes in providing solutions and products for drug discovery and development, analytical testing, as well as water and environmental testing, with a market capitalization of SEK 15.61 billion.

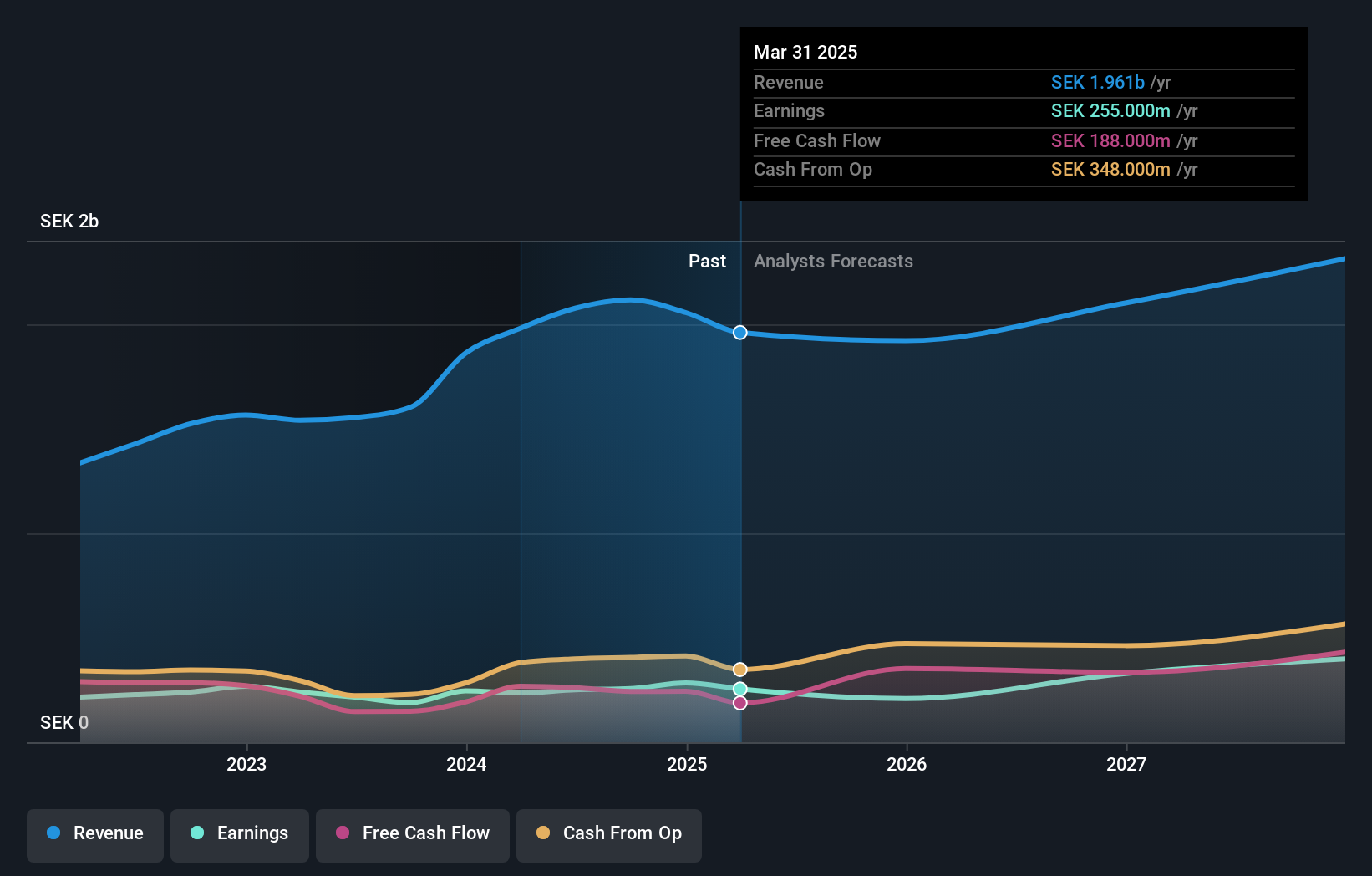

Operations: The company generates revenue primarily through its healthcare software segment, achieving SEK 2.08 billion in recent reporting. It demonstrates a robust gross profit margin of approximately 62.73%, reflecting efficient cost management relative to revenue generation.

Biotage, a Swedish life sciences firm, showcases robust financial health with its debt to equity ratio plummeting from 19.2% to 4% over five years, signaling strong risk management. The company's earnings outpaced the industry with a 16.2% increase last year while the sector declined by 13%. Trading at a compelling 39.3% below its estimated fair value and expecting an annual earnings growth of nearly 20%, Biotage represents an attractive opportunity amidst recent M&A buzz by KKR, hinting at heightened investor interest and potential strategic shifts.

- Click here to discover the nuances of Biotage with our detailed analytical health report.

Assess Biotage's past performance with our detailed historical performance reports.

Scandi Standard (OM:SCST)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Scandi Standard AB (publ) is a producer and seller of chilled, frozen, and ready-to-eat chicken products across Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom, and other European countries with a market capitalization of SEK 5.23 billion.

Operations: The company generates its primary revenue from two segments: Ready-To-Cook (SEK 9.70 billion) and Ready-To-Eat (SEK 2.61 billion), with a smaller contribution from other sources (SEK 0.52 billion). It incurs significant costs of goods sold, which consistently form the largest expense, impacting gross profit margins that have shown variability but trend around the mid-30% range in recent periods.

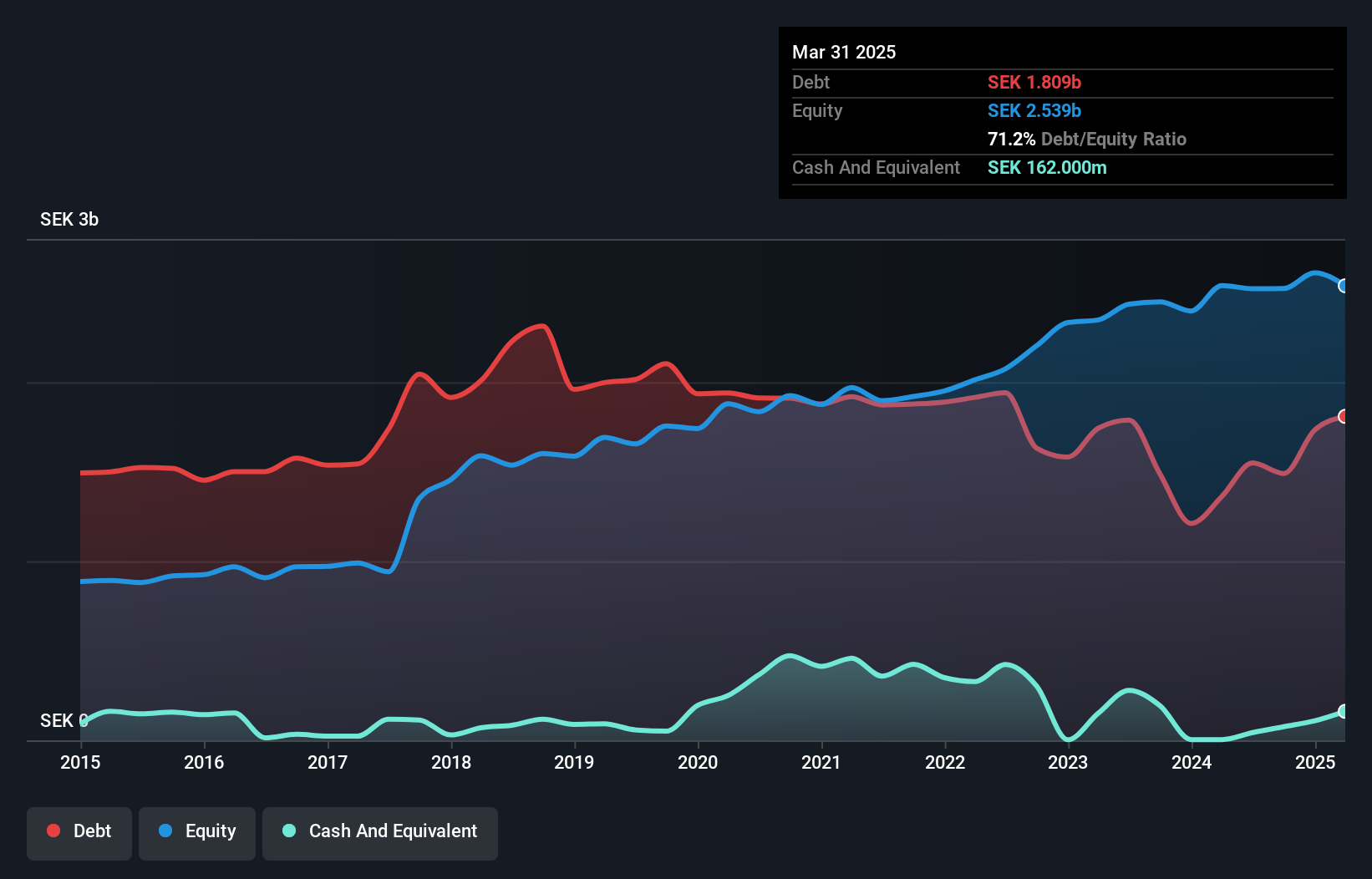

Scandi Standard, a notable player in the Swedish market, showcases robust financial dynamics despite its high net debt-to-equity ratio of 60%. The company's strategic maneuvers include securing a substantial SEK 3.2 billion sustainability-linked bank loan to bolster long-term growth. With earnings anticipated to surge by over 20% annually and recent sales hitting SEK 3,350 million in Q2 2024 alone, Scandi Standard stands out for its potential amidst lesser-tapped entities. Moreover, their debt reduction from 122% five years ago to current levels underscores prudent fiscal management.

- Unlock comprehensive insights into our analysis of Scandi Standard stock in this health report.

Evaluate Scandi Standard's historical performance by accessing our past performance report.

Make It Happen

- Unlock more gems! Our Swedish Undiscovered Gems With Strong Fundamentals screener has unearthed 50 more companies for you to explore.Click here to unveil our expertly curated list of 53 Swedish Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Betsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETS B

Betsson

Through its subsidiaries, invests in and manages online gaming business primarily in the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally.

Very undervalued with flawless balance sheet and pays a dividend.